Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

I Spy

A study from Princeton University and the University of Chicago revealed the extent of ad tracking on OTT platforms like Roku and Amazon Fire TV, as well as the lack of controls to manage trackers. According to the study, 89% of channels on Amazon Fire TV and 69% of channels on Roku contain up to 64 different ad trackers that plug into the larger advertising ecosystem. While digital ad platforms like Facebook and Google create ephemeral consumer IDs, OTT platforms hold onto identifiers long term. While Roku and Amazon both offer anti-tracking measures, they don’t comprehensively block all information from getting passed through to other apps. “…The countermeasures fall short of doing what they’re supposed to do,” Hooman Mohajeri Moghaddam, a Princeton researcher who worked on the study, told Wired. “So even if you enable the privacy option there are still other IDs that can be used to uniquely ID the user or device.” More.

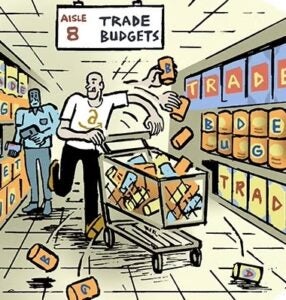

Holding On?

Agency holding companies have tried launching integrated agency shops dedicated exclusively to one brand to retain flagship clients like McDonald’s and Ford. But those may not have been sustainable models. McDonald’s is moving its business from We Are Unlimited, its dedicated Omnicom agency, Business Insider reports. Ford’s WPP agency group, BTG, ran out of fuel late last year. Overreliance on a single brand could make an agency or vendor too dependent to strongly voice their opinions at times, and can stifle innovation from outside ideas. AudienceScience, the tech vendor behind P&G’s internal trading desk for seven years, was left high and dry when the CPG giant in-housed those capabilities in 2017. More.

Welcome To The Party

Netflix has dominated the streaming scene for years. But it’s about to be “a whole new world” come November, when deep-pocketed competitors like Apple, Disney and NBC begin to introduce their own products, said Netflix CEO Reed Hastings at the Royal Television Society conference in England. “It’ll be tough competition,” he said. “Direct-to-consumer [customers] will have a lot of choice.” How will Netflix stay atop its throne? By sticking to its core focus of providing binge-able TV, and staying away from content like live sports and different release models, Variety reports. And while new competition will drive already astronomical production costs even higher, Netflix will stay out of the production business itself. “We’re not in the acquisition business,” Hastings said. More.

But Wait, There’s More

- A ‘Grassroots’ Campaign to Take Down Amazon Is Funded By Amazon’s Rivals – WSJ

- Netflix Must Launch Cheaper, Ad-Supported Option, Analyst Says – Business Insider

- Facebook May Copy Your App, But Amazon Will Copy Your Shoe – The Verge

- YouTube Is About To Demote A Wide Swath Of Its Creators – NYT

- Inside The CBS-Viacom Marriage, Concerns Of Synergy And Size – Variety

- VPN Apps Caught Serving Disruptive Ads To Android Users – TNW

- IAB Tech Lab Fleshes Out Plan To Target People Without Cookies – MediaPost

You’re Hired

- INKY Hires John Lyons As CRO – MediaPost