Average CPMs on the AppNexus platform rose sharply during the second half of 2015,

from below 20 cents last summer to $1.60 by early fall, as invalid traffic was rejected under the company’s anti-fraud efforts.

from below 20 cents last summer to $1.60 by early fall, as invalid traffic was rejected under the company’s anti-fraud efforts.

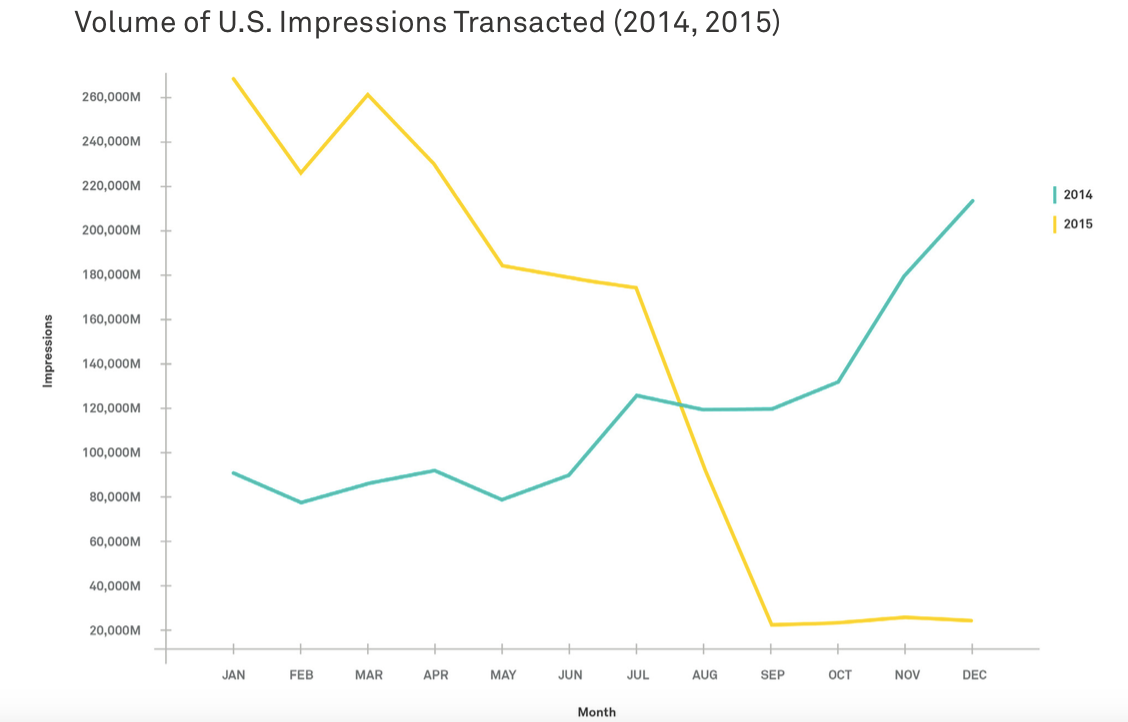

Meanwhile, volume fell off a cliff, with impression transactions plummeting more than 90% from December to September.

The company released the data Wednesday as part of its Q4 2015 Digital Advertising Index.

According to the report, AppNexus’ Inventory Quality (IQ) initiative to clean up fraudulent or invalid inventory was highly effective.

As the chart below shows, the initial 500% price bump that followed the company’s fraud purge was followed by a more modest 18% lift in December.

“What was more surprising [than the initial slope] is the second increase you see in December, around the holiday season,” said AppNexus Chief Data Scientist Catherine Williams. “The first slope was due to cutting out a bunch of low-value impressions – CPMs will obviously rise. That second lift in December is really about buyers perceiving the market differently, and shows an increased confidence to pour their big holiday budgets into our system.”

Impression transactions dropped from 260 billion in January 2015 to about 20 billion in September, where they hovered for the remainder of the year.

Williams attributed the drop to the removal of single impressions sold multiple times before being served to an actual human. “We’ve been cutting out the middlemen,” Williams said. “What you’re seeing here is not fewer ads served, although there is some of that, but also fewer page hops.”

Despite the dip in impressions, AppNexus says it powers the same amount of spend it did previously.

Click-through rates also rose during the quarter. For Williams, a rise in CTRs shows improved health in AppNexus’ ecosystem, which she described as both slightly surprising and gratifying. “You would think that kicking a lot of traffic off the platform would cause CTRs to drop. [The rise] speaks to buyers connecting more with real people who are actually responding to ads.”

AppNexus’ IQ initiative was a three-pronged effort launched in June, which enforced pre-bid supply screening, seller transparency and a money-back guarantee to affected advertisers across the platform.