With its acquisition of Yahoo on Monday, Verizon – and therefore AOL – is sinking its hooks into a treasure chest of cross-device data.

With its acquisition of Yahoo on Monday, Verizon – and therefore AOL – is sinking its hooks into a treasure chest of cross-device data.

“It’s very large and very deterministic,” said 360i president Jared Belsky.

Cross-device connectivity was ostensibly one of the big motivators behind Verizon’s acquisition of AOL in May 2015, and now the same could be said with Yahoo, at least in part.

“User data helps complete the story for AOL,” said Michael Provenzano, CEO and co-founder of Vistar Media. “They didn’t exactly have scale before, and now it’s starting to look more like they do.”

Yahoo claims to have a global audience of more than 1 billion monthly active users, including 600 million mobile MAUs, 225 million of whom use Yahoo Mail – and that’s a significant extension of Verizon’s reach and a potentially compelling prospect for advertisers.

“The idea of having massive user scale now combined with AOL certainly makes it much more attractive for buyers to turn to Verizon to run cross-device campaigns,” said Kenneth Suh, EVP of global business development at Unruly. “Presumably, the combined dataset is a large part of what motivated the purchase, so that advertisers can feel confident around deterministic data through [Verizon’s] platform.”

But that doesn’t mean that the combined entity will automatically be able to compete with the likes of Google and Facebook, both confirmed titans of cross-device matching and targeting.

For one, it’s not totally clear how much deterministic data Yahoo can really bring to the table.

Like any publisher that has logged-in users, Yahoo has access to deterministic data, namely email addresses. But that’s largely been a desktop-centric affair for Yahoo.

The question, said Mike Caprio, GM of programmatic and SVP of partnerships at Sizmek, is whether Yahoo’s users are also logging in on mobile devices.

“Without that, they would not have device IDs and would need to use probabilistic models to match them,” Caprio said. “Verizon’s user base may offer a bridge but would leave a gap globally, as well as users using other carriers.”

The fact is that not all of Yahoo’s 225 million Yahoo Mail users actually have the Yahoo Mail app installed. That overall number also includes 58 million people who access their mail using third-party mail applications, like the native iOS mail app. It’s possible that the only data being passed between Yahoo and third-party apps is authentication data, and if that’s the case, there’s a roughly 58-million-person hole in Yahoo’s cross-device potential.

But there’s nothing wrong with using probabilistic models to extend reach when there’s solid truth set underpinning the work. Together, Yahoo and AOL have enough logged in users across the US and APAC to provide a “deterministic dataset that can be used to train probabilistic models, thus enlarging the Yahoo/AOL cross-device ID dataset even further,” said Ed Chater, chief strategy officer and CMO of Adbrain.

Another point in Yahoo’s favor is Flurry, the mobile analytics company Yahoo acquired in the early summer of 2014. Flurry’s SDK, which is installed in more than 600,000 ad-supported and non-ad-supported apps, is a valuable source of mobile device data alongside Yahoo Mail, Yahoo Finance, Yahoo Sports, Tumblr and other Yahoo O&O.

The Flurry dataset “improves Verizon’s story to app developers and can potentially supplement Verizon’s vaults with mobile app device IDs,” Chater said.

The next chapter in that story is Verizon/AOL’s quest to become a more consequential contender for ad spend in a world increasingly dominated by Google and Facebook. With the addition of Yahoo, Verizon has a lot of advertising tech under its growing hood.

“The combination of Yahoo and AOL on audience, content, ad tech and data creates an entity with considerable digital scale [and] in the end, using that to create deeper audience engagement and experiences will certainly get the attention of advertisers,” said Viant CMO Jon Schulz. “Advertisers benefit from choice and alternatives.”

But whether Verizon is able to launch itself into the stratosphere “depends on the number of net new cross-device profiles Yahoo is bringing to Verizon,” said Adelphic co-founder Jennifer Lum. “Ongoing investment in building and acquiring engaged audiences – logged-in audiences in particular – will get Verizon closer to being a viable alternative.”

And Facebook and Google have a pretty daunting head start, what Belsky referred to as “a material lead in this arms race,” in terms of targeting options, user count and ad products.

But despite the fact that the Verizon/AOL/now-Yahoo dataset will still be “dwarfed” by Google and Facebook, “sometimes being the ‘open’ alternative is enough to move the needle,” said Caprio.

That aside, it will likely be quite some time before Verizon and AOL take advantage of Yahoo’s audience data to the fullest. Verizon is no stranger to privacy-related snafus – recall the zombie cookie affair – and it’s unlikely to do anything precipitous.

“Verizon is making aggressive moves to become a meaningful “number three” to Facebook and Google,” Lum said. “[But] Verizon will likely keep their growing dataset within their own walled garden for privacy reasons and commercial reasons.”

It’s also no easy technical feat to integrate behemoths and their sprawling tech stacks. That’s especially true in the telco space, whether large carriers have been buying up ad tech players for quite some time, like SingTel and Amobee, Telstra and Ooyala and Telenor and Tapad.

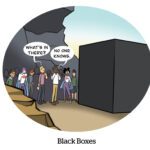

“When very large companies merge, the number of stakeholders multiplies and any project requiring to integrate the respective technology stacks will take a long time to flesh out,” said Chater. “Large telcos have been acquiring ad tech companies for quite some time, allegedly to help turn their omnipresent pipes into ‘smarter pipes’ and unleashing unprecedented monetization power – [but] how the telcos will execute on these plans to make their pipes smarter isn’t clear.”