Amazon has become the indisputable number three digital ad platform, after Google and Facebook.

Amazon has become the indisputable number three digital ad platform, after Google and Facebook.

But while the possibility of Amazon’s advertising business unseating the duopoly has been percolating, can it really surpass either Google or Facebook as an ad industry titan?

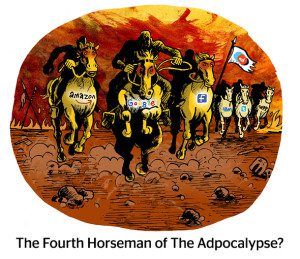

The numbers are … discouraging, at least in the short term.

Google is just too far ahead for Amazon or Facebook to surpass it in the foreseeable future. Google earned $116.3 billion in ad revenue in 2018, up $21 billion from the year before.

Amazon’s ad business more than doubled from $4.6 billion to $10.1 billion in that time, but it would have to double again and again just to match Google’s yearly raw growth. Only then could it start chipping away at Google’s $100 billion head start.

Catching up to Facebook’s $55 billion 2018 haul seems more attainable. Amazon’s ad revenue was a tenth the size of Facebook’s in 2014, but is almost 20% now and its growth rate is much higher, said Zenith head of forecasting Jonathan Barnard.

It’s possible, though unlikely, that Amazon would catch Facebook in the next three to five years, said Dan Salmon, BMO Capital Markets’ managing director of US internet and media equity research.

“To close that gap in the medium term would require either Amazon making a number of midsize ad-supported media acquisitions, or for Google or Facebook to be broken up, and we think that is still a low likelihood, notwithstanding Senator Warren’s recent polling strength,” Salmon said.

The bullish case for Amazon advertising requires the ecommerce company to make ad revenue a bigger priority in the next few years.

Amazon Prime Video, which captures most of Amazon’s overall consumer attention, is ad-free. Amazon also only recently launched a self-serve ad tech platform for buyers, and is integrating the Sizmek ad server business it acquired in May.

Amazon Prime Video, which captures most of Amazon’s overall consumer attention, is ad-free. Amazon also only recently launched a self-serve ad tech platform for buyers, and is integrating the Sizmek ad server business it acquired in May.

“For Amazon in particular, I think the main challenge is their ad tech capabilities,” said Forrester analyst Collin Colburn. The common refrain from CPG marketers is that Amazon’s ad targeting and interface isn’t as sophisticated, he said, and it keeps the platform from gaining adoption beyond its core online shopper marketing campaigns.

If Amazon buckled down on its platform tech and beefed up ad inventory with a publisher network and its streaming video products, it could catch Facebook in five or so years, said Mediaocean CEO Bill Wise.

But Amazon likely won’t reshape investments in favor of advertising. The AWS cloud gets more engineer attention than the ad tech platform, despite the ad platform’s admitted clunkiness. And as long as the Prime Video library remains a driver of Prime shopping subscriptions, the potential ad revenue is inconsequential.

And since Prime Video isn’t turning on ads anytime soon, Amazon just doesn’t capture enough consumer attention to break into Google’s or Facebook’s whole-funnel advertising business, said Brian Wieser, GroupM’s global president, business intelligence.

One of Amazon’s biggest ecommerce benefits – frictionless sales – is a disadvantage for brand advertising, Wieser said, especially compared to the Google and Facebook empires that control hours of average user attention per day.

“Time is a proxy for commercial opportunity,” he said.

The trump card up Amazon’s sleeve is, as always, its ecommerce data.

Amazon’s point of sale and intent data is “a lot richer” than anything else on the market, including Google and Facebook data, said Forrester’s Colburn.

Amazon’s marketplace transactions and Prime subscription data sets aren’t connected to the ad platform right now, aside from sellers paying a performance fee when Amazon ads drive a sale.

But if Amazon did open up its ecommerce data to advertisers, like to target customers that regularly buy high-price items, it would be a powerful differentiator from Google or Facebook.

“Amazon could arguably have the best advertising data set ever at scale,” Wise said.

But Amazon won’t necessarily exploit that data to boost advertising, which is still a marginal revenue stream (it doesn’t even break out ad numbers in earnings, folding the business into a catch-all “Other” segment). Advertising fuels Amazon’s core ecommerce business, not the other way around.

“It’s a question of focus,” Wise said. “If Amazon truly focused and made advertising a priority, then a takeover of Facebook in the no. 2 position in the medium term is within reach.”