Like Kendrick Lamar during the Super Bowl halftime show, Interpublic Group CEO Philippe Krakowsky had a message for all the haters out there.

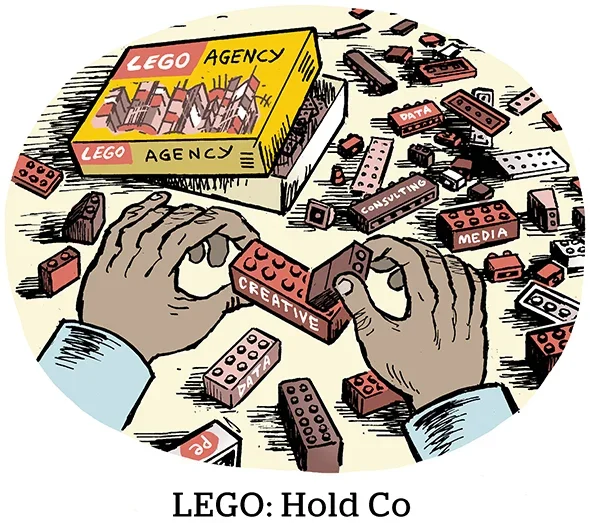

And that message was this: IPG’s impending merger with Omnicom in the second half of 2025 won’t affect its ability to do business in the meantime.

“A number of our competitors are clearly concerned enough about the combination that they’ve spent a lot of airtime talking about our being distracted,” Krakowsky told investors on Wednesday morning. “But our frontline talent is fully focused on clients, which is, obviously, as it should be.”

Partners and clients have been “enthusiastic” about the proposed merger, he said, and are looking forward to the “wider array of capabilities” that will be available after joining with Omnicom.

“Nobody in the industry has as comprehensive a solution as we will together,” claimed Krakowsky.

The opposite of doing numbers

That said, 2024 was a tough year for IPG. Although it purports to be in a “strong financial position,” according to CFO Ellen Johnson, the holdco is predicting an organic decrease in revenue of between 1% to 2% this year.

Per Krakowsky, IPG also fell shy of its forecast for 2024.

Last quarter, the agency generated $2.43 billion in net revenue (which includes billable expenses), representing a year-over-year overall decrease of 5.9% compared to the same period in 2023, as well as a 1.8% decrease in organic growth specifically.

IPG also reported $9.19 billion in net revenue for all of 2024, which is down 2.3% compared to the prior year but up slightly by 0.2% in terms of organic growth.

Johnson also pointed out that strong growth at Acxiom, IPG’s data arm, ended up offsetting continued losses at MRM (short for McCann Relationship Marketing) under McCann Worldgroup. Both are part of IPG’s “Media, Data and Engagement Solutions” segment, which cumulatively posted $1.16 billion for the quarter and $4.21 billion for the year – both losses overall, but representing organic growth rates of 0.6% and 0.2%, respectively.

Hey, wha’ happened?

Krakowsky cited recent client losses – which he stressed were decisions based on “the commercial terms enabled by principal media at scale” – as having negative impacts on the company’s 2024 results. (Krakowsky didn’t go into detail, but it would certainly seem like IPG doesn’t yet have enough negotiating power to satisfy some clients where principal-based buying is concerned.)

He also called out a “shift in the health care vertical” where “a competitor was able to leverage its much greater size to win a significant portion of a large creative account that [we’d] been awarded not long prior” – clearly referring to Pfizer, which consolidated its creative duties under Publicis in March after only 10 months of splitting them with IPG.

Looking ahead, Krakowsky said IPG expects revenue will continue to be challenged during the first half of this year, but IPG will work to put itself in the “strongest possible position” before the deal with Omnicom closes in the second half of 2025.

The restructuring will continue until morale improves

Part of putting IPG in a stronger position prior to the merger will include – you guessed it – “restructuring.”

This will take the form of centralizing some corporate functions, “streamlining” efficiency within agencies and focusing on offshoring and near-shoring certain parts of the business, all of which will reportedly generate savings of roughly $250 million in 2025.

(Note that this is different from the expected $750 million in savings that Omnicom CEO John Wren predicted last week as a result of the impending merger, which Krakowsky predicts will have “limited overlap” with IPG’s own internal restructuring.)

It’s all but assured that AI will continue to play a larger role in workflow, too.

For instance, IPG’s company-wide marketing platform, Interact, is already being used to analyze billions of data points across thousands of retail categories in 30 global markets, and the company has promised to invest in “talent and technology” related to AI, identity resolution, content management platforms, commerce and data.

These investments will not only save IPG money, said Krakowsky, but will also serve as complementary to what Omnicom is bringing to the merger, making the combined business even stronger in the long run.

Which begged this question from an investor on the call: How much of the decision to merge with Omnicom came from IPG’s recent challenges with principal-based media buying?

Sure, throwing in with Omnicom will certainly benefit IPG’s principal media capabilities, Krakowsky acknowledged. But “there’s just so much more about how the companies fit together,” he said. “The opportunity is much greater.”