Discovery Communications has explored web video here and there over the past few years as a promotional vehicle for its various cable TV networks, which include its flagship, TLC and Animal Planet. Online advertising has tended to be a secondary focus, with TV naturally being front and center.

Discovery Communications has explored web video here and there over the past few years as a promotional vehicle for its various cable TV networks, which include its flagship, TLC and Animal Planet. Online advertising has tended to be a secondary focus, with TV naturally being front and center.

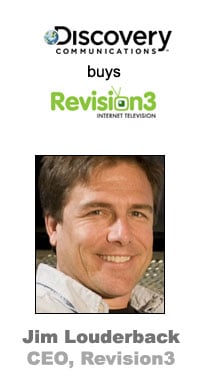

Online video programming producer Revision3 CEO Jim Louderback, speaking to AdExchanger a few hours after the San Francisco company was purchased by Discovery (read the release), was quick to say that there were no plans to become “more like traditional TV,” but that he did believe being part of a global cable operation would provide an obvious opportunity to try to attract Discovery’s blue chip advertisers.

“We just got married and haven’t even lived together yet, moved in the furniture, so to speak, so we haven’t talked much about the advertising plans,” Louderback said. “There’s going to be great synergies in the advertising sales, I’m sure, but we haven’t really covered that yet. Discovery has a worldwide sales force that has strong relationships with leading brands that we at Revision3 have coveted and would love to have running on our shows. We expect that we will be working hard on moving some of those marketers to support our programming as well.”

In a broad sense, seven-year-old Revision3 represents the “TV Everywhere” concept of allowing viewers to watch what they want, when they want and where they want — and why broadband video represents both a threat and an opportunity that cable can’t ignore. Discovery and Revision3 began talking a year ago, after being connected by the video producer’s early backer Greylock Partners after executives from the cable company began looking for potential tech partners out in Silicon Valley.

The two initially struck a distribution partnership and the relationship eventually expanded into a full acquisition, which was estimated at $30 million, according to AllThingsD’s Peter Kafka. Revision3 is well-placed to help Discovery more easily navigate the values and ways of original online video, as it claims to have 100 million video views a month with 23 million monthly uniques across 27 digital channels.

Earlier this year, Revision3 said its revenues grew 53 percent in 2011, with advertising up 80 percent year-over-year – though it didn’t offer any specific dollar figures. The only discussion of its ad deals at the time touted an arrangement to promote and distribute Epic Meal Time products.

Still, the value may be in Revision3’s potential to expand Discovery’s advertising reach to male demos. The video producer is heavily weighted toward guys 18 to 34 with its tech, gaming and entertainment programming like Tekzilla and Totally Rad Show, while Discovery is particularly popular with women, particular on its TLC channel and in its struggling joint venture with Oprah Winfrey on OWN.

“One of Revision3’s many strengths is in the area of integrating advertising partners and creating customized client solutions,” said J.B. Perrette, Discovery’s chief digital officer, in an email to AdExchanger. “With Revision3’s complementary genres such as science and tech, as well as their authentic internet hosts and talent, we can see potential for offering innovative opportunities for our ad partners across multiple platforms.”

As the past week’s NewFront presentations from YouTube, AOL, Yahoo, Microsoft and Digitas showed, online video is maturing and is growing fast – but with an estimated $2 billion in spending projected this year by eMarketer and other analysts, it’s nowhere near the $70 billion that TV will attract. Still, there’s a lot of money to be made by prominent players, and the connection with Discovery will allow Revision3 a higher profile in the eyes of major media buyers and marketers.

“The ability to target audiences through digital video is the value here,” Louderback said, noting that in addition to its own branded programming hub, Revision3 programming is available on an array of video sites like YouTube and Metacafe as well as on smart TVs and tablets via its branded app.

And Louderback, who has been CEO of Revision3 since 2007 and will remain in charge of the property, reporting to Perrette, said that he has no pretentions of evolving the property into a full-blown TV network. In other words, he’s happy to prove that online web video, with its more anarchic schedules and formats, can command TV-level ad dollars without having to actually become more “TV-like.”

“We’re not going to start developing TV programs,” he said. “We look at web original video as a new medium, a new way to tell stories and connect advertisers with audiences in ways you couldn’t do with traditional video. We don’t have to worry about finding 22 or 44 minutes of content and doing an ad break here and another one there. The shows and the ad breaks can be as long or short as is we want it to be.”

In trying to pull in more TV ad dollars, Revision3 has long participated in Digitas’ NewFront programs. But again, that doesn’t mean Louderback thinks there should be this clear dividing line between online and offline presentations, despite the differences in content.

“There are interesting parallels between what’s been happening with online video sales presentations like the NewFront and the TV upfront,” Louderback said. “If you think about the traditional upfront, it’s all about buying on the basis of scarcity. With online video, there is no natural scarcity. What we’re trying to do is create a form of scarcity by producing content around our hosts, offering something that you can’t really get elsewhere. We’re going to bring that idea of web original video to a company that is video native, but may not be as far along on the web as we are. Does that mean we’re going to do a NewFront next year? We don’t know, but it seems like there is potential in working closely on packaging content for advertisers with Discovery within either forum.”

By David Kaplan