No TIDs? No problem. Well, according to The Trade Desk, at least.

In August, Prebid.org made the controversial decision to nix universal Transaction IDs – which advertisers use to track ad transactions across multiple SSPs – in favor of providing unique TIDs for each seller.

The rationale for Prebid’s change was that buyers could use TIDs to link bid requests and inventory sources across different platforms, potentially letting them bypass publisher controls, including for pricing.

A debate has raged since Prebid’s update, which applies to Prebid version 10.9.0 and later. DSPs say they need universal TIDs to fight auction duplication and avoid wasteful supply paths. But publishers argue that universal TIDs give buyers too much power and that some duplication is necessary to drive bid density, which increases revenue yield.

Well, The Trade Desk just changed the conversation.

Last week, TTD CEO Jeff Green dropped a bombshell with the announcement of OpenAds, an auction wrapper that creates a separate, branched-off auction based on Prebid’s code that still uses universal TIDs and that other DSPs and SSPs will be able to bid into.

TTD is also launching an accompanying dashboard called PubDesk that will give publishers transparency into how buyers value their inventory and what signals matter for bid pricing.

A no-tricks auction

But why is the industry’s largest DSP wading into this discussion?

The new products aren’t just a reaction to Prebid’s TID change, Will Doherty, The Trade Desk’s SVP of inventory development, told AdExchanger. Nor are they intended to be a replacement for Prebid. They’re also not evidence, he said, that TTD is changing its long-time position as a platform for buyers in order to embrace the sell side.

“Our only goal is a fair and high-integrity auction environment,” Doherty said, “which is about more than just transaction IDs. High-integrity auctions drive superior performance [that] results in increased ad spend and bid values, which makes it a win for publishers as well.”

He added that The Trade Desk wants to provide an alternative auction environment in which publishers can sell their inventory based solely on “quality, ad experience and the size of [their] audience” minus the complicated auction and yield optimization mechanics that are baked into other Prebid auctions.

Yet publishers maintain that these yield mechanics help them generate more revenue. That’s why they use them.

But publishers can’t be sure there aren’t unnecessary ad tech fees and bidstream manipulations hiding in the complexity, according to Doherty.

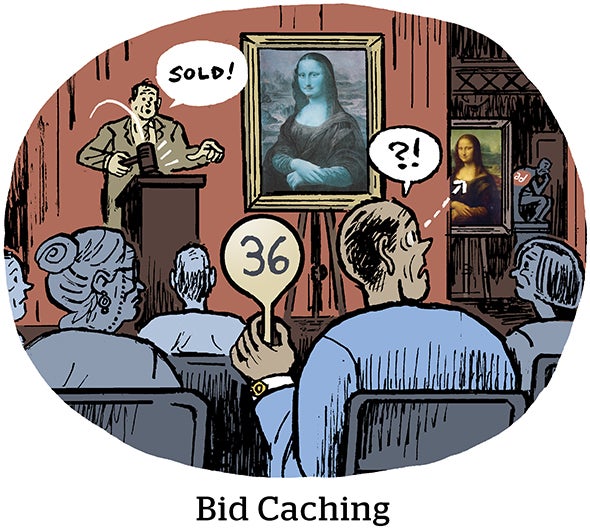

Meanwhile, buy-side platforms like TTD are in a constant battle to weed out contentious optimization strategies, like bid duplication, bid caching and ID bridging, which can lead to higher prices for buyers. But these practices aren’t always good for the sell side, either.

Based on insights from The Trade Desk’s OpenPath direct-to-publisher connection, “we see a mismatch in the distribution of ad spend between premium environments and more scaled environments,” Doherty said.

In some cases, that disparity happens because premium publishers haven’t invested in certain auction mechanics, he said, and “they’ve been disadvantaged” as a result. In other cases, he said, “we see hard-to-explain, aggressive take rates” that thwart premium publishers from getting a fair price for their inventory.

TTD sees OpenAds as a way for publishers to compare how much revenue they really get from these different auctions.

Advertisers that use The Trade Desk will still buy inventory through other auction setups and Prebid wrappers, Doherty said. Plus, OpenPath will remain in Prebid, and TTD is still on the Prebid board.

But for those publishers that “want to compete on content, not on yield or auction mechanics,” he said, OpenAds “will allow you to get your fair share.”

TTD’s alternative wrapper will also ensure there’s no unnecessary auction manipulation happening at both the publisher ad server and SSP levels, Doherty said. (TTD’s OpenPath only mitigates against manipulation at the SSP level.)

‘The truth of what we spent’

It’s hard for publishers to argue against more transparency.

Better insight into the opacity of auction dynamics would obviously be a welcome change in programmatic, said Justin Wohl, chief strategy officer at publisher tech firm Aditude, which offers its own Prebid wrapper (and soon, apparently, will be competing with The Trade Desk).

The fact is, publishers “don’t know what happens after the bid request leaves the wrapper,” said Wohl, who previously served as CRO for multiple publishers, including Salon, Snopes and TV Tropes. Much of the auction duplication that TTD is trying to eliminate with its wrapper is not even visible to publishers from looking at on-page signals, he said.

