Alphabet, which reported its third quarter earnings on Tuesday, generated more than $88 billion in Q3 total revenue, up 15% from a year ago.

Meanwhile, YouTube’s combined advertising and subscription businesses surpassed $50 billion over the past year. This is the first time YouTube has ever hit that milestone.

Impressive numbers. But investors seemed to only have eyes for AI.

The investor Q&A portion of Alphabet’s earnings call was almost all about generative AI, GPUs, CPUs and TPUs. (A TPU is a “tensor processing unit,” if you’re curious, which is a circuit developed by Google for neural network machine learning.)

A couple investors did ask about YouTube and Google’s advertising business, though.

Eric Sheridan of Goldman Sachs inquired about consumption versus monetization of YouTube’s short-form videos.

Philipp Schindler, Google’s chief business officer, said consumption is still rocketing upward. “Just to give you a number,” he said, “over 70 billion YouTube Shorts are watched every day.”

Schindler added that the monetization gap for Shorts and YouTube in-stream ads is starting to close, helped by an update that allows brands to buy the first ad in a block of Shorts posts, and another that puts Shorts in YouTube Select campaigns. YouTube Select is the new name for “Google Preferred,” a product that serves ads only to a top slice of popular, high-performing videos.

Ross Sandler of Barclay’s snuck in a question on whether Google has any contingency plans if the DOJ search antitrust trial voids its default search engine status – to which CEO Sundar Pichai offered the usual boilerplate response that Google plans to “vigorously defend these cases.”

Unsurprisingly, even questions about Google’s ad business were rooted in Google’s AI investments.

In answer to one about Performance Max becoming a tool for mid- and upper-funnel campaigns from Stephen Ju of UBS, Schindler said that “it’s very cost effective and it really finds customers wherever they are across all the different Google channels.”

Schindler also gave a nod to Demand Gen, a newer product from the same suite of Google AI-based ad tools, albeit focused on brand marketing and prospecting.

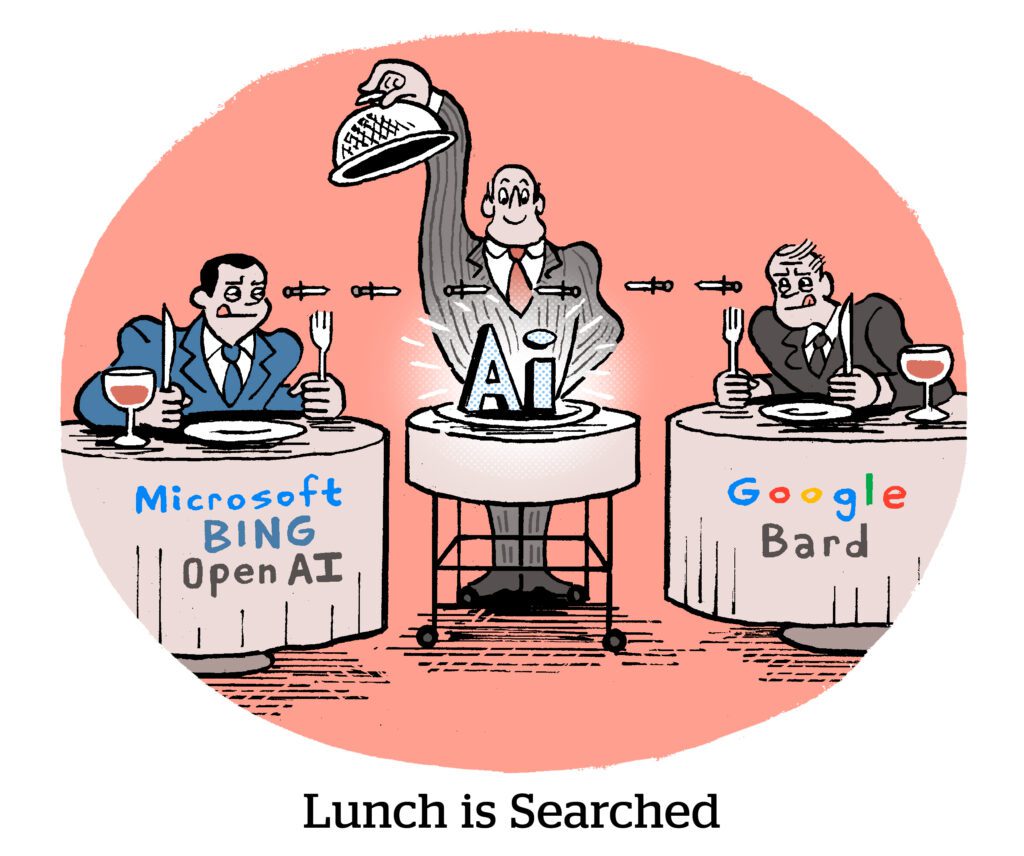

But what’s an Alphabet earnings call without a question about AI-powered search?

Wells Fargo analyst Ken Garewlsk asked why Google doesn’t offer two search engines, “one, an agent-like answers engine and then, two, a links-based more traditional search engine?”

But this isn’t Google’s first rodeo.

“In this moment, people are using a lot of buzzwords like ‘answer engines’ and all that stuff,” Pichai said. “I mean, Google started answering questions about 10 years ago in our search product with featured snippets.”