Email and search continue to drive the most referrals to ecommerce sites, according to Q1 2013 data from website optimization company Monetate. But word-of-mouth through social media does influence purchases, despite a lack of last-click attribution for the channel.

Email and search continue to drive the most referrals to ecommerce sites, according to Q1 2013 data from website optimization company Monetate. But word-of-mouth through social media does influence purchases, despite a lack of last-click attribution for the channel.

After analyzing more than 500 million online shopping experiences, the Ecommerce Quarterly report found conversion rates for email (3.2%) were higher than both search (2%) and social (0.7%) referrals. Additionally, social media’s add-to-cart rate was also lowest of the three at 3.2%, compared to 6.8% for search and 10.5% for email.

However, the report notes that word-of-mouth from social media can play an important role, citing an anecdote about a Facebook user who asks friends for recommendations and then going directly to the company’s website.

“With social in the mix, last-click attribution is not as accurate a measurement as it was with traditional display advertising,” Blair Lyon, VP of marketing for Monetate, told AdExchanger via email. “Brands need to be aware of the consumer’s intent on social channels, and this will vary brand by brand and channel by channel.”

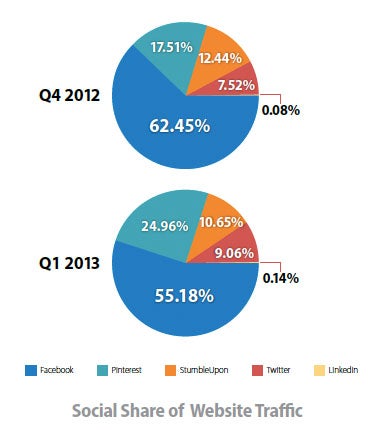

When it comes to just social media referrals, Facebook has the highest share of ecommerce referral traffic, but Pinterest boasts the highest average order value. In Q1 2013, Facebook accounted for 55.2% of referral traffic to ecommerce sites, a drop from Q4 2012 (62.5%). Pinterest gained from Q4 to Q1, rising from a 17.5% share of traffic to a 25.0% share.

Additionally, Pinterest had an average order value of $80.54, compared to Facebook’s $71.26 and Twitter’s $70.17, in Q1 2013.

As marketers work to determine where and how to spend their money and time online, this type of referral data can provide dazzling insights.

“Just because Facebook has over a billion users, for example, does not mean Facebook is a good place to market your products or services,” Lyon said. “For example, a craft brand might find they are able to drive a high volume of customers from Pinterest, yet none at all from Twitter. Understanding the preferences and habits of your customer base through data can help brands create the online experience their customer wants.”

Additionally, the study found that tablet and smartphones are also sending more traffic to ecommerce websites, with tablets rising from 6.0% of website traffic in Q1 2012 to 10.6% of traffic in Q1 2013, and smartphones jumping from 5.4% to 10.4% in Q1 2013.