Based on TTD’s announcement, Wohl said, “OpenAds is presumably going to be more responsible and more buyer friendly than other wrappers, but in what way, we don’t yet know.”

He added that determining how fair and transparent the solution will be in practice will depend on whether publishers get access to the data on bid disparities and hidden fees that inspired TTD to launch OpenAds.

The point of PubDesk, Doherty said, is to share such data with publishers.

It’s an evolution of what TTD was already doing with OpenSincera, he said, which gives publishers benchmarks on media quality signals like ad-to-content ratio that buyers can use to decide how much to bid on inventory.

PubDesk takes that approach a step beyond benchmarking, Doherty said, by giving individual publishers more direct insight into their own media quality metrics and what buyers are paying.

“This is the truth of what we spent, so you can make informed decisions,” he said. “It’s built to answer the publisher question, ‘How can I earn more from The Trade Desk?’”

Price discovery

TTD’s goal with all of these sell-side-focused product launches, Doherty said, is to encourage transparency between buyers and publishers by exposing programmatic waste.

That positioning may well prove to be true, said Scott Messer, founder of publisher consultancy Messer Media. The Trade Desk has generally pushed for transparency in ad tech and argued that cleaning up the open auction will be a positive force for reputable publishers, Messer said, so it’s worth taking the company’s pitch in good faith.

While it’s unique for a bidder to branch off its own auction, other bidders, including Criteo, have released their own wrappers before, Messer said.

However, it was a bold move for TTD to use Prebid’s open-source code to get around Prebid’s TID change by creating its own auction via a fork in the code, Messer said. “It’s like stabbing them with their own fork,” he joked.

But any potential benefits to publishers aside, Messer said, spinning off a new auction is a price discovery play by The Trade Desk that gives buyers more transparency into the lowest CPM they can pay. It’s part of the eternal push and pull between buyers and sellers when it comes to yield management, he said.

Buyers may be “frustrated” that certain auction mechanics are preventing them from seeing a publisher’s true price floor, Messer said. “But it is literally a yield manager’s job to extract as much of the buyer’s surplus as possible,” he added. “If the buyer doesn’t want to pay it, they can simply skip that impression.”

Problem is, publisher floor prices don’t reflect the true value of an impression, he said, which lies somewhere between the maximum price a buyer would pay and the floor price.

“My floor price is not the price I want; it’s the minimum I’m willing to accept,” Messer said. “[Price floors are] not just there to give DSPs guidance, but to cut out fraud and enforce minimum standards.”

And although TTD said “all the right things” in its announcement about looking out for the best interests of sellers, Messer said, publishers could be forgiven for being wary. After all, he said, pubs have heard these kinds of promises before from Google, Meta and others – and the end result always seems to be downward pressure on publisher CPMs.

But lower CPMs aren’t the only thing publishers may have to worry about from TTD’s wrapper, according to Messer. The introduction of another auction wrapper – in addition to traditional Prebid, Amazon TAM, Google Open Bidding and others – could increase publisher page loads, he said.

TTD, of course, denies that branching off a separate auction will increase the latency caused by programmatic, which means publishers will have to wait and see how it plays it out.

Even if latency doesn’t increase, however, Messer said, managing yet another auction will further complicate how pubs and ad ops teams approach yield optimization.

“Welcome to the wrapper wars,” he said.

No yield management, no SSP

Speaking of yield, The Trade Desk considers handling yield optimization for publishers to be the red line that separates SSPs from DSPs, Doherty said – hence why TTD wants no part of managing publisher yield through its Prebid wrapper or otherwise.

However, TTD will be providing bidding data via PubDesk that publishers can use for their own yield optimization.

Depending on how technically savvy a publisher is, this type of data could be extremely helpful, Messer said.

Still, he added, whether TTD sees itself as getting more involved on the sell side or not, the fact is that The Trade Desk was a pureplay DSP roughly a decade ago, and it’s been working progressively more closely with publishers in recent years.

Not every publisher will be sold on the sincerity of a demand-side platform’s pitch to help publishers, Wohl said. “Publishers are going to have a hard time trusting this much of their stack to a single company,” he added, especially one that’s also buying their inventory.

In order to drive publisher adoption of OpenAds, Messer said, TTD will need to ramp up its outreach and customer support efforts.

TTD currently has a publisher support team led by Doherty, but the company declined to share the size of the team or any plans to expand it.

But regardless of where TTD sees itself sitting in the supply chain, Wohl said, it has the chance to foster a more transparent paradigm for the industry by leading through example.

“Will they open source this?” Wohl wondered. “Will they let other wrapper companies attempt to be ‘good guys’ too?”

The Trade Desk confirmed that it plans to open-source certain aspects of OpenAds and PubDesk, but declined to specify which parts.

Looks like we’ll just have to wait until Jeff Green’s appearance at the Prebid Summit next week to find out more. AdExchanger will be there, too. Stay tuned for our coverage.