And the results are in! According to its Q1 2013 results, the GOOG made about $3.5 billion in profits, depending on your accounting principles. Get the release here.

And the results are in! According to its Q1 2013 results, the GOOG made about $3.5 billion in profits, depending on your accounting principles. Get the release here.

From the release:

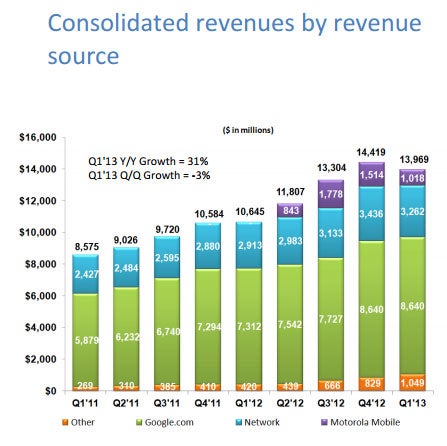

“Google Revenues (advertising and other) – Google revenues were $12.95 billion, or 93% of consolidated revenues, in the first quarter of 2013, representing a 22% increase over first quarter 2012 revenues of $10.65 billion.

- Google Sites Revenues – Google-owned sites generated revenues of $8.64 billion, or 67% of total Google revenues, in the first quarter of 2013. This represents an 18% increase over first quarter 2012 Google sites revenues of $7.31 billion.

- Google Network Revenues – Google’s partner sites generated revenues of $3.26 billion, or 25% of total Google revenues, in the first quarter of 2013. This represents a 12% increase from first quarter 2012 Google network revenues of $2.91 billion.

- Other Revenues – Other revenues from Google were $1.05 billion, or 8% of total Google revenues, in the first quarter of 2013. This represents a 150% increase over first quarter 2012 other revenues of $420 million.”

Here’s a link to the quarterly financials (PDF) and the earnings call slides in Powerpoint – joking – it’s in this PDF.

Considering the dip in 2013, looks like network revenue didn’t maintain the Q4-Q1 momentum that it did in 2012. But year-over-year, AdSense (which includes the DoubleClick AdExchange) shows an increase of 12%. I wonder if the quarter-to-quarter dip is due to a lower margin business of the ad exchange versus the AdSense ad network. Or how about users moving to mobile and the diminished CPMs – let alone the RPMs (revenue per thousand page views)?

Before the call begins: a pre-roll video of Googlers in Mountain View and some Google-y bikes. They look like they’re having fun. They should be; they just made $3.5 billion in three months.

Listen to the live call here (it will probably turn into the on-demand webcast).

And the call has begun! CEO Larry Page is on this one.

Page starts by discussing a Siri-like product that allows your smartphone to do what you want (mapping stuff, for example). He moves on to “seamless” products such as Google Play. Translation for ads: seamless means addressability across channels online and off (ideally). Page claims Enhanced Campaigns is a step in the seamless direction.

Page discusses a bit about “dark fiber” – internet access and what it means. Google wants the pipes!

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Daily Roundup

CFO Patrick Pichette takes over the call. He says “advertising policy decisions” impacted the slide in quarter-over-quarter network revenue. I’m sure Wall Street will be wondering what this is. Perhaps more publishers were booted depending on their biz – such as hosting piracy-related content. You’ll remember the Annenberg report, of course, which said Google was in the top 10 among advertising networks supporting piracy online. So if Google booted a lot of publishers, that’s much fewer ad placements with which to make revenue.

Pichette continues to go through the financials. You’ll have to look at the transcript to get his words; it will be at the bottom of this post when available. Before handing the call to Nikesh Arora, Pichette emphasizes Google’s interest in investing its business. This echoes what Jeff Bezos says about Amazon.

Arora says growth was stable across the globe and verticals such as autos and retail. Arora emphasizes that enforcement has been tightened around piracy (ding ding!).

Marketing gets a shout-out from Arora and points to the Chromebook success. Device love!

Arora says a shift to a multi-screen lifestyle is a key idea for Google to execute, and Google will help “marketeers” in this regard. Enhanced campaigns is one such solution, claims Arora. Also, the move of brand dollars online through retargeting is important to Google.

Ad Exchange is continuing to grow well, says Arora.

Wall Street’s Questions

RBC’s Mark Mahaney asks about Traffic Acquisition Costs and trends there. Pichette reiterates TAC has decreased just as network revenue has decreased due to the piracy rule change. He says mobile is on fire.

Page answers questions about something called the “Knowledge Graph” as search becomes more human.

Wall Street asks if Enhanced Campaigns will be bumpy for advertisers in the near term. Arora says no.

Pichette later addresses margins and mobile in regards to Enhanced Campaigns and says they’re doing what is best for the user and the advertiser. He demurs to answering specific questions about expectations with CPCs in mobile, etc.

Page and Pichette say it’s the early days in the internet access biz.

A Morgan Stanley analyst asks about online advertising hitting 50% overall for the ad industry, and how Google will be a part of it. Arora talks about Connected TV, video becoming more important in 5 years, and creating a compelling addressable opportunity via IP.

Deutsche Banc’s Ross Sandler wants to know about Google Glass: what’s the strategy? Will it always be $1,500 each? Larry Page says it’s early days for this product too. He points to third-party ecosystems like Android as a map for the future.

Jefferies’ Brian Pitz asks about the expansion of Product Listing Ad formats and PLA trends. Arora offers little more than satisfaction.

Goldman Sachs’ Heather Bellini wants to know about Fiber and the product line possibilities. Google CFO Patrick Pichette says waiting three seconds for YouTube sucks (my words). Google wants to make it faster, and their “dark fiber” Kansas City experiment is also about storage. Pichette says “so many” developers are moving to Kansas City. I gotta road-trip to KC sometime.

The last question is about Enhanced Campaigns and when there will be greater opportunity for attribution across devices. Arora fields this one, saying that “we’re still working on this” and should get most devices migrated in the next few months. No real discussion of attribution…

But, wait – one very last question about attribution and how offline is being synched up with online. Arora says that Google has performed hundreds of studies in regards to how online and offline cooperate. Still seems like early days for attribution at Google, too.

We’re done!

Read the earnings transcript on Seeking Alpha.