The Verizon-Yahoo marriage is still on and will close “as soon as practicable” in Q2, the companies announced Tuesday.

The Verizon-Yahoo marriage is still on and will close “as soon as practicable” in Q2, the companies announced Tuesday.

The companies have jointly amended the terms of their purchase agreement by $350 million, shaving 7% off Yahoo’s original sticker price of $4.8 billion.

The agreement puts an end to a monthslong game of “Will they, won’t they?” in the tech press following the revelations of Yahoo security breaches that affected upward of 1 billion users.

The settlement is great news for Yahoo, said Elgin Thompson, managing director of Digital Capital Advisors.

“Relative to the $1 billion discount discussed last October after news of the data breaches, it appears the $350 million reduction is a win for Yahoo,” Thompson said. “There is risk mitigation and then there is recutting the deal. $350 million, if that is the settlement, seems reasonable.”

Verizon and AOL executives remain enthused about the value of Yahoo’s assets, including its 600 million mobile monthly active users across scaled properties like Yahoo Finance, Yahoo Sports and Yahoo Mail.

Mail alone has 225 million logged-in users, lending valuable scale to AOL’s ad platform business.

“Verizon’s subscriber data coupled with Yahoo content and email addresses enables more precise ad targeting,” Thompson said. “This linkage is critical in light of the digital oligopoly/walled gardens of Facebook and Google controlling 80% of ad budgets. Verizon/AOL/Yahoo would still be probabilistic, but would move closer to deterministic.”

Then there’s Yahoo’s ad tech business – namely Flurry and BrightRoll.

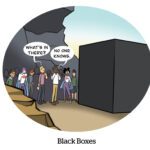

Observers say BrightRoll could serve as the basis for a combined ad stack, since it has both a video DSP and exchange, and AdExchanger sources have described AOL’s video platform Adap.tv as in dire need of an upgrade.

In addition to a price reduction, Verizon and Yahoo will now share “certain legal and regulatory liabilities arising from the data breaches,” according to the companies.

Upon the deal’s closure, Yahoo is responsible for paying 50% of any cash liabilities incurred from non-Securities and Exchange Commission (SEC) government investigations or third-party litigation related to the breaches.

Any liabilities arising from shareholder lawsuits and SEC investigations will continue to be Yahoo’s responsibility.