Who Blocks The Block Lists?

Omnicom and IPG have the FTC’s blessing on their proposed merger.

But within the proposed consent order for the merger, which the public can comment on for the next 30 days, there is language mandating that Omnicom cannot “deny advertising dollars to media publishers based on their political or ideological viewpoint” (which confirms a recent scoop from The New York Times, by the way).

This stipulation will likely favor right-wing publications and platforms. While both the left and right have been caught in brand-safety crossfire over the years (think the liberal outcry over the filtering out of gay and transgender content on platforms, or Sleeping Giants’ attack on Breitbart during the first Trump administration that panicked marketers into updating their blocklists), the right is currently most loud in its distaste over brand safety. The former government operative Elon Musk frequently voiced his frustrations with advertisers who pulled spend from X, and he filed a lawsuit that led to the dissolution of GARM.

But actual politics aside, the decision could cause headaches throughout the brand-safety industry, as the order specifically forbids Omnicom from working with “any third party with respect to Media Buying Services” that directs or denies ad spend based on politics – and also specifically calls out the use of exclusion lists to do that.

Interestingly, the decision is careful to carve out allowances for actions that are done “at the express direction of a particular client.” But maybe that’s just to give publications room to sue those advertisers directly, like X has been doing for the past two years.

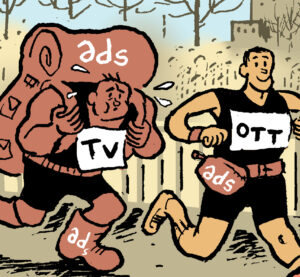

Pay Me vs. Paid Media

Influencer marketing has spilled over from experimental budgets in fashion and home goods to virtually every product vertical, even health care and finance. And gone are the test budgets.

The Cannes Lions last week was replete with social influencers and creators on panels and taking meetings with big brands, The New York Times reports.

For one thing, the influencer category has matured, according to the Times. The tactic – as in, paying creators to promote your product – is now table stakes for even conservative brand categories that require strict oversight.

Advertisers’ concerns that an influencer might go off on an inflammatory diatribe or fail to meet brand standards seem to have waned. Marketers have accepted some loosening of creative control in exchange for authenticity and the virality that happens when a critical mass of social users are exposed to a #sponcon message.

Influencer marketing is “a significant part of the marketing transformation we’re driving, which is moving from the old ‘one to many’ communication model – which is one message broadcast to many people – to what we call ‘many to many,’” says Unilever CMO Esi Eggleston Bracey.

Smart Choices

Google has cut its smart TV group, which makes smart TV sticks and the TV operating system, by 10%.

Rather than focus on hardware and the OS, Google plans to invest more in its AI and cloud businesses and to focus on YouTube as its primary TV business, reports The Information.

Google’s Android TV OS ranks fifth in terms of usage, behind Roku, Samsung, Amazon and LG. YouTube is faring much better. According to a recent Nielsen report, TV viewers spend 67% more time watching YouTube than Netflix. While Alphabet still doesn’t fully break out YouTube, its cloud and YouTube units ended 2024 with an annual run rate of $110 billion in revenue, CEO Sundar Pichai shared during the company’s most recent earnings.

Google’s shift away from its smart TV hardware and OS is potentially good news for the likes of Roku and Amazon’s Fire TV, not to mention The Trade Desk, which is hoping to get some manufacturer pickup for its Ventura TV OS.

It’s less good news for Google’s staff. Up to a quarter of Google’s smart TV team may have been affected by the recent cuts.

But Wait! There’s More

How indie ad agencies are competing against the holdcos. [Ad Age]

Relatedly, new Dentsu North America CEO Beth Ann Kaminkow on being “right-sized for the moment.” [Adweek]

Publishers aren’t the only ones fighting back against AI scraping – so are fanfic writers. [The Verge]

The Onion mailed every member of Congress a longer version of the ad it recently placed in the Sunday New York Times. [The Handbasket]

Spotify’s video podcast program draws praise from creators, but skepticism from podcast and ad networks. [Digiday]