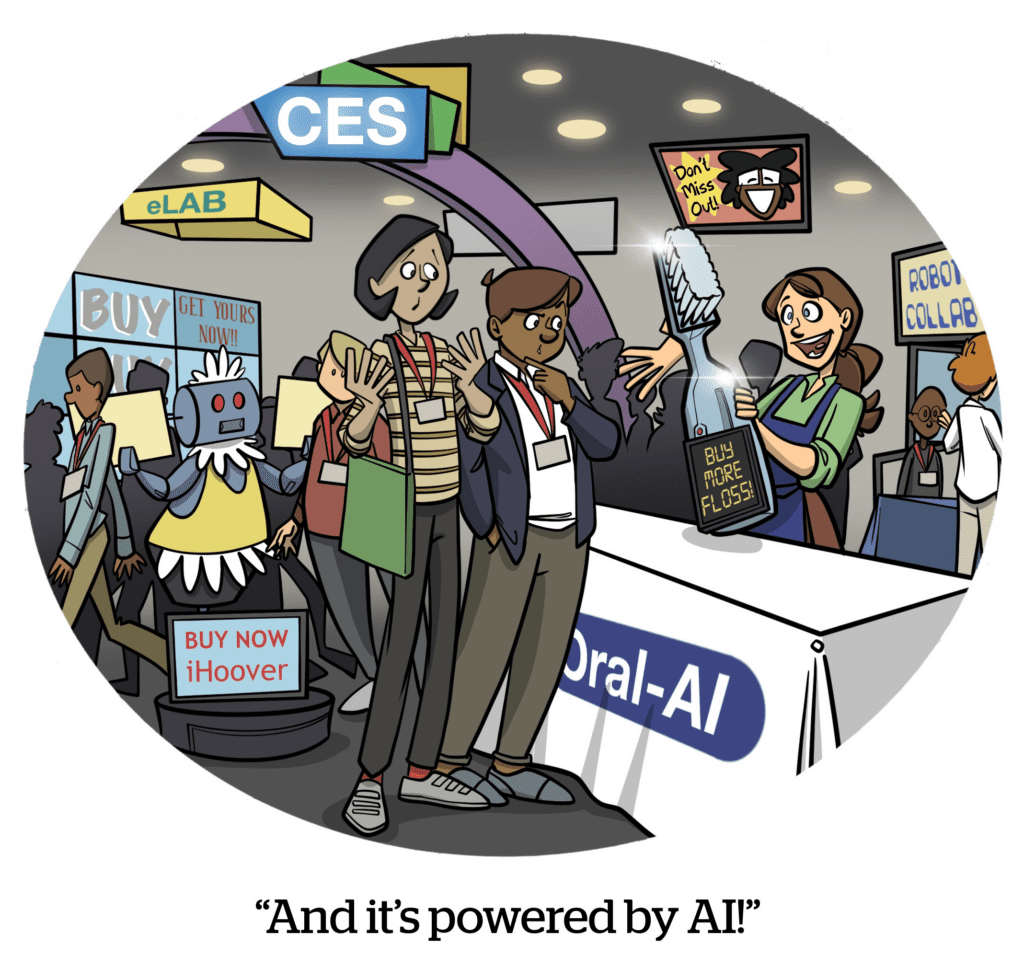

Real Assistants Would Be Fired By Now

Call it the Hardware Revolution that wasn’t.

For years, consumer tech devicemakers have been promising incredible AI-backed products – phones, tablets, glasses and more – and failing to deliver, The Verge reports.

Amazon, for example, has boasted of new and improved Alexa-powered devices. But no new device has been launched since 2023, when Amazon announced its plans for an AI Alexa integration. Its built-in AI services haven’t improved, either.

But “Apple is probably the worst and most obvious offender here,” writes The Verge. Its iPhone 16 ad campaigns spent more time shilling Apple Intelligence AI than highlighting the phone itself – and the AI product didn’t even ship for months. The new iPad, meanwhile, doesn’t support Apple Intelligence.

Then there’s the Humane Ai Pin. Humane raised a quarter billion dollars for its AI-enabled pin that was going to change personal computing. HP acquired the startup for scraps last month.

Another example is Meta’s Horizon Worlds game and shift to the metaverzzzzzzz.

What’s the connection to advertising? For one, these companies made a lot of misleading claims in their ads. But they’re also major ad sellers themselves.

In an alternate universe where the Humane Ai Pin is a thing, it probably becomes an ad network that ruins society.

The Weak Link In The Email Chain

Email newsletters are seeing a bit of a “boomlet,” as Brian Morrissey describes it at The Rebooting. But will this mini newsletter boom turn into a bust?

The success that Morning Brew, Industry Dive and a few others have had in building newsletter businesses set off a wave of copycats, Morrissey writes. That’s the reality of the publisher market, where revenue and traffic-starved pubs chase what’s working for a few innovators.

But that bandwagoning inevitably oversaturates the market, and early gains become diminishing returns, according to Morrissey. In the end, newsletters are subject to the same pressures affecting digital publishing, like traffic disruptions, audience commoditization and tech platforms catching on and spoiling the party.

Take, for instance, the glut of newsletter ad networks that popped up during this boom period. These networks, along with generative AI, make it trivial to launch and monetize a newsletter, which contributes to commoditization.

Plus, much like how the publisher paid traffic/ad arbitrage bubble eventually burst, newsletter publishers are cannibalizing each other’s traffic, Workweek CEO Adam Ryan tells Morrissey.

The current boom in newsletter subscriber growth is being driven by paid recommendation engines, Ryan argues.

“If you shut off that faucet,” he says, ”most of them collapse.”

Tariff, And If (And If)

The escalating one-upmanship of tariffs between the US and many other global trading partners is rippling throughout the economy and marketing industry.

But, especially early on, the effects fall in seemingly arbitrary ways upon certain sectors.

For instance, the big focus at the moment is on aluminum and steel manufacturing. Tariffs on these materials have major implications for car manufacturers and, say, a brand that sells beverages in cans.

But Europe’s retaliatory tariffs are carefully honed to increase costs to American consumers while attempting to minimize the downside for Europeans, WSJ reports. American-made motorcycles, motorboats and whiskey received heavy tariffs. The next round will fall on cranberries, garden umbrellas, tablecloths and handkerchiefs, for some reason, followed by American chewing gum, poultry, white chocolate, soybeans, carpets and watermelons, all within the next month or so.

Canada’s next round of tariffs are expected to target tools, computers, sporting goods and cast-iron products.

So, stock up now?

But Wait! There’s More

February data shows Shein’s and Temu’s sales dropped dramatically after Trump first announced his tariff plans. [Business Insider]

Meta is getting sued by French publishers for AI-related copyright infringement. [TechCrunch]

Big brands now prefer to do quiet agency reviews, rather than trumpet their RFP contests. [Digiday]

Sonos is abandoning its plans for a streaming video player. [The Verge]

Food delivery and app operator Wonder acquires Tastemade for roughly $90 million. [WSJ]

Google reportedly owns 14% of AI startup Anthropic. [NYT]

You’re Hired

Catalina snacks hires Elias Aoukar as chief supply chain officer. [release]

Thanks for reading AdExchanger’s daily news round-up… Want it by email? Sign up here.