Wait, there’s good news in the fight against ad fraud?

The global monetary impact of ad fraud is expected to go down this year, the amount of mobile fraud happening in the ecosystem is much lower than feared and programmatic can be just as safe as direct-sold if buyers implement the right security measures.

The bearers of these good tidings are the Association of National Advertisers (ANA) and bot detection outfit White Ops in their third annual joint study on the state of digital ad fraud, released Wednesday.

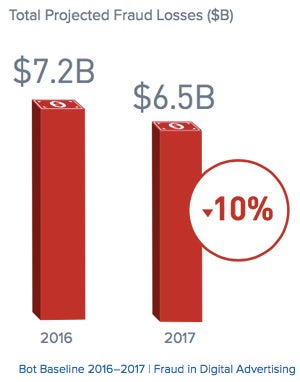

White Ops projects $6.5 billion in financial losses due to ad fraud this year, down 10% from the estimated $7.2 billion bite fraudsters took out of ad budgets in 2016. The new number is just a tad higher than the $6.3 billion loss the duo predicted as part of their first study in 2015.

While $6.5 billion is still a hefty chunk of cash, the reduction is encouraging, said White Ops CEO Michael Tiffany.

“What we’re seeing is finally the first macro sign that the war is winnable, although it’s certainly far from won,” he said.

But why is the tide turning? It’s not because fraudsters are getting lazy or complacent. Rather, the economic incentives to commit ad fraud are shifting as marketers get smarter about protecting themselves.

“The cost of succeeding at ad fraud has gone up, and as a result, the golden age of low-end display arbitrage where you can buy bot traffic for a fraction of a cent and monetize it in cheap CPM inventory is just no more,” Tiffany said.

Fraud in desktop display advertising will go down from 11% last year to 9% this year.

But the picture isn’t as rosy for video, which remains a hotbed of bot activity. The fraud rate for desktop video spend will amount to 22% this year, down only slightly from 23% last year. The higher CPMs available for desktop video inventory still make it worth a fraudster’s while to pay more for bot traffic.

Programmatic, however, is no longer an inherently risky endeavor. The report found that the sophisticated safeguards put in place by a growing number of programmatic buying platforms and by publishers to thwart shady traffic sourcing are working.

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Daily Roundup

Paid traffic acquisition remains the ANA’s least favorite thing ever (other than agencies that use the murkiness of the programmatic supply chain to conceal undisclosed fees), because that’s how most fraudsters steal their daily bread.

The report found 3.6 times more fraud nested within paid traffic than nonsourced traffic.

“The fact is, sourced traffic is driving a lot of the ad fraud out there,” said Bill Duggan, group executive president at the ANA, who encouraged advertisers to include language in their contracts to make it clear that they won’t pay for bot impressions coming from sourced traffic.

“The fact is, sourced traffic is driving a lot of the ad fraud out there,” said Bill Duggan, group executive president at the ANA, who encouraged advertisers to include language in their contracts to make it clear that they won’t pay for bot impressions coming from sourced traffic.

Cash-out sites – sites packed with ads and fake content built specifically for the enjoyment of bots – account for 20% of all domains on the internet. Although that’s a startling stat, they don’t necessarily represent 20% of the problem, Tiffany said.

Although bot farms and sourced traffic sent to cash-out sites are a fraudster’s bread and butter, those sites never achieve high CPMs. The bigger fraud trigger, White Ops found, is seasonality.

Digital ad inventory is growing as more people spend more time online. But it’s not growing fast enough to meet demand. And at certain times of the year – November and December, for example – spending far outstrips supply, and publishers with real human audiences respond to that volatility in ad spend by turning to third-party sources for new visitors.

And that’s where fraudsters can really make bank and traffic starts to get “really botty,” Tiffany said.

“Bot traffic rises and falls in response to inventory demand,” he said. “And bot operators make their money through traffic sourcing, by selling visitors on demand on a CPC basis.”

The study also took a look at mobile fraud for the first time this year, and … didn’t find all that much fraud, actually.

Fraud represents less than 2% of all app and mobile web display buys because mobile CPMs are lower and because fraudsters need to get users to install their fake apps. Legit apps have a hard enough time with user acquisition, let alone apps like Vampire Doctor or Waxing Eyebrows.

Also, the inventory that is vulnerable to ad fraud – mobile web video, for example – isn’t usually an area where brands spend much cash.

“We’re trying to do a true cost analysis here,” Tiffany said. “We’re not looking at all fraud attempts, because that would cause us to overestimate. We only care about fraudulent traffic that is defeating bot detection and getting paid for – and that is quite low and contradicts what the doomsdayers are saying.”