Sabrina Sierant joined Mondelez more than 12 years ago, working on some of the company’s candy brands like Sour Patch Kids and Swedish Fish and its confectionery business.

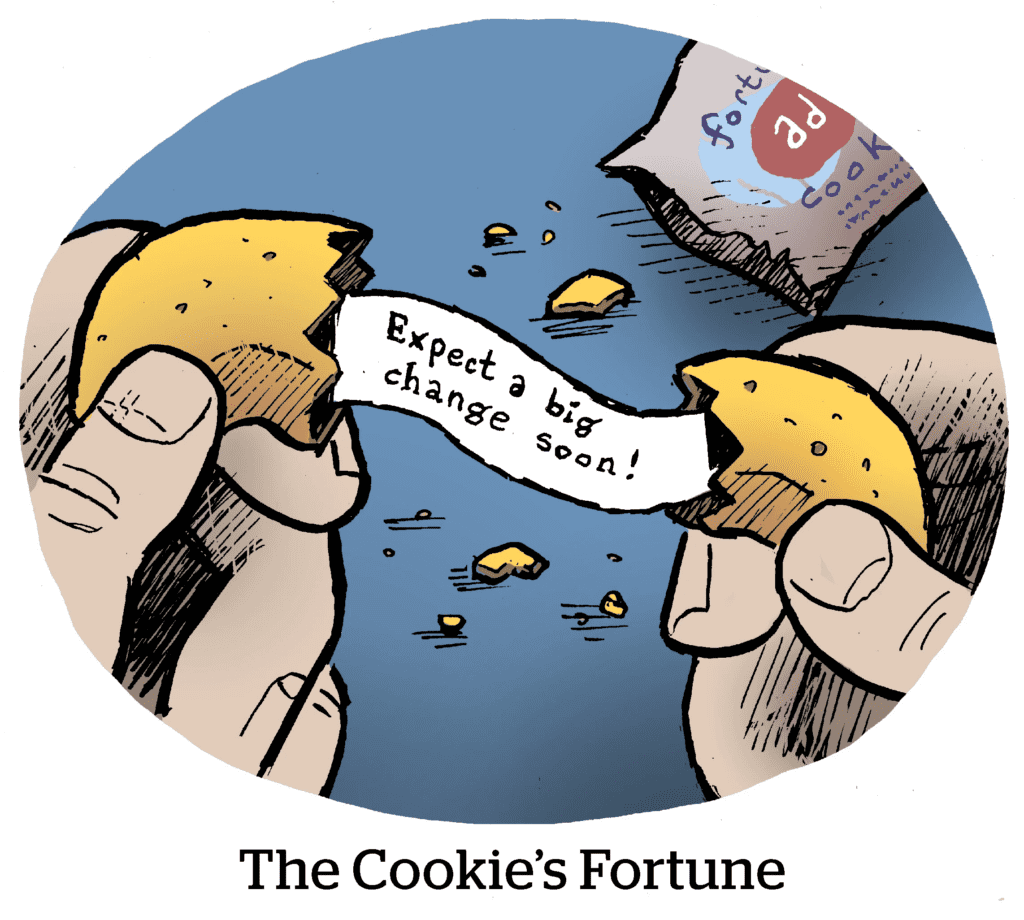

In December 2019, she took on marketing for the US Chips Ahoy! business, as Mondelez orchestrated a major rebrand and reinvestment in its cookie brand.

Five years ago brings us back to a whole different lifetime when it comes to consumer behavior and the economic landscape.

No only was there the shopping upheaval during 2020 and 2021, and then a major reset in 2022 and 2023. The price of cocoa, the main ingredient in chocolate, has quadrupled in that time.

Though Chips Ahoy! doesn’t have its own site or direct-to-consumer business (unlike the other well-known Mondelez cookie Oreo), it has dramatically changed its marketing mix since the rebrand in 2020. The brand has embraced social media, influencers, out-of-home media and other new channels in pursuit of new, younger consumers for the product.

