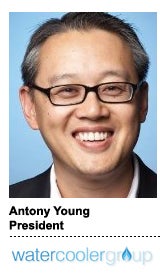

This week saw the formal launch of a marketing services company geared to entertainment clients. Water Cooler Group contains four agency brands – Maude (offering creative and strategy), Media Storm (planning and buying), Hip Genius (social media) and Bolt (for iTV). Among its clients are Food Network, MLB Network, Major League Soccer, Viggle, and cable upstart Fox Sports 1.

This week saw the formal launch of a marketing services company geared to entertainment clients. Water Cooler Group contains four agency brands – Maude (offering creative and strategy), Media Storm (planning and buying), Hip Genius (social media) and Bolt (for iTV). Among its clients are Food Network, MLB Network, Major League Soccer, Viggle, and cable upstart Fox Sports 1.

Given that entertainment is an emerging category in the audience-buying world, we reached out to president Antony Young for perspective on how Water Cooler might leverage data for its clients. Young was previously CEO of Mindshare North America.

AdExchanger: What kind of agency network is Water Cooler?

ANTONY YOUNG: A lot of our business has been traditionally in the media and entertainment fields. As a result, we’ve built an agency to work with that category, in particular. That makes us quite different. We’re organizing our thinking around how to get media brands out there.

Entertainment has certainly been the most aggressive category when it comes to creating content, distributing content, and activating social media. Media agencies have been very heavily focused on the paid media side. The starting point for Water Cooler group is, how do you activate the unpaid media first? And how do we make brands more entertaining? How do we make their marketing things that people want to spend time with?

What role will media buying play?

We’ve got much bigger resources in the areas of social and content, and we’ve done a smart job of integrating that with media in a much more open, integrated and collective way than I think many other media agencies are doing right now.

Where does data fit in?

We’re dealing heavily with engagement. There’s a much higher level of thought and endeavor that’s put behind creativity-in-media. If a movie doesn’t open strong, or a show’s ratings don’t deliver, we hear about it the next day.

Everything we do is very accountable. As creative as we need to be, everything has to drive audience. Media is across so many more platforms. That’s driving us faster into many more platforms.

What about programmatic media?

I would say, traditionally, the entertainment industry has been a lot slower to address programmatic. That’s going to change fast. We’re becoming more sophisticated. In the audience buying area, we’re getting very focused about how to buy that audience and how to identify audience.

There are many more ways to determine an audience profile beyond the classic filters. That’s where we start to attract entertainment dollars. We’re starting to constantly judge, for example, if someone is a keen watcher of The Bridge on FX, what other shows they are likely to move into.

If we’re pitching movies, a studio doesn’t really care what profile or person comes in and watches a movie. We do know we need to identify the likelier prospects for a whole host of reasons.

CPG companies and retailers have led the programmatic business. As we start to move off the obvious filters into contextual profiles of what’s an “entertainment profile,” there are more dollars coming [to programmatic] from this category.

What else?

In this world of audience buying, a lot of the skill is in matching the content to the audience rather than the other way around. It’s about what audiences, what mindsets, what life stages do we want to talk to? What is the messaging that’s going to resonate the most with those audiences? That’s something we are quite nicely placed to do. Media and creative need to work more closely together. This is a challenge for agencies – but the media buy can be more sophisticated if it can be tied to the creative messaging.

So audience buying technology will inform creative & content, rather than the other way around?

Yes, I think so.

It seems more content companies are willing to pay networks like Taboola and other “content recommendation” startups for incremental views of entertainment content. Is this an area of future development for you?

Yes, I think so. We believe any paid media solution that adds reach to deliver content is always going to be important.

Follow Antony Young (@antonyyoung) and AdExchanger (@adexchanger) on Twitter.