Digital ad pioneer Eric Picard started Rare Crowds last year with the vision to help publishers and ad networks create more complete media packages in response to complex advertiser RFPs. He says the company does this by layering more attributes onto each impression than has previously been possible through existing ad serving technologies.

Digital ad pioneer Eric Picard started Rare Crowds last year with the vision to help publishers and ad networks create more complete media packages in response to complex advertiser RFPs. He says the company does this by layering more attributes onto each impression than has previously been possible through existing ad serving technologies.

Rare Crowds began as a division within Traffiq and was later spun off and incorporated as an independent company in March. After a beta period that began in February, Picard is now raising a second round of seed funding (Initiative’s North America CEO Nick Pahade is an angel investor). The business employs five people: four engineers in Bellvie, one in Rhode Island, and a tech ops/ security guy who works half-time but will move to full-time in the future.

We spoke with Picard about the Rare Crowds vision and business model.

What problem do you solve?

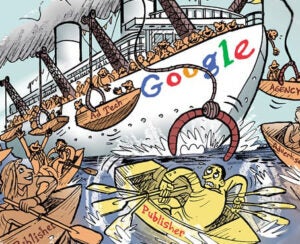

ERIC PICARD: The agency, when they’re putting together the media plan and the campaign and RFP, they spend an immense amount of time working with market research and really understanding the goals of the client, and getting that entire package very well dialed in. RFPs are pretty complex. There’s a lot of information in there. If you break it down into attributes that can be used for booking inventory or targeting things, there’s between 50 and 100 attributes that get handed off to the publisher. That’s a rich set of information.

Publishers have a huge amount of data about their audience. They are able to answer those RFPs with lots of data, whether that’s media data or whether audience data. The problem is the existing ad serving systems don’t allow publishers to package up inventory and there are few responses with more than two or three simultaneous attributes.

There are a whole bunch of reasons for that, having to do with inventory prediction and lists. It’s just the way that these ad systems function. The whole industry has been very focused on prediction. We have to predict how much inventory we are going to have so we can sell it in advance, when you are talking about premium inventory. In RTB, all of the systems that have been developed really allow you to target much better and do not have to worry about prediction.

We are trying to help publishers very easily and quickly respond to inventory requests, RFPs, in a way that allows them to package up that inventory very fast, in like 10 minutes — and then not have a complex negotiation. We’re finding this hyper-targeted inventory that has more than four attributes, that’s what we define as a “rare crowd,” all the way out to 12 or 15 or 20 attributes. If it exists, we’ll find it.

What phase of the business are you in?

We have spent more than a year and four months building the technology. We went into beta with agency clients in the end of February 2012. We incorporated the company in March. The company raised money initially to get through that beta phase.

We have now entered our go-to-market phase and we are beginning to sell directly to publishers and ad networks. We are raising more funds to cover that phase, which is probably another two to three months of work, at which point we will raise a Series A. Where we are at right now is initial go-to-market. The milestones we are running after are customer validation.

Who’s the target customer?

The solution is really for premium publishers. We think of that as the top 200 or 300 publishers. They’ve got to have a decent amount of volume. This isn’t for bloggers obviously. If you have a human sales force, probably you have enough volume to warrant this.

It’s also for ad networks that want to do inventory procurement over ad exchanges and offer a new type of premium inventory that can be procured with RTB.

Any thoughts on mobile and where you guys play in publisher mobile growth?

The way I usually say it is that we have built a very generic product set — “generic” in a very positive way. What we have built works across display, mobile, video, social. It’s agnostic really to what the media type is. All of the ad systems out there, whether they are mobile systems or whether they are video or display, at this point, everybody has got APIs. There is some way we can plug in to do what we do.

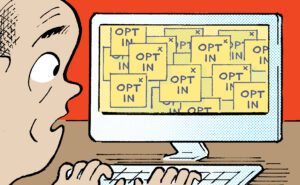

The same problem exists everywhere, which is that inventory that is being sold today, whether it’s in mobile or whether it’s in video or social or anywhere else, generally don’t have tons of targeting applied at the impression level ‑‑ I’m trying to think of a simple way to say this ‑‑ that are ANDs instead of ORs.

You can buy very targeted inventory from somebody like Facebook, but a lot of the inventory is ORed, so a lot of targeting is actually ORed. When we’re involved, every piece of data that we’re applying to an impression is an AND, so it’s very explicit. We know that if we deliver an impression, these are the attributes that were on that impression.

What about native formats such as Facebook’s?

Anything that is delivered by an ad server that is not a completely closed system that doesn’t allow anybody to plug‑in, we can plug into. I don’t know of any systems that are like that anymore. That used to be the default. Even as recently as three years ago, most systems were closed. But that is the big development work that has been done in the last few years. So we can plug into really anything. Right now, we can get on Facebook ads through AppNexus, there’s no reason we couldn’t package up a Facebook‑specific product even for the Facebook sales team, but we haven’t started those conversations yet.

Do advertisers know they’re using that rare crowds, does someone, whoever is issuing the RFP, do they have any idea?

It would be great if they did, but I don’t care.

If a DSP came to us and said this is fantastic, we want to offer this to our customers, they could hit our APIs and build a UI on top of their existing system on top of our APIs and off of rare crowds, integrated fully into their system if they want it, but that’s a longer sales cycle and I don’t want to go there first. It’s not our first go-to market.

Follow Eric Picard (@ericpicard) and AdExchanger (@adexchanger) on Twitter.