For over a year now, audiences have been changing channels (pun intended).

In today’s day and age, a robust healthcare media mix covers a variety of channels, including television, digital, social media, audio, out-of-home and others, all dedicated to one goal: targeting the right audience at the right time with the right message.

Though this premise seems simple, it is immensely complex.

The media mix

The television advertising channel has long dominated a marketer’s media mix, capturing nearly a quarter of US advertising expenditure – with healthcare advertisers making up a significant chunk of spend. But for TV advertising, the messaging always had to be broad to resonate with the millions of eyeballs exposed to the ad. And when the message resonated and drove a purchase, there was no way to capture, measure or attribute it.

The evolution of digital has forever transformed advertising, providing a way to not only drive a purchase directly through an ad but to measure campaign effectiveness and attribute marketing efforts to a company’s success.

Yet, even in light of attribution models tied to digital, TV had maintained its appeal because it had continued to deliver on its promise, standing firmly on two key pillars: the broadest possible reach (scale) accompanied by great economy of sale.

That promise was broken in 2024. Now, the question is how long it will take before the budget owners act accordingly.

2024: the music stops

Since 2019, more than 30 million households have left traditional cable behind and shifted their focus to streaming and CTV platforms like Netflix, Amazon Prime and Hulu. Every quarter brings with it a decline: 1.62 million in Q2 2024 alone, down to 68 million households.

Contrast that with connected television (CTV), an umbrella term covering everything from Roku to YouTube to the digital apps of the TV programmers. In 2024, per Emarketer, CTV viewership eclipsed linear by nearly 2 million viewers (233.9 million CTV viewers compared to 232.3 million linear viewers).

Scale, one of the big pillars of linear, has fallen over. And, importantly, CTV inventory can fit into an omnichannel framework much more readily than linear. CTV has the possibility of data capture and integration into the attribution model that’s driving marketing today.

More on that difference: The viewers who remain on linear have distinct viewing habits, with heavy distributions of households that are either watching for hours daily or barely tuning in once a week on game day, which makes for a fragmented, unpredictable audience.

But what about the second pillar of linear: economy of scale?

Hidden costs: a little math

It’s hard to perform a direct financial comparison of linear and CTV pricing. The former is predominantly made in large upfront commitments, but, ultimately, those buys are made on the basis of guaranteed minimum ads served, usually as measured by Nielsen ratings (though VideoAmp has developed a more digitally aligned form of measurement which can be applied to linear).

The ad seller will serve ads during timed spots, which are believed to reach the right demographics. Then, sellers retrospectively align the total number of ads served and serve additional ads to ensure they deliver the amount they’ve committed to.

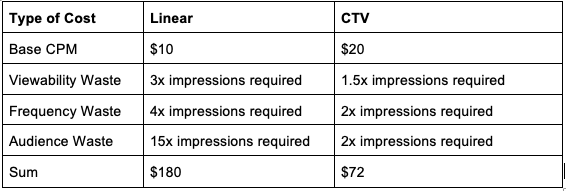

When comparing both channels only on a cost per thousand (CPM) basis, linear appears to be the cheaper option. Publicly available sources will tell you linear is $10-$15, though large healthcare organizations with more buying power can use volume to negotiate lower rates. In contrast, CTV rates come in around $20-$35 CPMs. These are the topline numbers that have driven the narrative of TV’s cost efficiency.

However, breaking it down further, we can factor in three areas that impact media efficiency on the two channels very differently:

1. Viewability waste:

Just because an ad for a new drug airs doesn’t mean people are watching it. Studies show that 30% of ads on linear TV play to empty rooms. This viewability gap means advertisers have to increase the number of ad exposures to make sure the target audience actually sees the ad.

As a result, the CPM for linear TV ends up doubling or tripling to account for this waste. On CTV, since viewers only see the ad when they actually log into the streaming application, they are more likely to be paying attention.

2. Frequency waste:

Branding advertising requires consistency of delivery to ensure it makes an impact. Research indicates that audiences need to be exposed to an ad one to three times a week for at least eight weeks for the campaign to be effective, since the advertiser needs time to build up brand familiarity in the mind of the consumer.

With linear TV, you’re forced to serve ads to a broad audience to achieve these frequencies, and there’s no guarantee you’ll reach the right people. Linear viewers are increasingly unevenly distributed between very high and very low frequency watchers, making it hard to achieve consistency of message delivery.

Approximately one-third of linear ad impressions are wasted because they reach viewers at too low a frequency to have an impact, while one-third of impressions are wasted because they reach viewers who have already seen the ad enough times that week. This creates a costly “frequency tax” of about four to eight times the base CPM. Again, frequency inefficiencies are much smaller for CTV, so frequency waste adds approximately double the cost to the CPM on that channel.

3. Audience waste:

If you’re serving the same drug ad to everyone watching a given show at the same time, the majority of viewers will not have the health condition described in the ad.

This can be mitigated to a degree by some tactics such as data-driven linear. But without being able to more granularly segment your buys, you’ll always serve ads to people out of footprint.

In higher-prevalence cases like obesity or hypertension, you might expect one in three people watching a program to have one of the conditions. In the case of lower-prevalence conditions, the odds are much lower. This adds another level of waste. However, it is quite variable depending on the condition being promoted.

CTV, by comparison, can use consumer audiences (PurpleLab’s among them) to ensure ads are only served to more relevant households.

Completing the cost analysis:

Factoring those elements in, we’re left with a table that looks like this.

When you take these inefficiencies into account, linear costs advertisers roughly three times more per 1,000 impressions compared to CTV. In both cases, the operational requirements and system limitations impose additional costs above the list price of buying the ads, if a brand wants to obtain the results it’s seeking.

But, crucially, the linear infrastructure imposes a vastly higher hidden cost. The different media buying structures of the two channels have served to obfuscate this, but the price has become clearer as TV investment teams have gained more data on effective costs.

For healthcare and pharma brands, this information is especially valuable. CTV lets you focus on your ideal audience (e.g., people who may be looking for osteoporosis medication), so you’re not wasting impressions on irrelevant viewers. That’s a huge advantage for a sector where compliance and audience relevance are essential.

What this means for healthcare marketers

While CTV is eclipsing linear, it’s still no match for the scale of linear at its peak. CTV can be a great channel for branding, but it is executed differently, with tools that can help serve ads to the right audience with the right frequency.

Healthcare marketers who want that branding push will likely want CTV, but they’ll need fewer impressions and will need to pay a bit more for them, because then they won’t be hitting as many of the wrong people, and their content will actually be seen.

It means, crucially, that attribution and accountability are coming to CTV at a moment when social and search channels are actively dimming the lights on attribution. While this may feel challenging, it’s a good thing – it means marketers may be able to prove value in a way that investments in walled gardens will not.

How to take CTV targeting to the next level

What if you could take CTV’s built-in targeting features and supercharge them for healthcare? That’s where PurpleLab comes in. From audiences that you can now activate across your preferred TV platform to detailed pre-campaign consumer media analysis that can feed into campaign filters, we’re here to help give you the insights needed to activate strategic healthcare campaigns. Drop me a line – we’re always interested in brainstorming the shortest distance between two points.

For more articles featuring Ted Sweetser, click here.