Research suggests ad spending on free ad-supported TV (FAST) channels in the US jumped nearly fourfold between 2020 and 2023 and is expected to double between 2023 and 2025.

Ad buyers are spending because more viewers are giving FAST channels a chance. (No one likes wasting an average of 11 minutes just to find something to watch!)

Still, the FAST channel market has a long way to go. Fill rates are as low as 38%, according to a recent report by One Touch Intelligence. Publishers often bundle broadcast, cable and streaming inventory together because buyers want to run across broad portfolios. But buyers also seek transparency into where their ads are running and remain unsatisfied with the lack of it on connected TV.

Part of the issue is related to programmatic versus direct buying. Media sellers are more likely to share more competitive information with direct clients rather than make it available in the programmatic bidstream, says Michael Scott, VP and head of ad sales and operations at Samsung Ads North America.

For example, Scott says, only Samsung’s direct buyers have access to its competitive automatic content recognition (ACR) data. But when it comes to show-level data – which buyers won’t stop demanding – some publishers and FAST channel owners are offering more transparency as a competitive edge to woo buyers. Samsung, for example, provides transparency into channel and genre at the impression level for Samsung TV Plus buys.

I sat down with Scott to get some hot takes about the state of transparency in TV ad buying today.

On Samsung’s ACR: “We don’t sell or license our ACR. It’s there to help publishers make programming decisions and to help advertisers make media planning decisions, such as targeting more precise audiences. It’s part of our competitive data offering, so it has to stay on our property – it can never leave.”

On buyers using DSPs to manage direct campaigns: “Although buyers often get more data from sellers when they buy directly – as is the case with Samsung’s ACR data – it doesn’t take away from the value of programmatic platforms. In some cases, buyers use demand-side platforms as a blunt instrument to manage media decisions for cross-platform campaigns in one place, such as frequency capping and campaign pacing.”

On show-level transparency: “The biggest hurdle with show-level data is the lack of consistency and standardization. Some content owners may label the first episode of the first season of a show as ‘S1E1,’ while others will label that episode as ‘Sea1 Ep1,’ for example. Not to mention the variations on actual show titles, like ‘Game of Thrones’ versus ‘GoT.’

Standardization aside, publishers are split into two different camps when it comes to show-level transparency. On the one hand, some publishers are very controlling over their inventory and package everything together because they don’t want buyers to cherry pick.

On the other hand, there are publishers that are willing to share more transparency into the shows where ads appear because they see it as a fair value exchange. Buyers are willing to pay more for the shows they know their audience is watching.”

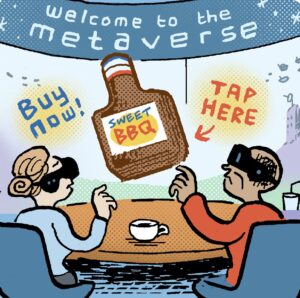

On shoppable TV: “Shoppable TV is in really, really early days. QR codes are in the infancy stage. Adoption takes time because consumer habits have to change. Publishers and advertisers are trying to get viewers more comfortable using their TV remote for something other than choosing a show to make them start considering TV viewing as a more interactive experience.

Interactive ad units like trivia or quiz-style ads are one example of a strategy we’re trying. At the end of the day, shoppable TV executions need to be elegant. They can’t be lazy, like just slapping a logo somewhere and expecting users to click on it. It has to be worthy of both the viewer’s attention and the advertiser’s investment.”

Answers have been lightly edited and condensed.

Are you enjoying this newsletter? Let me know what you think. Hit me up at alyssa@adexchanger.com.

For more articles featuring Michael Scott, click here.