The Downbehinds

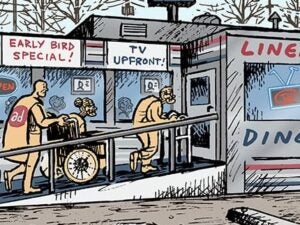

Historically, the TV upfronts served a real purpose. Advertisers learned about what new programs, sports or whatever was on the docket that year and exciting opportunities for a brand to attach itself to a particular star or show.

But nowadays TV dealmaking has shifted to “always-on” models for advertising, Mark Marshall, NBCUniversal’s chairman of global advertising and partnerships, tells Ad Age.

Though the digital counterpart to the upfronts, the NewFronts, hitched itself to TV’s sales extravaganza, the whole idea of high-premium commitments for future inventory doesn’t jibe with real-time ad tech. And big TV advertisers have long begrudged the upfronts as a way to lock in higher ad spend despite diminishing ratings.

But the big broadcasters are coming around, too.

Jeff Collins, Fox’s president of advertising sales, says that if broadcasters rethought the upfronts the events would be earlier in the year to influence annual strategies that are set in January and February.

It may not be perfect, according to Collins. But, he added, “I have yet to see somebody come up with a better format.”

Don’t Hate, Activate

One classic bit of ad jargon is the notion of “activation.”

For analytics solutions, data clean rooms, CDPs and many other ad products, it’s a way to express (in a deliberately obtuse way) that audience data is used to target ads.

Google’s data clean room, Ads Data Hub, was originally just for post-campaign measurement and analytics. When it started shipping audiences to DV360, the Google DSP, that was “A Big Step From Analytics To Activation.”

For social creators like Alix Earle, “activation” is the preferred nomenclature to describe influencer deals that aren’t simply payments to promote some item, per The Wall Street Journal. She prefers to negotiate equity in brands she believes are growing or undervalued and involve herself more directly. She was a stakeholder in Poppi, for instance, which she promoted highly. That paid off when Poppi was acquired by Pepsi for $2 billion. (The deal actually closed yesterday.)

Marques Brownlee, a consumer and tech product reviewer, has a similar relationship with Ridge.

It’s a sound arrangement, too, for creators with major talent for driving sales but who avoid far greater costs and risks than if they launched a brand themselves.

Twice The Trickle

ChatGPT is sending almost twice as much traffic to publishers so far this year compared to 2024, reports Digiday. But the actual referral numbers are still pretty paltry.

ChatGPT’s generative AI search produced 243.8 million site visits for 250 websites in April, according to Similarweb. That’s up 98% compared to last April. But it’s not even a million hits per site.

One publisher told Digiday that referrals from AI search are up 1,000% year over year. But, they added, “it went from a number close to zero to a number that’s still of negligible impact.”

However, the overall share of traffic ChatGPT sends to external sites is tilting toward news publishers. News and media sites accounted for 83% of ChatGPT’s external traffic in April, which is up from 64% in January.

But by most indications, generative AI search represents more of a drain on publisher traffic than a stream of new users. A recent TollBit study found generative AI search sends 96% less traffic to external sites than traditional search. So don’t expect publishers to be distracted by a trickle of traffic.

But Wait! There’s More

The FTC is investigating whether liberal media watchdog Media Matters illegally colluded with advertisers to damage X’s reputation. [NYT]

PR firms are on the generative AI hype train – but how much more spam can inboxes take? [WSJ]

Target cuts its annual revenue outlook citing tariffs and boycotts over its DEI ban, and now its CEO is in the hot seat. [Bloomberg]

NBCU bids for the MLB broadcast package that ESPN abandoned. [WSJ]