Before Warner Bros. Discovery’s Q3 earnings call even began on Thursday, the investor relations team made it clear that leadership did not want to talk about the company currently trying to sell parts of itself to potential bidders.

Which wasn’t exactly true. They didn’t want to field specific questions, sure, but WBD’s leadership kept talking about the hypothetical acquisition anyway.

As of now, the plan is still to spin out Discovery Global as a standalone entity again, which is on track to happen in mid-2026.

At the same time, there is an “active process underway” to determine a suitable buyer for Warner Bros.’ streaming and studios business, said CEO David Zaslav.

And, a bonus, whichever company eventually grabs that deal will be the proud owner of a third “Gremlins” movie that’s now set to debut in 2027, Zaslav also added. So maybe that sweetens the pot.

Linear drag

And the thing is, the WBD pot could use a little sweetening. (Although, to be fair, the studio business isn’t the problem – that part of the company grew a whopping 24% year over year this past quarter.)

WBD’s total revenue for Q3 decreased at a YOY rate of 6%, from $9.6 billion last year to just over $9 billion this year.

Part of that decline stems from unfortunate comparisons to the 2024 Paris Olympics, which were on WBD platforms across most of Europe and provided a sizable ad boost. Revenue would have been flat if not for the Olympics in Q3 2024, according to the company’s earnings release.

But WBD is also facing steady declines in its linear TV network numbers, with revenue declining 22% YOY from $5 billion to $3.8 billion in Q3.

For streaming media, advertising increased 15%, from $205 million to $235 million. That’s thanks to an increase in the company’s ad-supported subscriber tiers. The company ended Q3 with 128 million subscribers, up 2.3 million compared to the previous quarter.

It is a painful reality that WBD’s 15% growth in streaming ads amounts to $30 million net-new dollars, whereas a 22% decline in network TV ads means a $1.2 billion shortfall. One of those things is not like the other.

In total, Q3 ad revenue declined by 16% YOY from $1.68 billion to $1.4 billion.

Spinning out streamers

With its shaky financial footing, it’s small wonder WBD is so interested in spinning out Discovery Global, which houses most of the linear network business – and why it’s trying to crank out as many new streaming services as possible, including a new standalone sports app and the recently launched CNN streaming service.

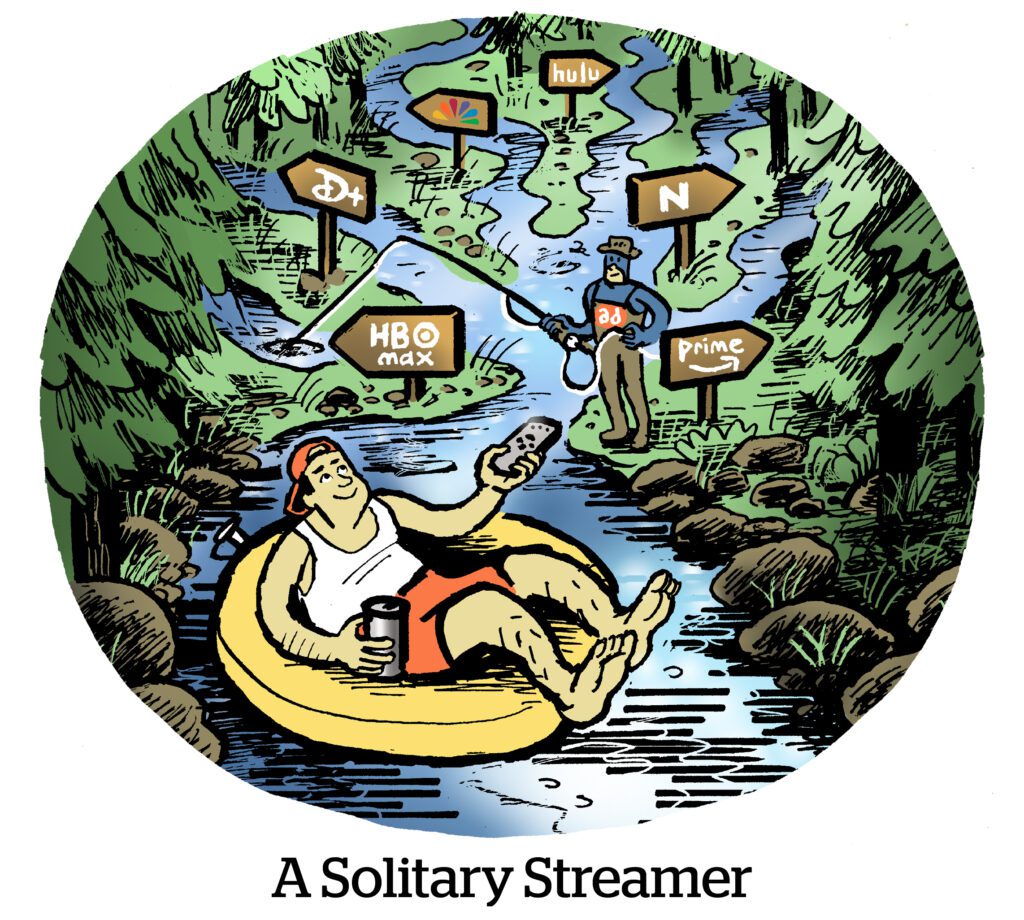

Which begs the question, at least from one investor: How come WBD is developing so many new genre-specific streamers, when, up until now, it seems like the industry had been trending toward consolidating streaming services?

(You know, kind of like how WBD originally planned to get rid of its Discovery+ platform after moving all that content over to HBO Max, or how it shut down the original CNN+ app right after merging in April 2022.)

The difference is that all these new services are powered by the same technology underneath, said CFO Gunnar Wiedenfels, which makes implementation and monetization much easier.

Besides, he added, WBD has already seen success in other markets from separating sports out as an add-on, as opposed to bundling it into an existing service. So why not charge subscribers more for a new thing?

“Don’t think of it as sort of completely separate, standalone products and technology stacks,” said Wiedenfels. “These are skins on essentially the same product platform.”