Two trends dominated the paid search space during the holiday season of 2012: mobile impressions and spend, and Google’s new Product Listing Ads.

Two trends dominated the paid search space during the holiday season of 2012: mobile impressions and spend, and Google’s new Product Listing Ads.

Google transitioned its Google Shopping search from a free model to a paid one. The new PLAs work more like AdWords, with retailers and merchants providing Google with information about a product, including an image and the price, and then working through an auction-based programmatic bidding approach.

According to data from Adobe, PLAs are more effective than traditional text ads and, by mid-December, PLAs accounted for 17% of all ad spend on Google and 10.7% of paid search ad spend overall.

“The transition happened gradually,” said Sid Shah, director of business analytics for advertising solutions at Adobe. “In October 2012, Google started rolling it out, and impressions jumped, so advertisers noticed and started changing their ad spend. As retail season wound down, PLA spend also wound down.”

Click-through rates were 34% higher than non-PLAs, Adobe found, because images are attractive for consumers. However, average order value was 12% lower than standard ads, as consumers can compare prices from the PLAs on the search page and pick the lowest price right away. ROI, conversion rate, and CPCs are all comparable to standard ads, showing normalization, Shah said.

One challenge for PLAs is how these ads will translate to mobile devices. Adobe found that mobile performance of PLAs was not as great as for desktop, because consumers are often researching or just browsing on their mobile devices, but still turn to their computers to make online purchases.

As consumers increase mobile shopping—eMarketer reported that U.S. mobile commerce sales reached $24.7 billion in 2012, up 81% from 2011—this could change.

Adobe found that online retail spend was up by 16% between Q4 2011 and Q4 2012 and that Google grew its retail paid search share, to 86.5%, up from 85.9% in Q4 2011, This was due, in part, to the new paid PLAs and overall mobile search traffic.

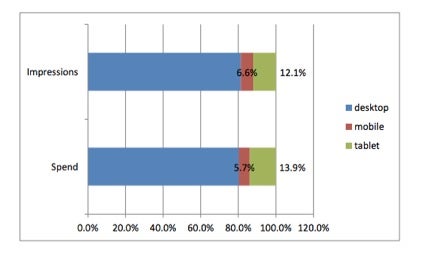

Mobile and tablet traffic combined accounted for nearly 20% of all retail impressions and spend in Q4, according to Adobe. For impressions, mobile accounted for 6.6% of retail impressions, while tablets saw 12.1%. Spend was skewed slightly more toward tablets, with 13.9% of retail ad spend set aside for tablets and only 5.7% set for just mobile. This is an increase from Q4 2011, when mobile and tablet accounted for approximately 10% of retail impressions.

“All this points to the fact that tablet and smartphones will continue to grow,” Shah said. “I predict that 30% of all traffic will be through mobile by the end of 2013, including 25% that will be tablet.”

The usage of smartphones and tablets is often set by the holiday season, as activations rise during and after the holidays, when many consumers receive mobile devices as gifts. Once the mobile traffic jumps around the holidays, as it did in 2011 and in 2012, Shah said, it sets a higher baseline going forward.

As the holiday season moves further into the past, mobile and tablet usage may be up, and Google may have picked the best time to launch its new PLAs. “PLA programs are more complex to operate than a regular AdWords program,” Shah said. “It remains to be seen how it will stabilize in 2013.”