Publisher monetization choices are among the most covered and critiqued aspects of our industry. I’m as guilty as anyone; it has been the through line of everything I’ve written about since 2023.

If you’d prefer to skip the archives, here’s the summary: The core challenge with publisher monetization is the perception that more partners, requests and ads drive better outcomes than a higher-fidelity, lighter-footprint approach.

Even if you agree there are alternatives to volume-driven strategies, you have to concede they’ve been the more widely adopted path.

And why not? For publishers staring down AI-driven extinction events, unrealistic quarterly goals and layoff-laden headlines, resorting to reselling, duplication, ad density and black-box ID bridging probably feels better than the alternatives.

For all the advancements in our industry, we’ve done a terrible job rewarding publishers for monetization choices that align their supply to quality and outcomes vs. short-term yield bumps.

But is it overly optimistic to think that’s changing? The debate surrounding The Trade Desk, Transaction ID and OpenAds makes one thing clear: The largest buyer in the open market intends to create an auction that finally rewards publishers for prioritizing direct paths, inventory quality and signal fidelity.

Quality is an opportunity, not an obstacle

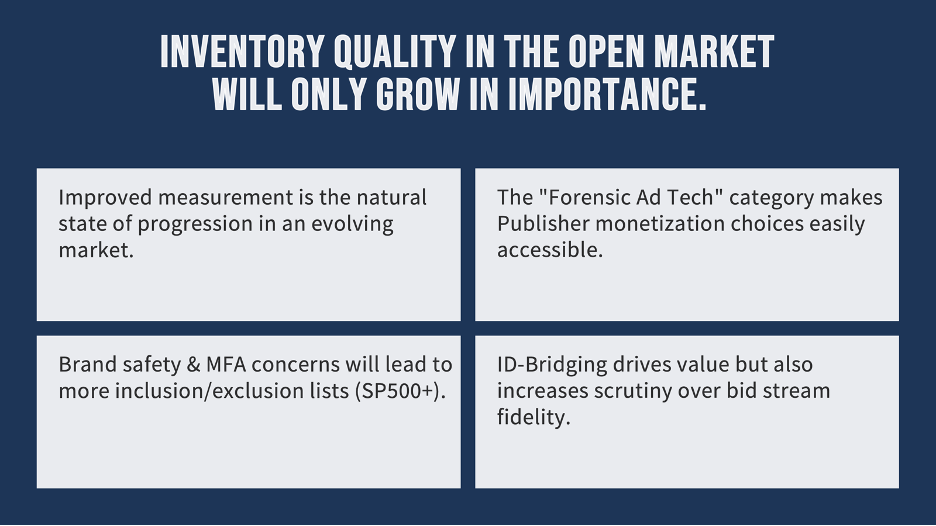

In November 2024, I gave the keynote presentation at the AdMonsters Publisher Summit. I ended that talk with three bets for the future of the open web. This was the first:

(The forensic ad tech category includes companies like Jounce Media, Adalytics, DeepSee and Sincera.)

Publishers are the foundation of the open internet. But after users, advertiser dollars are what sustain it. If we accept that reality and acknowledge that open web supply is effectively unlimited, it leaves us in an ecosystem where advertisers can be incredibly selective about where they buy.

That’s not a buy-side talking point. It’s a market reality. So while the surge of MFA inventory in the bidstream was annoying, the media attention it created accelerated advertiser, marketer and DSP scrutiny of open web quality.

That’s a good thing! Increased scrutiny serves as a step forward for publishers who have built sticky, direct relationships with their audiences – something incredibly difficult to do and long overdue for a reward.

In my 18 years working as a publisher, most of it building and monetizing bootstrapped startups, the hardest lesson I’ve learned is that the most effective long-term revenue strategies align with the best interests of the advertiser.

That realization wasn’t born out of altruism. It came when I recognized that no matter how engaged my audience was, I’d never compete with publishers like Condé Nast, Paramount or Disney on a brand level.

If that’s my reality, then what does a viable, repeatable competitive advantage look like in an open market? A direct relationship with the user, retention, engagement and a reasonable ad footprint with signals buyers care about like viewability, attention and identity.

That doesn’t mean advanced yield strategies aren’t important or shouldn’t be a part of publisher solutions. It just means it’s ok to acknowledge the difference between driving value and exploiting loopholes that buyers dislike and technological advancements aim to make obsolete.

The OpenAds value prop

Unwind Media began passing Transaction IDs after integrating with OpenPath in 2023. We also send UID2 for authenticated audiences.

Like everything else in our stack, these integrations weren’t launched without scrutiny. We tested, measured at the bid level and scaled only when the data supported it. Both OpenPath and UID2 have delivered strong, unique value, but the takeaway isn’t that any single partner is the answer. It’s that measurable signal quality and direct pathing have consistently correlated with better business outcomes, something I believe will only accelerate in the open market moving forward.

Publishers should remain partner-agnostic and approach every new initiative, including OpenAds, with the same rigor applied everywhere else. The goal isn’t to anoint buy-side heroes or sell-side villains; it’s to identify opportunities where transparency and efficiency can meaningfully and sustainably improve results.

OpenAds is worth testing because it aims to challenge a longstanding structural issue in programmatic: opaque auctions, hidden fees and an oversupply of low-quality inventory. Even if you’re a publisher running a clean stack, your partners might not be. That lack of verification hurts everyone.

OpenAds represents a broader need for trusted, verifiable auction standards, something industry bodies like the IAB Tech Lab or Prebid could also advance through open frameworks. The goal should be the same: Find ways to “trust but verify” so the publishers and SSPs doing things right are rewarded and those extracting value through opacity and inefficiency are forced to evolve or exit.

For publishers who rely on open-market monetization, that’s an experiment worth running with a partner large enough to make an impact.

Validation from results

When The Trade Desk CEO Jeff Green described OpenAds’ primary purpose, to create cleaner auctions and better buyer performance, he also acknowledged that it must drive better outcomes for publishers. Transparent, high-integrity auctions should improve ROI for advertisers and build a healthier marketplace for everyone, especially publishers.

I don’t know whether OpenAds will prove to be a net positive for the open internet. However, I do know that bid jamming, reseller-packed supply chains, hidden fees and user-identity manipulation are not.

The open web doesn’t need more volume; it needs validation of audiences, of quality, of signal and of trust. That directly aligns with improved publisher revenue and better advertiser outcomes.

That would feel like real progress.

“The Sell Sider” is a column written by the sell side of the digital media community.

Follow Emry DowningHall and AdExchanger on LinkedIn.

For more articles featuring Emry DowningHall, click here.