Independent trading desk Accordant Media uncorked on Friday a consolidated offering called Audience Targeting System (ATS) designed to make programmatic trading more accessible to direct market clients and prospects.

Independent trading desk Accordant Media uncorked on Friday a consolidated offering called Audience Targeting System (ATS) designed to make programmatic trading more accessible to direct market clients and prospects.

The goal, according to company CEO and co-founder Art Muldoon, is to demystify the world of programmatic trading. To do this, Accordant consolidated four components it had developed since the company’s inception in 2010: a data-management platform (DMP) called Audience Optics, a buying platform, an analytics suite and a reporting portal.

“Over the last 12 months, we scaled up our engineering team considerably and made a concerted effort to unify the different components of our technology,” said company COO and co-founder Matt Greitzer. “We’ve augmented it with other components to make the complete package of ATS.”

One point of augmentation: the Accordant buying platform. Over the past nine months, the company’s data science team has refined the algorithms that powered the platform, making it more robust.

Accordant, which has about 60 employees, positions itself as a services company as much as it is a tech vendor. It essentially offers the white-glove service, helping clients (around 60 of them – 80% marketers and 20% media agencies, whose abilities Accordant magnifies) navigate the choppy programmatic waters with its technology.

“Our ATS system represents an integration of probably 75 different types of vendor relationships in addition to the proprietary technology we’ve built,” Muldoon said.

AdExchanger spoke with Muldoon and Greitzer.

AdExchanger: Give me an overview of the different vendor relationships you have.

ART MULDOON: There are data providers, media quality and validation providers, dynamic creative solutions providers. These aren’t our deep expertise, but we have best in class partners integrated into our system. Then you have DMP and direct publisher relationships that are also important, as part of our integration.

You had most of the components of ATS in-house, but you also had to build some things. What are some of the newer elements?

MATT GREITZER: We built a fully-functional cross-channel attribution tool, which stacks up favorably with the off-the-shelf attribution tools from Convertro or Adometry. We built it and integrated it into our overall platform. We had analytics, but hadn’t productized it. We productized it over the last six months, as well as enhancements to our reporting dashboard.

How many direct publisher relationships do you have?

MG: There’s the open market inventory across display, mobile, video and social, where we work with the ad exchanges. There are a dozen-plus there. And we have about 150 direct publisher relationships today, which are private exchange and private marketplace deals,

How do you anticipate those private exchange partnerships growing in a year?

MG: It’ll grow. It’s growing very fast over the last nine months. Twelve months ago we had maybe a dozen or so. We are signing up two or three a week, and it’ll continue to grow over the next year because publishers view this programmatic channel as a new and efficient way to transact. It’ll also grow because of our client mix. One of the things we’ve done – and we’re not unique here – is look for private marketplace and programmatic direct deals we want to structure on a client-specific basis.

Are all of the transactions that occur on a private exchange programmatically executed?

MG: That gets into semantics. For us once the initial deal is structured, it’s executed programmatically. The deal delivery and terms are all defined and executed automatically. In some cases, if the deal terms is that you’re setting up a programmatic direct deal and it’s a flat CPM with a fixed delivery amount – how programmatic is that? It looks like a negotiated insertion order. Some people would say that’s splitting hairs.

The vast majority of things we do in the private marketplace is either a one to one programmatic integration in a biddable environment or a restricted marketplace integration in a biddable environment. For us, even though we’re doing some stuff that looks like a direct bought deal, the majority of what we’re doing is programmatic and biddable in some way, shape or form.

What percentage of your buying activity occurs in a public vs. private exchange, and how will that change over time?

MG: Eighty percent is public exchange today, and 20% is private. That’ll shift. We’re pretty bullish on the public exchange. There are some people in our space who cast dispersions on the viability of the public exchange, but we still find it’s a very valuable way to reach audiences. The number of publishers we transact with in private marketplaces will increase, so the share of dollars and impressions will also increase. I can see a point, maybe 24 months from now, where we’re 50-50.

AM: Accordant works with blue chip marketers and great, direct brands. In particular, we’re providing the quality assurance that programmatic is both productive and safe place to transact advertising dollars. The direct yield we do with blue chip publishers is very important for us and our clients and we look to enhance that quality.

MG: We have a couple of advertisers that are very performance-oriented, doing 95%-plus of their buying in the open market. We have another client who’s a niche player in the education space and they have the majority of their dollars running in the private market.

What goes into an advertisers’ decision whether to buy in a private vs. public market?

