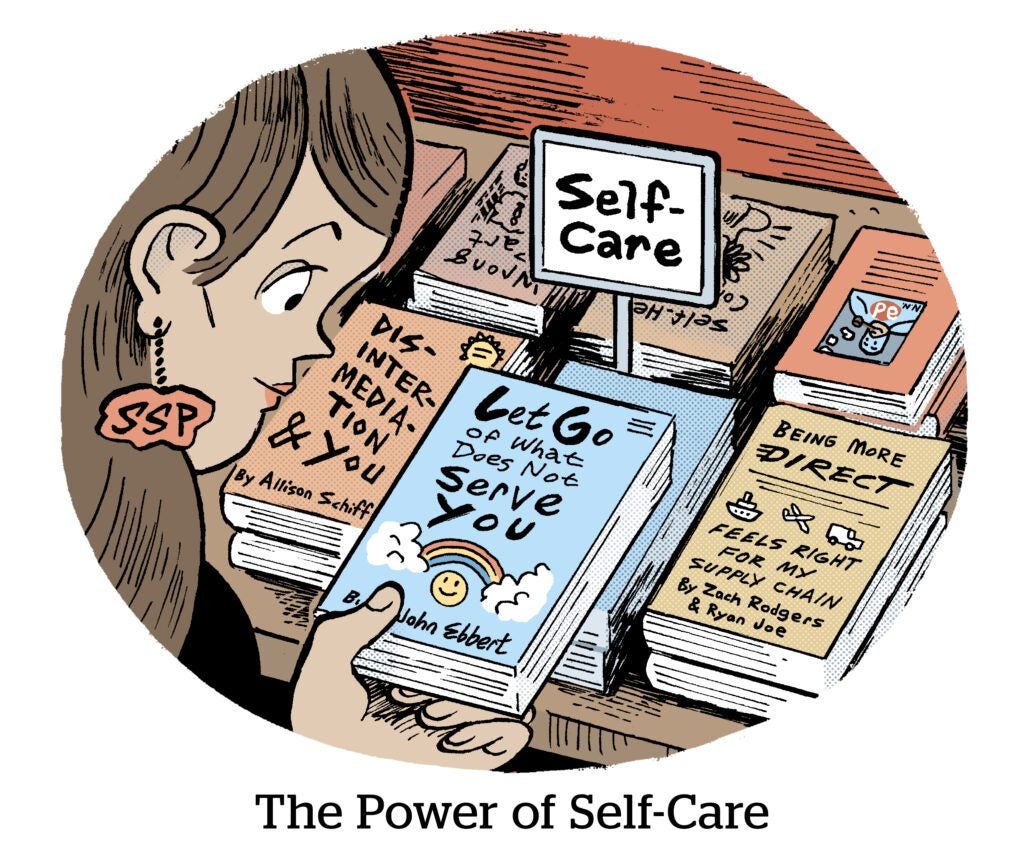

What even is the difference between a DSP and SSP anymore?

Google Ad Manager (GAM), which is Google’s sell-side business, is reportedly pursuing direct deals with the buy side – the implication being that demand-side platforms, including Google’s own DV360, would be cut out.

How do we know? The Information recently dropped a juicy scoop about GAM representatives hosting a dinner for top ad agencies in New York City in July to discuss ways that GAM could work directly with buyers. An anonymous source who attended the gathering told The Information that the GAM team brought up tech that would allow agencies to buy ads directly through GAM.

The report sparked speculation that Google is preemptively preparing to spin off GAM in the event it’s forced to divest its bundled SSP and ad server – which is exactly what the Department of Justice is seeking as a remedy to Google’s monopoly in the sell-side ad tech and ad server markets.

But Google told AdExchanger the dinner was just part of GAM’s ongoing efforts to build relationships with agencies in order to improve monetization for publishers. Google also said this is part of a wider industry trend in which sell-side platforms are increasing their outreach to the buy side.

Legal pressure (and peer pressure)

To be fair, SSPs are increasingly going direct to the buy side.

Both PubMatic and Magnite have launched direct-to-buyer connections for certain online video and CTV deals, which is partly a response to DSPs, including The Trade Desk and Yahoo DSP, going direct to publishers.

And it’s true that GAM has been stepping up its outreach to agencies, confirmed Brian Binder, senior director of TV, audio and display innovation at performance marketing agency Tinuiti.

“In recent months, we have had more meaningful conversations with the GAM team focused on supply optimization,” Binder said, adding that it “isn’t new” to see agencies engaging with supply partners.

And while Binder agreed that GAM going direct to buyers “feels especially significant given the upcoming antitrust trial ruling,” it’s possible that Google is just “stepping up to keep pace with other supply partners that have already leaned into more direct relationships with buyers,” he said.

But there are also other market forces at play on the demand side, according to a different agency source who requested anonymity.

“Google is squeezed right now from a programmatic perspective,” they said. “The bigger picture to me is that Amazon is going to start taking more and more share. I also see The Trade Desk hanging in there and being far more relevant for retail media networks than Google.”

