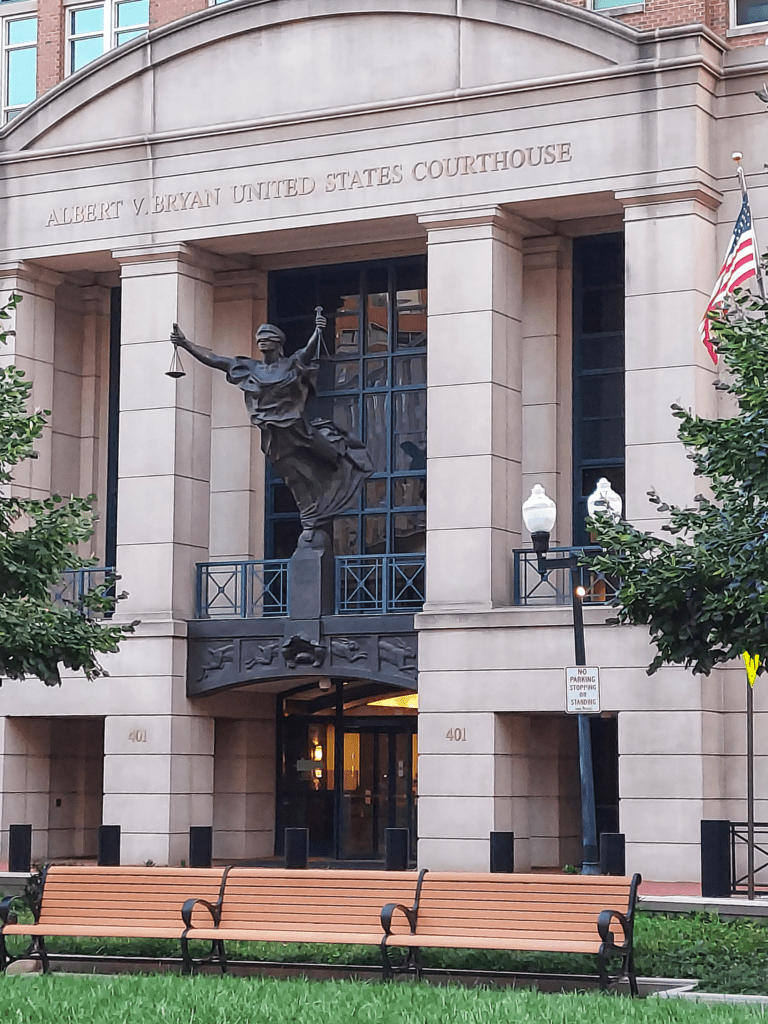

Google will spend the next four to six weeks in a Virginia courtroom defending itself against allegations that it operates a monopoly over the digital advertising industry.

The trial, which begins today, could end in the breakup of Google’s ad tech business, including a forced divestiture of its ad server and ad exchange.

After opening statements, Tim Wolfe, SVP of revenue operations at Gannett, is scheduled to take the stand. Gannett, which owns USA Today and more than 200 local news outlets, has a pending federal lawsuit of its own against Google, filed last year in New York, for allegedly monopolizing the digital ad market.

Index Exchange CEO Andrew Casale will testify when Wolfe is finished. (Google’s motion to exclude so-called “lay witness opinion testimony” related to its alleged anticompetitive behavior was denied last week.)

The government will seek to prove that Google’s M&A strategy laid the groundwork for its “later exclusionary conduct across the ad tech industry.”

According to the DOJ, Google made ad demand from Google Ads exclusive to AdX and gave its ad server exclusive access to bidding information from its exchange, which would be an example of anticompetitive tying. This, the DOJ will argue, is why Google controls more than 90% of the ad server market.

But what will Google argue?

Google’s case in a nutshell

On Sunday, Google published a blog post written by Lee-Anne Mulholland, VP of regulatory affairs, broadly sketching out the main points it plans to make in its defense.

Google has made most of these arguments in some form multiple times before.

The first is that the ad tech market is crowded with competitors of all sizes. As evidence, Google points to media companies (like Comcast and Disney), retailers (like Walmart and Target) and ad tech platforms (like Criteo, Index Exchange and The Trade Desk). It also calls out full-stack players (like Meta, Amazon and Microsoft’s Xander) and the fact that newbies keep entering the market (like PayPal, Costco and United Airlines).

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Daily Roundup

If that argument sounds familiar, maybe it’s because you read this 2019 Google blog post entitled “The ad tech industry is crowded and competitive,” highlighting Telaria and Rubicon (pre-Magnite), TTD, Index, MediaMath (RIP) and OpenX as proof that Google is up against stiff competition in the ad tech sector.

Google will also make several other oft-used arguments, including that its ad tech fees are lower than industry averages and that the DOJ’s actions could raise ad prices and harm small and medium-size businesses.

Lastly, Google will contend that it’s already more open than it needs to be and that it makes its ad tech tools interoperable with those of its rivals, even though there’s no duty to deal under US antitrust law.

“In court, we will show that ad buyers and sellers have many options,” Mulholland wrote, “and when they choose Google they do so because our ad tech is simple, affordable, and effective. In short – it works.”

I wonder if Standard Oil went into their trial saying kerosene lamps work.

— Adam Heimlich (@adamheimlich) September 8, 2024