AdExchanger caught up with Sierant about the new product launches and how marketing priorities have changed.

How has the media plan changed for the brand since you joined?

When I started on the business, we had a traditional media plan that was heavy on TV and then some digital and social. Back in 2020, right before COVID, we started reinvesting back into the Chips Ahoy! business.

But our target growth consumer was a Gen Z household. And we were getting stronger returns in digital and social. So we have moved away from TV, with a smaller amount on TV, and the majority of media spend is digital and social, and we’ve just started dabbling in out-of-home where it makes sense.

Are there new channels you’re particularly excited about?

Shopper marketing and the point of sale are always a part of our plans. But in terms of new things, we have been using influencers more recently and found success with creator content as well as bigger influencers and celebs.

Any examples?

Last year we did a partnership with Keke Palmer. She did some content for us – not just for paid, but through her channels that we then boosted.

We’ve also worked with more what you might call micro-influencers for our gluten-free launch.

And in Q4 we launched this new big chewy cookie and partnered with Big Sean – you know, because it’s our big cookie. That was also digital, social and live events. We have started to do more in-person work, like with Big Sean at ComplexCon in Las Vegas, where we had the big cookie launch.

We’re doing more in-person, too, because (the new product launches) are really targeted at on-the-go occasions. And so that’s also the campaign where we decided to launch out-of-home media and billboards across the US.

It’s funny, I happen to have recently done a handful of interviews with well-known grocery store food and beverage-type brands, and each has used the phrase “on the go” to describe their campaign target.

Well, in the last 52 weeks, on-the-go consumption has grown four times faster than at-home consumption. It’s where we’re looking to expand because that’s where consumers are going.

Are the retailer media networks part of your media plans?

Yes, we work with them.

We’re with some of the top retailers, and it’s part of the retailers’ shopper marketing plans to spend on their retail media networks.

That has also been increasing over the past two or so years as a percentage of our spend.

Is it increasing because you see great scale or value there, or is it more just the cost of doing business and being carried by big grocery stories?

We’ve seen some success. We are still experimenting, but they have access to their shoppers and are able to target in ways that we might not be able to outside of their platform. So we’re still learning a lot across our brands at Mondelez.

I don’t know that every retailer and every campaign is, like, a gold standard. But I think we’re still learning and have seen pockets of success that you know we want to replicate.

To go back to something you mentioned – was the gluten-free cookie line a relatively recent launch as well?

It launched almost a year ago.

It’s had strong success so far with 48% of consumers coming back. So a 48% repeat rate is great, and I think we’ll continue to expand in this area because it’s working, and the gluten-free segment continues to drive growth for the category as well.

The cookie tastes great, if you haven’t tried it. I will say it’’s hard to tell the difference. It tastes like a Chips Ahoy! cookie, and most people don’t even know that it’s gluten-free.

You’re much more likely to get me with the big chewy cookie. But are there any other launches with keywords like, say, “protein,” “low-sugar” or “nondairy,” along those lines?

We’re monitoring consumer trends and looking at what’s a good fit for Chips Ahoy!

And taste is still the No. 1 priority because consumers don’t want to sacrifice taste, even with some of these claims.

We’re definitely exploring other areas but nothing I can share yet.

And on the macro-economics …

Here we go.

Hah. But not even tariffs; I was thinking about the price of chocolate. Would those macro-trends push you to, perhaps, do a non-chocolate cookie?

I mean, Chips Ahoy! – our crunchy blue bag – it’s a real chocolate chip.

But our CEO and CFO have said in general how Mondelez is managing through the situation.

Too iconic to drop the chocolate chip, I guess.

We’re just having to be smart about how we spend in other areas.

Luckily, we’re not a chocolate bar, so Chips Ahoy! isn’t hit as hard. But we definitely have to be smart, especially within non-working media and marketing costs.

We need every dollar to work as hard as it can for us.