Turn announced feature upgrades to its demand-side platform as well as an agency holding company client win in Omnicom Media Group in a release today. Regarding the upgrades, the company said, “Capabilities include single-click deployment across all real-time bidding (RTB) inventory sources, automated budget allocation and a new audience extension technology.” Read the release.

Turn announced feature upgrades to its demand-side platform as well as an agency holding company client win in Omnicom Media Group in a release today. Regarding the upgrades, the company said, “Capabilities include single-click deployment across all real-time bidding (RTB) inventory sources, automated budget allocation and a new audience extension technology.” Read the release.

AdExchanger.com spoke to Turn CEO Bill Demas about the release and industry trends.

AdExchanger.com: Beyond offering a “hard dollar” return on ad spend, what other benefits does the Turn platform offer its clients?

BD: Analytics is a big component. The platform includes a feature rich Audience Insights module that provides detailed demographic and psychographic audience profiling for campaigns. These analytics can be viewed during and after a campaign, but many of our clients actually use it to analyze an advertiser’s existing customers prior to the campaign launching. The data is then used to help inform messaging strategies, creative design themes and media planning across both exchanges and traditional guaranteed buys.

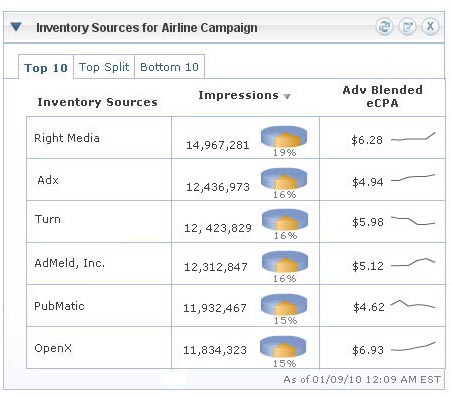

Image replaced 1/26/10

For campaigns that are targeting a very niche audience, the Audience Extension module can be utilized to identify additional, high performance ‘act alike’ audience segments. By finding these new audience segments, our clients are able to go beyond just optimizing within the existing budget, to identifying whether the budget itself can be increased!

For all platform clients, Turn also offers the added benefit of a full media services division (the Turn Network). This team works with our clients to acquire additional inventory, when needed, from publishers that are not currently on the exchanges. For campaigns that are reach and volume constrained even after deployment across all of the exchanges and sell side optimizers, this can add significant incremental volume to the campaign while still achieving performance objectives.

AdExchanger.com: As a startup, what are some of the keys to effectively meeting the needs of a holding company initiative?

BD: Every holding company is unique in its strategy, objectives and the technology, data and service assets they bring to the table. We are firm believers that being able to provide a highly customized technology and service offering is key to meeting the needs of these clients. Our job is to provide a best-in-class media buying and optimization platform to our clients, but at the end of the day, Turn is only one part of their unique solution.

AdExchanger.com: How important is the Turn ad network to helping fulfill client campaigns for a client with significant buying scale such as Omnicom Media Group? How do you manage the perception that the Turn ad network may compete with Turn demand-side platform’s white-label clients?

BD: Today, not every publisher is on an exchange, and for the ones that are, not every impression is sold through an exchange. Consequently there is a lot of high value inventory that simply can’t be purchased through an exchange or the sell side optimizers like AdMeld, Pubmatic or Rubicon.

For highly targeted campaigns that are reach constrained, Turn’s media services works with them to acquire additional inventory. What’s really cool about this model is that the Turn DSP treats this inventory just like any other RTB inventory source: if it meets the campaign’s performance objectives the impression is utilized, otherwise it’s not. Consequently, Turn Network is purely complimentary to the other inventory sources. For our clients this is a significant value-add because it provides incremental reach and volume. Also the whole process is fully transparent, so there’s never any question of it being competitive in any way.

By John Ebbert