Global media powerhouse Carat has lowered its 2015 global ad spending forecast from 4.6% to 4.0%, reaching $529 billion, in the wake of a similar ad sector demotion from rival agency group Zenith Optimedia.

Global media powerhouse Carat has lowered its 2015 global ad spending forecast from 4.6% to 4.0%, reaching $529 billion, in the wake of a similar ad sector demotion from rival agency group Zenith Optimedia.

“That’s the new normal [for growth],” said Jonathan Barnard, Zenith’s UK-based head of forecasting. Barnard cited volatility in the eurozone, slowdowns in developing markets, recessions in Russia and Brazil and political conflict elsewhere.

Both Carat and Zenith predicted things will pick up next year, aided by the US election cycle and summer Olympic Games in Rio. Carat expects 4.7% growth in 2016, whereas Zenith said 5%.

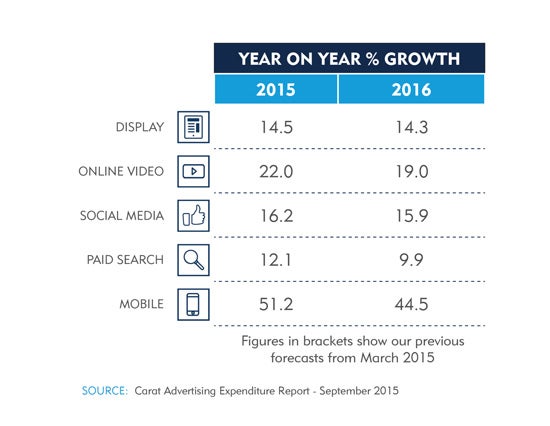

As always, digital remains a bright spot. Carat, part of the Dentsu Aegis Network, forecasts global digital ad growth of 15.7% in 2015, led by mobile, video and programmatic.

Carat’s report noted that programmatic buying is growing at a rate of 20% per year and predicted it will continue to do so for the next several years. By the end of 2015, in the US, programmatic transactions will account for 52% of non-search digital advertising spend, Carat predicted.

Meanwhile mobile and online video advertising, driven by social media platforms, will grow 51.2% and 22%, respectively, this year.

Zenith does not release specific figures on programmatic growth rates, but Barnard said programmatic is rapidly becoming the standard for major agency buys and it’s “hugely important.”

The Carat report projected that North American ad spending will grow 4.2% (revised from 4.5%) to an estimated $203.3 billion this year. In 2016, spending growth in North America will be up 4.5% (revised from 4.6%).

Notably, TV remains the dominant medium globally with 42% share of total advertising spend in 2015, and the channel is expected to grow 3% in 2016. However, TV’s share of spending will show a decline over time as advertisers diversify their media mixes and consumers steadily shift their video consumption to streaming video, VOD and OTT options, Carat said.

Digital ad spending, including mobile, is projected to overtake TV ad dollars by more than $4 billion by 2018, according to Carat.

Also of note, Zenith found that mature markets will lead ad spending growth for the first time in nine years – markets like Western Europe, North America and Japan.

China is slowing but it’s still growing twice as fast as the world as a whole.

“Digitally, it is one of the fastest-growing markets in the world,” Barnard said. “It leap-frogged directly to the mobile Internet.”