And dealing with these competitive dynamics – which are already a reality for Google – is likely a far more pressing concern than any potential legal fallout from the antitrust case, said several sources who spoke with AdExchanger.

In other words, Google isn’t immune to market pressure.

The fact that even GAM must now go direct to buyers – potentially cutting out DV360 in the process – is evidence that SSPs increasingly need strong buy-side relationships to control and grow their business, said Jana Meron, founder of sell-side consultancy Lioness Strategies.

“The closer you are to the revenue, the more control you have over your own business,” she said.

And, according to Amanda Martin, CRO at publisher ad network Mediavine, while it could be true that Google is preparing to bypass DV360 as part of a potential divestment of GAM, it’s just as likely “they are future-proofing whether they are forced to divest assets or not.”

Plus, supply-path optimization strategy cuts both ways.

Although there’s a possibility that GAM could cut out DV360 as an SPO play, other DSPs have cut out SSPs by going direct to publishers – and there’s no guarantee that DV360 won’t do the same, Meron said.

“I think it’s more about protecting [GAM’s] business if DV360 decides to go around them,” she said.

But why buy through GAM?

Speaking of circumventing DV360, Google emphasized to AdExchanger that even if GAM launches a direct buying option, agencies will still be able to buy inventory through GAM in a variety of ways, including via DV360, Google Ads and through third-party DSPs participating in the Google Authorized Buyers program.

Agencies can also continue to access GAM inventory through third-party SSPs using SDK Bidding, Google Open Bidding and header bidding setups.

Which raises the question: Given all these options for buy-side demand to flow to GAM, why would buyers even want to purchase inventory directly through GAM instead?

Well, doing so just makes sense, from the publisher perspective, at least.

Buying directly from an SSP illustrates the value advertisers get from SPO by cutting out unnecessary hops in the programmatic supply chain, said Mediavine’s Martin. “It’s a growing trend for buyers to explore paths that do not take the traditional path of DSP to SSP to publisher,” she said.

And because GAM includes Google’s DoubleClick for Publishers ad server, Martin said, it makes sense for GAM to highlight it as a benefit for direct deals, much as other SSPs have done.

Magnite’s ownership of the SpringServe video ad server, for example, has boosted its direct business in the CTV channel. In a similar fashion, GAM could capitalize on its ad server’s wide adoption for display and online video ad serving.

However, simply owning an ad server doesn’t inherently mean GAM will perform better than other supply paths, Martin added. “The promise of a more direct, more efficient path will need to be proven through performance,” she said.

And ad agencies will need a lot of convincing on the performance front before they decide to dedicate large budgets to purchasing through GAM. Even just getting agencies onboard with testing could be an uphill battle.

The agency sources who spoke with AdExchanger for this story were very mixed in terms of their interest in GAM’s outreach.

A second ad agency source who also requested anonymity said they could see some SPO value in dealing directly with GAM. “From a buyer’s perspective, it creates an interesting opportunity of doing some agentic curation and direct buying,” they said, noting that “it’s almost like OpenPath for Google,” alluding to The Trade Desk’s direct-to-publisher solution.

But a third anonymous agency source, whose remit focuses mainly on TV and CTV campaigns, said they don’t see any value in buying directly through GAM versus buying through DV360. “It’s silly that it’s largely a display and online video-only platform,” they said.

In short, whether GAM will be an attractive direct buying option for non-display and online video inventory remains to be seen. Meanwhile, The Information’s coverage flagged recent complaints buyers have had about GAM’s apparent lack of support for CTV, mobile apps and gaming, which many buyers see as growth opportunities compared to the relatively stagnant online display market.

But for its part, Google underscored GAM’s efforts to strike partnerships beyond display channels, such as its deals with TV broadcaster Univision, gaming giant Roblox and music streaming app Spotify. These deals, Google told AdExchanger, demonstrate GAM’s push to ensure advertisers can reach audiences wherever they are, including on new channels.

But whether buyers take Google up on GAM’s new strategy will depend on the additional perks GAM can offer them beyond simply being pipes to publisher inventory, Meron said. It’s a struggle all SSPs know too well.

“Buyers prefer to buy through the path that provides them with the best value,” she said, whether “because they have preferred rates or post-auction discounts or because the SSP has tools and/or customer service that they find valuable.”

The biggest remaining unknown, Meron added, is whether pressure from competitors and regulators forces GAM to play nicer with advertisers and publishers, rather than continuing to use its market dominance to benefit Google. If GAM is forced to finally create a transparent and unified ad auction, rather than running separate auctions for GAM and third-party SSPs, all the better, she said.

“GAM always had the highest revenue share of any of the SSPs, with most publishers paying Google an ad-serving fee, fees for log files, an AdX revenue share and an Open Bidding share of 5%,” Meron said. “My question is, will Google be forced to be more generous than they have been on revenue shares and take rates to maintain dominance?”