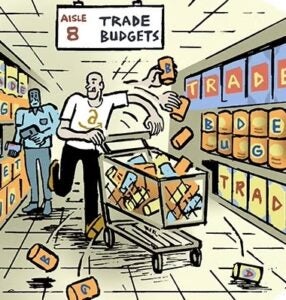

Everyone wants their “premium” inventory in digital advertising. But putting ads within quality experiences, next to quality content, has been a decade-long problem.

How do we get programmatic to reward quality? Digital media is floundering, while bottom-of-the-barrel websites are flourishing. Can digital media flip these incentives to ensure we can continue reading quality websites and reward high-quality creators?

On this week’s podcast, we discuss how quality is being tackled both on an industry level, and on a company level. Last week, our Senior Editor Anthony Vargas attended a Trade Desk event where the DSP continued its relentless messaging about the “premium internet,” and he details their efforts to curate a more premium subset of the open web. And Vargas also covered how the Brand Safety Institute is trying to create more transparency about made-for-advertising website classifications, and help publishers who are unwittingly cast as made-for-advertising websites.

Lockr and Viant

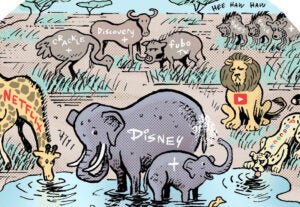

Then, ad tech consolidation continues. So far this year we’ve seen Sincera acquired by the Trade Desk, Rockerbox by DoubleVerify, and Vistar by T-Mobile, to name a few.

On Monday, Viant announced it was buying Lockr. At least according to analysts on Viant’s earnings call Tuesday, it was not the acquisition they were expecting. Lockr, a B2B2C company, with products for consumers and publishers, has first-party identity data, which could be matched with Viant’s identity graph that lives within its DSP (and was originally built on the back of MySpace info). We dive into what this acquisition could mean, as yet another emerging ad tech startup is combined with a larger ad tech acquirer.