What’s The Problem?

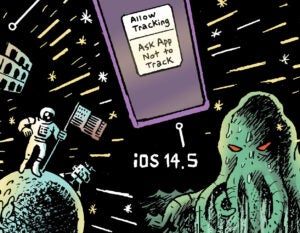

Google’s rapid expansion of search AI Mode and AI Overviews (AIOs) created several strange paradoxes.

Ask almost any web publisher (as in, anyone who isn’t Reddit) whether they’re seeing Google referral traffic fall, and they’ll probably say, “Yep.”

Google, however, continues to maintain that its AI-based search products send traffic to a wider range of publishers. Google also insists its generative AI responses monetize at the same rate as traditional search ads. Google’s immense and fast-growing search revenue backs up this claim.

Raptive’s strategy chief, Paul Bannister, tells Digiday that, “eventually,” Google and OpenAI will be making vast sums from AI search. And when they do, “publishers should share in that upside over time and not be stuck in some crappy deal where the platform gets all the benefit.”

But it might be more accurate to replace “eventually” with “today.” Although a few publishers scored data licensing deals with LLMs, none have revenue-sharing agreements tied to how often Google’s generative AI uses their content.

Google is already making money on AI-generated search and has the earnings to prove it. If publishers don’t see a dime, that’s someone else’s problem.

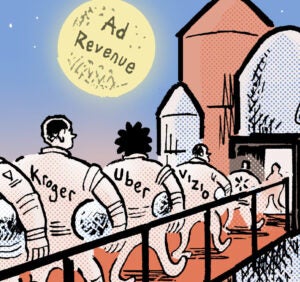

Lost In The Amazon

Amazon jolted the retail media sector late last week when it abruptly stopped all Google Shopping ad campaigns.

This isn’t the first time. Amazon has halted Google search ads in the past, seemingly for competitive reasons. But everyone is wondering what the rationale is this time, writes Search Engine Land.

If Amazon pulls its Google ad budgets for a while, both Google and publishers would feel it. Amazon is a large backstop advertiser that strengthens CPM rates and bid density across the board.

However, it’s more likely a short-term break. One theory Search Engine Land cites is that Amazon is running its own measurement and attribution test of Google search and shopping. It wouldn’t be the first to do so – both eBay and Airbnb have similar case studies – and full campaign stoppage is, in fact, the best way to test a channel for incremental ROI.

Or, perhaps, Amazon’s warehousing and fulfillment network needs a break as part of a post-Prime Day readjustment.

But here’s another rather juicy theory courtesy of Mike Ryan, head of ecommerce insights at Smarter Ecommerce. Ryan suggests that Google is introducing a Performance Max-based marketplace campaign product and that Amazon has paused its Google Shopping ads as it focuses on adopting these still-in-beta marketplace campaigns.

Come-And-Go Commerce

Speculation about Google’s commerce product plans aside, now is a particularly interesting moment for startups and smaller indie players in the category, Adweek reports.

One reason why is because there’s room for them to grow.

Microsoft bought PromoteIQ in 2019, one of the early standouts, but folded it last year. Meanwhile, although Criteo remains active in the space, CitrusAd – one of Criteo’s main competitors – was bought by Publicis in 2021, making it less attractive for other agencies to partner with.

Commerce ad tech startup Koddi just won Kohl’s business, which was up for grabs because Microsoft had unceremoniously ditched PromoteIQ. PromoteIQ used to power the Kohl’s Media Network.

Other startups, including Moloco, Topsort, Kevel and Pentaleap, are in the mix as well and gaining market share, Adweek writes.

Then there are the retail search and commerce marketing platforms like Skai and Pacvue, which are also gaining ground.

Commerce is exciting open terrain. Google has had a relatively limited presence in retail media because until now it hasn’t had a shopping marketplaces campaign product. (See above.) And yes, Amazon has third-party ad tech for marketplaces, but it only launched earlier this year and it’s still in beta with just a handful of clients.

But Wait! There’s More!

How one marketer learned to stop worrying and love Google’s Performance Max. [Search Engine Journal]

TikTok is beefing up its search ads team. [Digiday]

Warner Bros. Discovery will split into two companies, with the David Zaslav-led streaming and studios business to be called Warner Bros. and the Gunnar Wiedenfels-led global network business to be called Discovery Global. [The Hollywood Reporter]

Astronomer sidestepped its Coldplay-induced PR disaster by hiring frontman Chris Martin’s ex-wife Gwyneth Paltrow to become its “temporary spokesperson.” [Business Insider]

VPNs dominate the UK Apple App Store’s most downloaded apps list days after the country’s online age verification law went into effect. [BBC]

Electricity bills are going up across the country, and AI data centers might be to blame. [WaPo]

But for real, though, why are AI chatbot subscriptions so expensive? [Wired]

You’re Hired!

Main Street Sports Group, owner of FanDuel Sports Network, appoints Jim Keller as EVP of advertising and sponsorship sales. [release]

DoorDash hires longtime ad executive Lee Brown as CRO. [The Information]