While MAGNA Global and ZenithOptimedia projected in their most recent forecasts that digital ad spend will exceed TV by 2017, Dentsu Aegis Network’s Carat begs to differ.

While MAGNA Global and ZenithOptimedia projected in their most recent forecasts that digital ad spend will exceed TV by 2017, Dentsu Aegis Network’s Carat begs to differ.

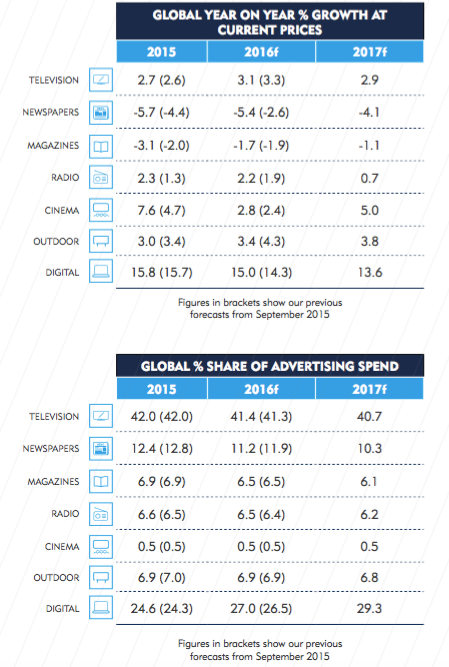

The agency’s global ad spend report released Thursday found that while digital media will account for 29.3% of global advertising spend by 2017 ($161 billion), TV will still reign with 40.7% of global spend.

Nevertheless, digital continues to lead growth across advertising categories. Carat projects digital to increase by 15% this year and 13.6% in 2017, driven by growing spend in mobile (37.9% in 2016), online video (34.7%) and social media (29.8%).

Notably, Carat found 12 markets, including Hong Kong and Estonia, where the most ad spend is digital. The US is predicted to join this list by 2018.

The surge in mobile coincides with ZenithOptimedia’s global ad spend forecast, released last Monday, that predicts mobile ad revenue will account for 92% of new advertising dollars by 2018.

TV, which still dominates global ad spend, commanded 42% of the market in 2015 and is expected to grow 3.1% in 2016 due to the Olympics and US elections. The US presidential election alone will generate $6 billion in ad spend.

“The strength of digital continues to be the dominant element of the growth of the global advertising expenditure whilst TV remains the foundations of our industry,” said Jerry Buhlmann, CEO of Carat’s parent company, Dentsu Ageis Network, in the report.

But TV and digital are coming together as Carat leverages programmatic capabilities to “combine TV and rich consumer data to buy against people, not schedules,” said Carat global CSO Sanjay Nazerali.

Carat expects global ad spend to grow 4.5% YoY through 2017, reaching $538 billion in 2016. This is slightly down from Carat’s September forecast (4.7% YoY) due to lowered expectations in China and Brazil. Despite volatility in foreign markets, all regions are predicted to continue positive through 2016.

North American ad spend will grow 4.3% in 2016, thanks in part to the US elections.

Aside from print, which continues its decline, Carat predicts positive growth for all other media including out-of-home, radio and cinema.