“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Matt Scharf, manager of display media operations and analytics at Adobe.

The topic of viewability has infiltrated our lives. Viewability vendors flood the marketplace as marketers take steps to measure their campaigns. If you’re one of them, you’re headed in the right direction, but you’ve only just scratched the surface because measuring viewability is just the bare minimum.

Viewability poses two problems to marketers. They’re both equally important but only one gets discussed. Meanwhile, the other smolders behind the scenes, dragging down the efficiency of your media.

The one you’re probably aware of because every one talks about it is the inventory quality problem. Simply put, marketers waste budget by paying for out-of-view impressions when they shouldn’t. This will take a long time to solve. The industry needs to figure out the economics of moving away from the standard CPM buying model and replacing it with vCPM, where only “viewed” impressions are paid for. And once that happens – if it ever does – you will have waited a long time to solve only half the problem.

The other half is the inventory attribution problem. It’s the unspoken dilemma in the industry, the forgotten side of viewability. Marketers attribute conversions back to media that was never in view by the end user. In the same way that marketers pay for all out-of-view impressions, they also assign credit to out-of-view impressions. There is no argument to be made for an ad to receive credit for driving a conversion if the end use never saw it. But this happens – frequently. And to make it worse, marketers optimize towards these erroneous conversions.

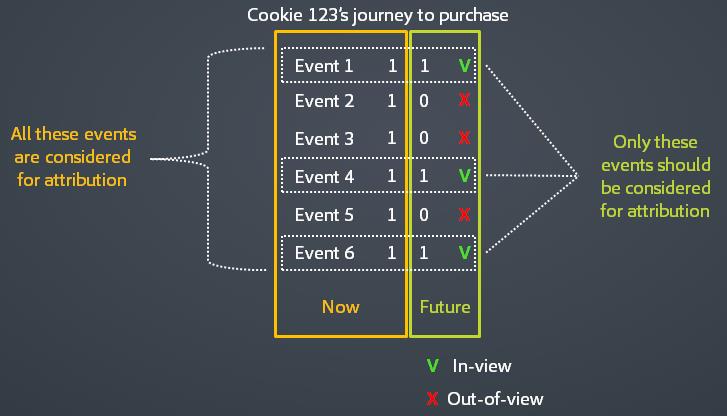

Why? Most attribution platforms don’t consider Viewability as an input to inform attribution. If they have that capability, most advertisers are not taking advantage. The standard approach is to simply look at whether a cookie was served an ad prior to a conversion. Then they consider all those events viable for attribution credit, regardless of whether they were in view by the end user or not. For example, if there were three impressions served to a user prior to converting but two were never viewed, the standard approach by attribution models is to consider all three to be eligible for attribution. Yet, in reality, only one impression had anything to do with that conversion.

To quantify the impact to marketers with a very simple example, let’s assume you have $100,000 of incremental budget to drive as many cost-efficient conversions as possible. You’d evaluate the historical performance of all media placements to see where the $100,000 would be best invested.

Here are two placements to consider. Without using viewability data to make your decision, you’d choose Placement 1 because it can drive orders more efficiently. A $35 cost per order is better than $40. That’s an easy decision.

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Daily Roundup

But there’s a better way. By adding viewability rates with some simple math, we have a new metric to address the forgotten side of viewability: viewable cost per order (vCPO). It’s the attribution version of vCPM, which is used to address the inventory quality problem.

To calculate vCPO, you effectively discount the number of orders by the view rate. If only 48% of impressions are viewed, we should only take credit for 48% of orders.

We now have a completely different view on performance above. The proper choice is now Placement 2 due to the higher view rate. By simply incorporating viewability into performance considerations, you’d drive 129 additional orders by choosing Placement 2. And the monetary value of those additional orders is $8,643 (129 orders x $67, the amount you’re paying to drive the orders).

That’s just a small example. Imagine how big that number would be for an entire campaign.

This is a good step toward evaluating your media performance through a new lens by applying your viewability data. But it’s a flawed solution and therefore temporary until the industry solves for what it really needs.

What The Industry Really Needs

Attribution platforms need to ingest viewability data. Proper attribution looks at the media touches a cookie was exposed to prior to converting, then weighing which touch is the most causal and worthy of credit. The above example of excluding a percentage of total orders is too arbitrary. The proper way to do this is to exclude out-of-view events from attribution consideration.

And therein lies the problem. Attribution models aren’t ingesting viewability data so they cannot exclude the events that are not in view. The two ad tech platforms best positioned to push the industry forward are ad servers and multichannel attribution platforms. The solution can be as simple as a file with binary events – a series of 1s and 0s in a successful path to conversion. All 0s are out-of-view events that should be excluded from attribution consideration.

Which Ad Servers Will Be First?

Ad servers already serve ads and provide attribution for most marketers. All they need to do is measure viewability, too, and exclude out-of-view events from attribution consideration at the cookie level. They can then provide two columns for conversions: one with the standard approach applying credit to “served” impressions, and another column showing conversions for “viewed” impressions, after excluding out-of-view impressions.

Marketers will not only thank them for being able to consolidate the number of ad tech vendors they use, but they will also do a back flip when they can optimize more intelligently and avoid juggling another data source from yet another viewability vendor.

Could multitouch attribution platforms fill the void? They are also well-positioned because they’ve already mastered the complicated process of cookie data ingestion from multiple channels. Incorporating viewability into your multitouch attribution model is a big advantage.

This is a gaping hole in the marketplace and a huge opportunity being missed by ad tech platforms. Who will be first? In the meantime, there is always the vCPO calculation. It’s better than nothing.

Follow Matt Scharf (@Matt_Scharf), Adobe (@Adobe) and AdExchanger (@adexchanger) on Twitter.