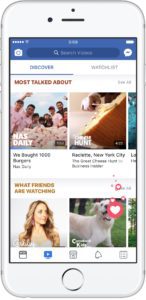

Facebook Watch, the social giant’s video hub that went live for select users on Wednesday, already has a roster of digital video launch partners – like Time Inc., Hearst, Brit & Co., Tastemade, Quartz and McClatchy.

But Facebook also wants to broker content deals with the likes of big TV companies like Univision, Major League Baseball and A+E.

And to find long term-success, Watch needs to convince publisher partners to allocate enough episodic video content to feed the portal and to entice consumers to tune in.

But Facebook faces steep competition both from publisher’s owned-and-operated TV apps and from emerging video services like Hulu’s live offering, YouTube TV and DirecTV Now.

Many of these live and on-demand video services are priced on a subscription model, which helps drive incremental growth for broadcast TV nets who’ve lost users to cord cutting.

James Murdoch, CEO of 21st Century Fox, praised the value of those incumbent online video platforms during the broadcaster’s Q2 earnings call Wednesday, calling YouTube TV and Hulu’s live TV offering “significantly valuable” in diversifying pricing models and expanding access to TV content for viewers.

By contrast, some industry observers think Facebook Watch is just a fancy extension to Facebook’s newsfeed.

And while TV partners like FOX Sports appreciated the chance to capture the consumer mid-scroll, many found the mobile newsfeed environment wasn’t ideal for long-form viewing.

Meanwhile, YouTube was more or less built as a video destination and archive for long-form content since the start.

Yet, Facebook Watch partners say video producers simply need to adapt to the delivery method.

“The newsfeed, which [catered to] autoplay without sound, created this ecosystem of videos that are really different from what most video producers made before Facebook came along with their algorithm,” said Solana Pyne, the executive video producer for publisher Quartz. “That video was often square, text-heavy and focused on capturing someone’s attention.”

New creative demands mean content owners must get savvier with storytelling, Pyne said, and she’s hopeful that Facebook Watch will provide a place for users to engage with more of Quartz’ video content.

Ironically, Facebook has been challenged with proving out engagement and viewability for advertisers, despite its growing volume of video content.

“Facebook has been unable to get more than 30% of their audiences to surpass 2-second viewability,” said Field Garthwaite, co-founder and CEO of the video personalization platform IRIS.TV.

“Facebook has been unable to get more than 30% of their audiences to surpass 2-second viewability,” said Field Garthwaite, co-founder and CEO of the video personalization platform IRIS.TV.

“This is jaw-dropping, when we all hear about how Facebook has the most engaged audiences,” he added. “Facebook is the opposite experience of TV – it’s quick, meandering and reactive, whereas TV and premium video in general are [more passive] and watched with clearer intent at a longer duration.”

So Facebook has to ensure that Watch attracts audience before it can talk monetization – despite testing formats like mid-rolls that don’t just mimic the standard video pre-roll.

“Quartz has never run a pre-roll ad on any video it’s produced, and Facebook is trying to avoid this experience as well,” said Jay Lauf, co-president and publisher of Quartz.

“Facebook obviously has a large and engaged audience. We’ve seen tremendous success with our video that is shared natively to Facebook [and] their scale and engagement levels is an encouraging baseline.”

Yet, with an audience as large and engaged as it is on Facebook, Lauf acknowledged, “there should be monetization opportunities to tap into down the line.”