MG: Within the Audience Optics component of ATS, we have an inventory discovery tool. We’ll often run in the open marketplace for a new customer, find certain inventory sources that are driving outsized share of performance. That’s how we figure out a certain publisher is driving outsize performance. Maybe we should structure a private deal with them, see if we can get more inventory, more access, preferential access, preferential pricing. It’s very much a fluid dynamic of using the open marketplace for discovery and doubling-down on the inventory sources that are popping in terms of driving outsized value.

To what extent are concerns around fraud in the open marketplace legitimate?

AM: It’s legitimate that it exists, but it’s overblown. We have a seven filter process for evaluating inventory we consider on behalf of our clients, and when we apply that – we released a case study a year ago and potential fraud was reduced by 80% through our filtering processes, so that under 1% of ads we’re delivering are labeled as suspicious. So with systems like ATS and marketers working with experienced professionals, fraud should not be an ongoing problem. But it’s problematic for an uninitiated person who wants to just start buying programmatic media and may not have the capabilities, team or understanding of what they’re doing.

Inc. Magazine noted Accordant had pulled in $27.1 million in 2013 revenue at a 1663% growth rate. That’s accurate?

AM: The number is accurate, it’s been certified by our CPA, there’s no bullshit in it. When we look at our 2014 projections, we’re certain we’ll still be on the Inc. list next year.

What’s driving that growth?

MG: It’s a few things. We have a unique model. Our philosophy has always been having strong technologies, services and great data insight to make programmatic palatable to marketers. We’re starting to see clients’ budgets grow. We’re getting more clients and more clients with bigger budgets, and our model resonates.

The market overall is growing and as people look for ways to navigate it, we’re becoming a go-to solution for marketers looking for someone to help them navigate the landscape

And the third thing is we have great clients and we work really hard to make them successful, driving really good quantitative success for our clients that’s measurable in our business metrics. Because of that, we’ve retained and grown the clients we’re fortunate enough to have.

Who are your competitors and how does your model differ?

MG: We tend to compete more with most of the DSPs in the space. The primary difference between our model and a DSP model is they’re explicitly software companies. The DSP model is to provide a one-size-fits-all software solution with very little ongoing service or strategic support. For certain customers, that’s fine. Our differentiator is we have the software and the strategy and the expertise to co-pilot the software with our customers. The people who want to work with us appreciate that and they want expertise and guidance.

AM: A secondary competitor, besides DSPs, are ad networks trying to get into more programmatic direct business with marketers. Those networks are often presenting themselves as CPA-oriented drivers but are very opaque. For marketers who might be performance driven, they might like the results those networks are driving but are extremely frustrated by the lack of visibility into what they’re doing and what’s working and why. We’re 100% transparent with our clients regarding the cost of media we’re buying, which audiences we’re targeting, which inventory sources are most productive. This is extremely energizing and comforting to them.

MG: I’d add a third category of competitor, though they’re not direct competitors since they have a captive customer base: the holding company trading desks. We find when marketers look for alternatives to holding company trading desks, because of a lack of transparency they get from those entities, we’re a good option for them and get a lot of inbound interest from that.

The counter argument is that one doesn’t get great results without opacity. How do you respond?

AM: Why is that necessary? We have no problem driving those same results and sharing with our clients why we’re doing it and how we’re doing it. It creates an additional value for the client. Insights they get from a programmatic media buy may help inform a direct buy or an offline buy or a print or TV buy. Marketers don’t get when they do an opaque network buy.

What is transparency, beyond revealing the price paid for media?

MG: There are a couple. Price obviously is a big one for us. We fix the price up front, so there’s no arbitrage.

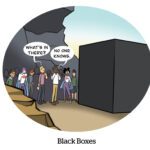

The second one, which is important and resonates with a lot of marketers as well, is we’re transparent about the optimizations we make. And whether those are the optimizations the team makes on a day-to-day basis, or even the inputs into our algorithms we’re building, like what parameters within the algorithms drive success and how we’re weighting those – we’ll share that back with customers. We’re the opposite of a black box.

The third thing is the inventory partners and technology data partners we’re working with. We’ll share that back with customers so they know exactly where their ads are running and what data and technologies were used to augment the delivery.

Going back to that Inc. Magazine list, a lot of the ad tech companies have exploding revenues, yet that’s not reflected in how some of the stock of the public companies are performing. Why is there a discrepancy?

AM: We’re fortunate to be in a market that’s the beneficiary of a fundamental transition in the way media is being bought. We’re growing at a very significant rate, and have been profitable for three years.

The public market investors have multiple choices of companies to invest their dollars and the ad tech companies are harder to get their arms around. This is partly because we don’t operate with five year long-term contracts that provide extremely predictable revenue streams. We work hard to compete for clients who have different choices.

Ad tech may not be the best public market investment category. The changes in the stock prices the public companies get might in part be due to the fickleness of the investors behind them.