Are you a technology or retail company? If so, you’ve probably got a bigger problem with ad fraud than your CPG or telco counterparts, at least according to Integral Ad Science’s Q2 2014 Industry Report, which includes information from the ad tech companies, exchanges and agencies it works with.

Are you a technology or retail company? If so, you’ve probably got a bigger problem with ad fraud than your CPG or telco counterparts, at least according to Integral Ad Science’s Q2 2014 Industry Report, which includes information from the ad tech companies, exchanges and agencies it works with.

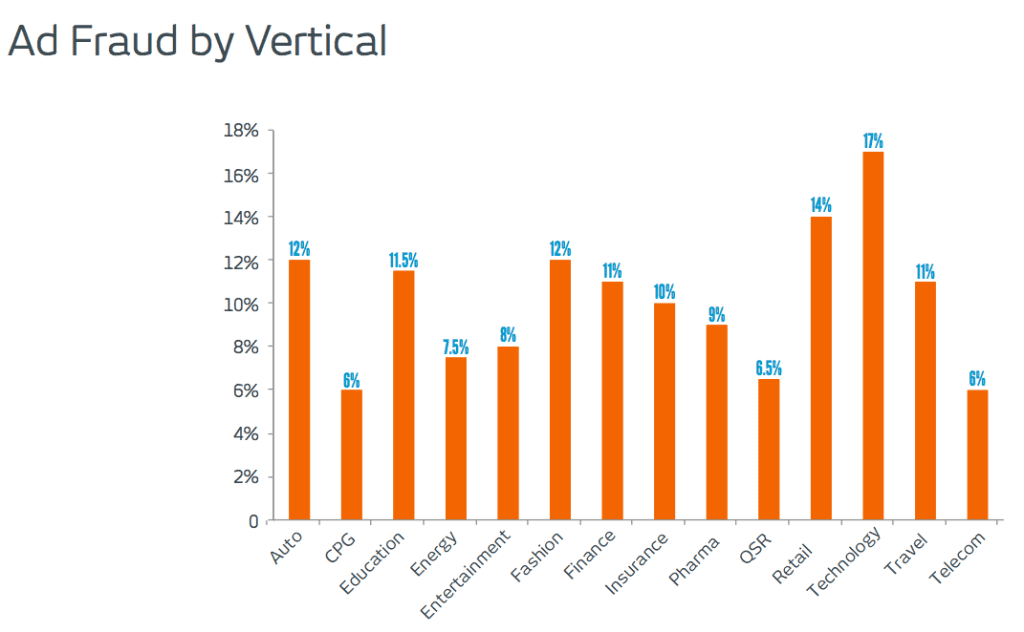

So why are verticals like technology and retail – where 17% and 14% of impressions are fraudulent, respectively– suffering more than CPG (6%) or telecom (6%)?

“Verticals tend to buy in different ways,” said David Hahn, Integral’s SVP of product.

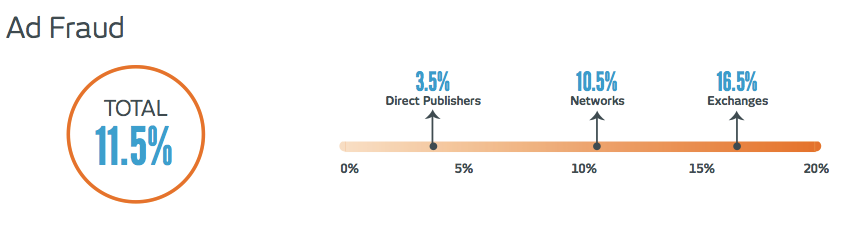

Verticals with lower fraud rates tend to buy directly from publishers, where 3.5% of impressions are fraudulent, according to Integral. This compares favorably against exchanges (10.5%) and ad networks (16.5%).

“Certainly the direct-response-type advertisers or verticals will look to leverage as much scale as they can,” Hahn said. “That introduces some of the additional risks you might not find if you’re doing smaller scale campaigns purely on publisher direct.”

Other verticals that suffer from comparatively higher rates of fraud include automotive (12%), fashion (12%) and education (11.5%). Those blessed with lower fraud rates include fast-food or quick-service restaurants (6.5%) and energy (7.5%).

At a high level, Integral divides ad fraud into two general categories: bots that fool an ad server into believing an ad made an impression on a human when it didn’t, and publishers that either buy traffic from sketchy sources in order to expand their reach or dump hidden ads across their pages.

But it’s a constant arms race – as advertisers and ad tech companies get better at ferreting out fraud, fraudsters adapt different tactics.

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Daily Roundup

Independent consultant Ted McConnell described the fraudsters as “an enemy that’s shape-shifting, agile, belligerent, invisible, greedy, fast and brilliant.”

Integral has seen bots programmed to drag themselves through legitimate websites, confusing antifraud mechanisms that hunt bot-infested machines based on visits to sites with fraudulent reputations. Other bots swap out domains to avoid detection. Additionally, some pretend they’re operating in Google’s Chrome browser, which Integral claims limits the detection abilities of many antifraud products.

“Any change in the patterns leads to potential misses by detection models,” the company said in an email. “The vast majority of fraud used to happen in IE browsers. When Chrome entered the mix, it could confuse models looking at IE; and showed that other things may have changed as well (for example, Chrome browsers could be faked or bots hijacking Chrome could behave differently).”

Integral’s quarterly report also looked at viewability and brand safety as it applied to publisher direct, exchange and ad network channels. In terms of viewability, inventory purchased directly from publishers led the way (55.5% of ads were in-view) followed by ad networks (45.9%) and exchanges (45.3%). Not surprisingly, buying direct tended to yield the most brand-safe inventory (6.2% had moderate to very high risk, according to Integral) followed by exchanges (9.6%) and ad networks (10.1%). These results were mostly static, compared to surveys from previous quarters.

“Across all our products, we’re doing probably north of 2.5 billion impressions per day in terms of conducting our analysis for our reports,” Hahn said. These impressions come from the major demand-side platforms (DSPs) including Turn, DoubleClick Bid Manager, AppNexus and The Trade Desk. Integral also looks at exchange traffic through sell-side partners like Adap.tv.

“And we work with several hundred brand managers,” Hahn said. “Probably over half of the Fortune 100 are clients of ours.”