Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Time Is Money

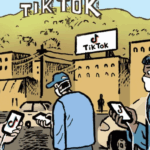

The olds may see a TikTok feed and think, “Who can keep up with that?!” But TikTok knows that many of its younger users routinely watch the app at double speed.

TikTok’s internal user surveys and data reveal a tween/teen generation of locust-like content consumers, according to a report by Wired. They feast in seconds and move on.

That blazing, frenetic pace makes TikTok a viral sensation. But TikTok will have to fight its nature to mature and reach the next growth phase.

Last summer, the US TikTok app extended the maximum video length from one minute to three. The app is widely testing five-minute videos, and there’s a beta test for 10-minute clips.

TikTok isn’t following users into longer content. Rather, it’s being pushed in that direction by advertisers and by the necessity of competing with the incumbent online video players.

Facebook and YouTube have the scale to spin up their own major TikTok clones (see: Instagram Reels and YouTube Shorts). TikTok can’t simply defend its home turf and expect to grow.

Whose Fake News?

Google and Facebook claim they’ve (finally) got a handle on how to vet political ads – but cons can still slip through the net.

Since September, Google allowed ads for fake government handouts that garnered over 100 million views, HuffPost reports. The campaigns targeted the elderly and used videos of Joe Biden to solicit sign-ups. Google removed the campaigns when it was alerted, but that’s not the point. The point is, these campaigns were able to slip by Google’s automated moderation.

Google includes human review in its search approvals, but declined to elaborate on how this particular bad acting evaded its systems.

Facebook dealt with a similar scandal last month when users were scammed by fake debt management ads featuring pictures of Boris Johnson this time.

Will there be consequences for the platforms or the fraudsters? Probably not.

But platforms are under closer scrutiny now, and these cases are blood in the water for regulatory sharks. They easily meet the “unfair or deceptive” standard to be considered illegal and warrant investigation at the very least.

Facebook’s Face-Plant

Did you hear that thud? That was the sound of Meta’s stock dropping like a wet sack of your uncle’s cringiest posts.

Facebook and Instagram’s parent company recently saw its share price plummet 45% from a peak in September 2021, representing one of the worst stock price free falls for a Big Tech company since the Great Recession, Bloomberg reports.

What’s behind the inverted hockey stick trend for Meta? Mostly, Apple’s AppTrackingTransparency framework. Since ATT went into effect last year, Facebook and Instagram have struggled with ad targeting and providing commerce-focused advertisers with the same conversion rates and analytics they enjoyed in the pre-ATT era.

As a result, smaller ecommerce brands have shifted Facebook spend to competitors like Google, Amazon and Snap, according to The Wall Street Journal. During its Q4 2021 earnings report last month, Meta said ATT will cost the company around $10 billion in ad revenue this year.

And there’s another shoe ready to drop. Google’s plan to roll out a Privacy Sandbox for Android has Wall Street predicting that Meta’s ad revenue woes will likely get a lot worse before they get better. But some market watchers are confident that Meta will find a way to bounce back and, to be fair, it’s got an army of highly motivated engineers at its disposal.

But Wait, There’s More!

The ad industry is divided over the future of third-party addressability. [Digiday]

How Apple might break fingerprinting in iOS 16. [Mobile Dev Memo]

Hundreds of Salesforce employees protest the company’s foray into the NFT market. [Thomson Reuters]

Spotify’s deals with high-profile stars have made headlines – not podcasts. [Insider]

The IRS gives taxpayers another verification option other than facial recognition. [Axios]

Meta’s social VR platform Horizon hits 300,000 users. [The Verge]