Criteo’s shares leapt more than 20% Wednesday morning after the company reported continued profitability growth and a strong financial footing.

Investors rewarded Criteo despite the fact that total revenue actually ticked down year over year – from $566 million in Q4 2023 to $553 million last quarter – while its full-year revenue also decreased by 1% in 2024.

Still, Criteo is considered an ad tech standout because it carries no long-term debt and has high cash flow, giving it “significant financial flexibility,” said CFO Sarah Glickman.

CEO Megan Clarken touted that Criteo has transitioned from a retargeting specialist to an enterprise-level ad tech solution. And even with the shift to retail media, the company has demonstrated a “resilient take rate,” she said.

This was Clarken’s final earnings call as Criteo’s CEO. On February 15, she will hand the chief executive reins to Michael Komasinski, previously Dentsu’s CEO of the Americas.

The enterprise

There are already real-world examples of how Criteo is transforming into more of a martech ecosystem hub rather than just a DSP or retargeting solution.

Criteo counts 225 retailers using its retail media network, the latest addition being Harrods, a luxury store in the UK. Other retailer clients include major chains like Macy’s and Best Buy, as well as what one might think of as long-tail retailers, such as Toys”R”Us, Michaels and Giant Eagle.

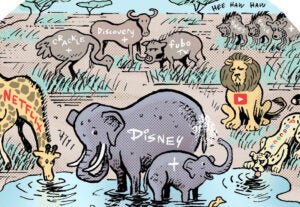

But some of Criteo’s retail media suppliers are on another plane entirely.

“We were delighted to be asked by Microsoft last year to, basically, partner with them for their retail media play, because they wanted to focus on other things,” Clarken told a Citibank analyst.

In 2023, Criteo announced an integration with Shopify, and it remains the only third-party ad tech partner for the Shopify Audiences program, Shopify’s prospecting and retargeting solution. Meanwhile, Criteo’s own retargeting solution was surprisingly revived to growth last year via a new integration with Meta, which allows Criteo to match and retarget within the Meta walled garden.

Agency holdcos make up yet another new enterprise sector.

Big agencies are a relatively new demand source for Criteo, but they grew more than 50% year over year in 2024. Although growth has continued into this year, Criteo didn’t disclose the exact rate to investors.

“Our platform value proposition positions us to win with agencies, which continue to be a strategic channel for us,” Clarken said. “Our agency business growth outpaced the growth of the rest of our business in 2024 and we expect to accelerate further on this momentum.”

It’s also helpful that Komasinski, Criteo’s incoming CEO, is the former head of dentsu’s business in North America.

Although retargeting margins are superior to Criteo’s newer retail media offerings, investors prefer this new direction. As a pure-play retargeter, Criteo’s value proposition was narrow. It has 3,500 brands accessing its retargeting demand, but Criteo was also keenly vulnerable to external factors, such as Apple’s privacy policy update.

As a strategic vendor for the likes of Microsoft, Meta, Shopify and Omnicom, Criteo can’t be so easily removed from the equation.

Investor perspective

But Wall Street liked more than just the new ad tech and agency partnerships.

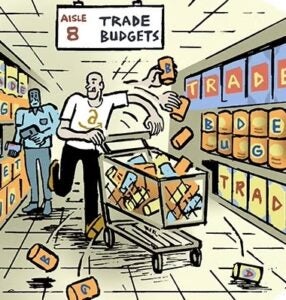

For one, Criteo spent $225 million to repurchase shares in 2024, far more than it ever had before. Relatedly, Criteo faced an activist investor last year. Investment firm Petrus Advisers bought 5.5% of the company and demanded, among other things, share buybacks and a review of potential acquirers.

Repurchases boost share prices by removing shares from the market without increasing a company’s value. Yet spending $225 million on financial fancy footwork could be a bitter pill for Criteo employees without a large personal equity stake and who would rather see that money spent on hiring or R&D.

The sum – $225 million – is roughly double Criteo’s total profits for all of 2024.

But investors are behind the move and have authorized another $200 million for share buybacks in 2025.