Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

DTC You Later

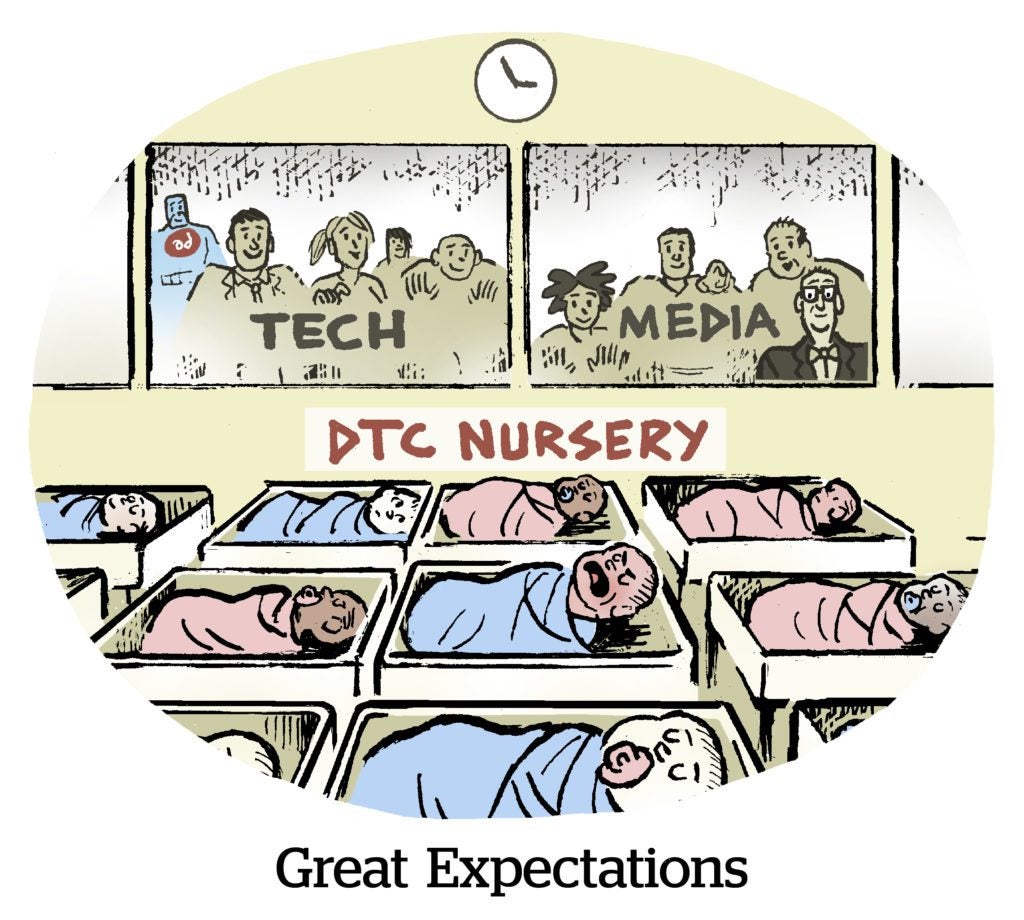

Direct-to-consumer brands are struggling across the board.

And the latest example is Ampla – a debt lending service that specializes in the DTC economy. The VC-backed startup is now struggling financially, The New York Times reports. It’s looking for a suitor and, in the meantime, has frozen accounts for some DTC customers, which are the types of companies “relying heavily on social media sites for marketing and buzz,” as the Times puts it.

Ampla lent DTC brands at favorable rates, allowing them to buy Meta ads and stock inventory to grow their brands. But rising interest rates made it harder to lend to DTC companies, because brands weren’t willing to take on loans at crushingly high interest rates.

Plus, the industry overall had “inflated expectations” of what first-party data could do for DTC businesses, as Marty Kihn of Salesforce put it last week at Programmatic I/O.

Ben Perkins, founder of the DTC men’s clothing brand &Collar, an Ampla client that lost its credit line, puts it this way: “I think it’s one of the bigger moments in DTC. … I think there’s going to be decent fallout.”

Sailing Down-Stream

Sony is investing in intellectual property and content rights, rather than entering the streaming services market directly, The Wall Street Journal reports.

It’s a keen move.

Take the BBC. Its ad revenue and licensing fees (what British households pay for the channel) both dropped from 2023. But total revenue was way up at an all-time high. What’s that about?

Well, the BBC has the rights to “Bluey,” the hit kids cartoon that’s now a pillar of engagement on Disney+. Disney gets value in terms of retaining household subscriptions, but the BBC really profits. (Disney doesn’t even get “Bluey” characters at its parks.)

Brands with valuable IP, such as Lego and Hasbro, have shown how to play their hand effectively.

Sony, likewise, has cornerstone IP in film and gaming, including “Spiderman,” “Halo” and “The Last of Us,” now a hit show on Max.

Why would Sony want to be a streaming service when it can own the IP and profit without suffering the headaches of that uber-competitive market of streamers?

A Net Loss

Microsoft Advertising pulled off a coup when it snagged Netflix’s RFP for a CTV ad tech vendor.

That deal was never going to last forever. But it’s unwinding quicker than we thought.

Netflix intends to wean itself from Microsoft’s ad tech by the end of 2025, Adweek reports.

For one thing, building ad tech will help Netflix cater directly to advertisers with bespoke ad units, according to Simulmedia chairman Dave Morgan.

With an in-house ad stack, Netflix could also shave off some latency. You know how sometimes a streaming ad simply doesn’t render? That can be because the real-time ad tech system, with its pings to outside ad servers on top of everything else, didn’t identify the right ad within a few milliseconds or served an ad without the right creative specs.

It happens a lot. But it happens less when the ad tech stack and content feed share an owner.

Netflix isn’t new to uncomfortable business evolutions, either.

“They’re constantly doing things they said they never would do,” said eMarketer analyst Ross Benes.

But Wait, There’s More!

News publishers striking AI data licensing deals are making a huge mistake. [The Atlantic]

Spindl and a network of web3 tech and advertising businesses launch an on-chain ad attribution system. [blog]

Why publishers are preparing to federate their sites. [Digiday]

Foursquare lays off a quarter of its employees. [TechCrunch]