“On TV And Video” is a column exploring opportunities and challenges in advanced TV and video.

“On TV And Video” is a column exploring opportunities and challenges in advanced TV and video.

Today’s column is written by Philip Inghelbrecht, co-founder and CEO at Tatari.

Advertisers often wonder when it is the right time to move into TV advertising. Sadly, many wonder if TV even makes sense because of its reputation as a big-budget brand privilege. Worse, many think the answer is “never.”

But TV is often appropriate earlier than most advertisers assume. In general, a good indicator of the right time to go into TV is when incremental spend on digital platforms, such as Facebook or Google SEM, stops driving incremental sales. This can be tested by doubling spend on digital platforms, for example, and checking if the sales volume doubles as a result. If the ROI holds, then it makes sense to keep investing in digital channels.

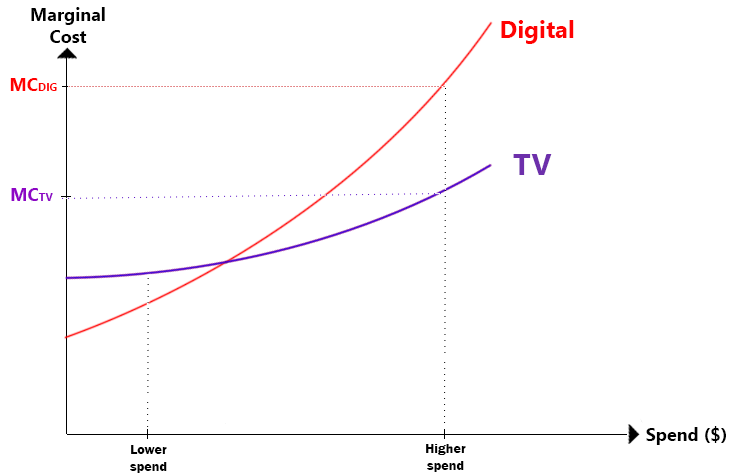

What often happens, however, is that digital platforms scale well in the beginning but quickly hit diminishing returns. Paid digital channels suffer from increasingly higher marginal costs as spend increases. In other words, it becomes very expensive to acquire additional customers.

TV, on the other hand, scales better at higher spend and, admittedly, tends to drive less ROI at lower spend. This can be best seen in the figure below, which shows the typical relationship between digital platforms and TV at different levels of spend.

Digital platforms usually – though not always – perform better than TV at lower spend because the marginal cost of advertising on TV is higher at lower spend. However, TV outperforms at higher spend because the marginal cost does not increase as steeply as that of digital platforms.

So, if it turns out that digital platforms are no longer scaling well, then it is time to consider offline marketing platforms like TV. Based on my experience, most companies spending $200,000 per month on Facebook are usually able to acquire customers at lower marginal costs through TV. For those advertisers, it makes sense to pilot TV advertising.

Furthermore, TV can be entered and proven at a low cost, with as little as $50,000. Even more importantly, TV campaigns can be managed with low spend on a week-to-week basis and do not need to be multimillion-dollar undertakings and commitment. Higher levels of spend will bring more benefits in measurement – for example, the ability to measure conversions at the level of network or rotation – but advertisers are free to increase spend only if they see proven ROI.

Follow Tatari (@TatariTV) and AdExchanger (@adexchanger) on Twitter.