Advertising’s AI revolution had the sell side in an existential crisis at AdMonsters’ Sell Side Summit in Austin, Texas, this week.

Publishers commiserated about traffic declines of 30% or higher since AI search tools like ChatGPT and Google’s AI Overviews hit the market. To put the traffic problem in perspective, sports-focused publisher On3 impressed attendees by sharing that its audience growth this year was flat compared to last year.

Given the new reality of cratering site traffic, publishers seemed clear-eyed about the threat they’re facing.

“Web pages are going to die,” said Patrick McCarthy, SVP of programmatic monetization at People, Inc., during a fireside chat on his company’s post-search strategy.

But AI wasn’t just a source of doom and gloom at the event.

Media owners are also hopeful that their long-undervalued audience data will fuel advertising’s automated future – if only they can finally wrest control of the industry narrative away from ad tech middlemen.

Searching for answers

A common refrain at the event was that search traffic is gone, and it’s not coming back. The numbers bear that argument out: For search queries that feature a Google AI Overview, organic click-through rates have fallen 61% since mid-2024 and paid click-throughs have dropped 68%, according to Seer Interactive.

The best path forward in the AI search era, according to McCarthy, is for publishers to try and “maintain” the web page business while diversifying into other areas.

For People, Inc., that diversification includes its D/Cipher contextual targeting platform, which uses AI to surface new insights into how audiences engage with content and ads. For example, McCarthy joked, you’d be surprised how much more effective wine ads can be when they’re served to parents reading advice on how to discipline their kids, rather than being served to them the next day.

In addition to in-house tech, McCarthy said People Inc. is also prioritizing live events and social media marketing, which it shored up with its recent acquisition of cooking creator network Feedfeed.

Indeed, multiple publishers who presented at Sell Side Summit highlighted the need to engage audiences off-site while finding new ways to more effectively monetize audiences on-site.

Today’s consumers are happy to stay in their platform of choice’s infinitely scrolling feed rather than clicking away to other sites, said Amanda Martin, chief revenue officer at publisher ad network Mediavine, in another fireside chat at the event. Consumers’ habit of endless scrolling means search is also losing its share of market – so publishers need to find eyeballs wherever they can.

“Google probably just doesn’t have as much to give out as they used to have,” she said.

A better seat at the table

Amid these shifts in consumer habits, publishers seemed resigned to the idea that their business model is fundamentally changing. And they’re looking to remain ahead of the curve and avoid missing out on opportunities as they have in the recent past.

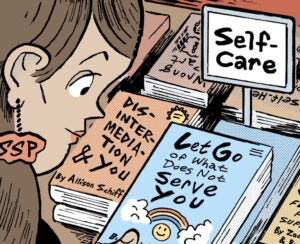

Take the sell-side curation trend, which has been a boon for SSPs, third-party curators and AI-based SaaS products, but which many publishers feel has only introduced new data fees to existing ways of doing business.

“You’re seeing new technology come in with AI that’s inserting fees into direct, which is an area that didn’t have fees,” Martin said. “In the curator marketplace, you have a lot of middlemen building up really nice businesses. It’s another example of a space where publishers haven’t stood up.”

But Martin didn’t begrudge SaaS companies and curators for collecting data fees. Instead, she said publishers should be “playing more of a role than they are” in data monetization and “extracting a CPM for their data.”

Martin also acknowledged the irony of calling out middlemen, seeing as Mediavine is a SaaS monetization partner for 17,000 publishers but owns and operates only a few sites. She said the reason companies like hers have taken the lead in directing industry trade orgs like Prebid is not only because they have more tech resources, but because publishers haven’t asserted themselves strongly enough.

Publishers need to “squeeze the middle” by taking a page from the buy-side playbook and pursuing more direct deals, Martin said. That includes a mix of direct sales, as well as more direct programmatic business via offerings like The Trade Desk’s OpenPath.

However, she said that publishers are currently too incentivized to keep the middlemen in the mix.

For example, regarding programmatic’s great Transaction ID debate and the buy side’s battle against bid duplication: Martin said the real problem is that working with multiple SSPs and duplicating bid requests actually puts more money in publishers’ pockets. Which means the buy-side platforms need to change what signals they’re prioritizing.

“By putting another line on my ads.txt, I might get 1% more revenue,” she said. “You shouldn’t be able to water down your supply chain and see economic benefit.”

Chasing media quality with AI

Fortunately, Martin said, buy-side platforms like The Trade Desk at least appear to be serious about wanting to reward publishers for creating high-quality ad experiences and are de-incentivizing working with several SSPs and overloading sites with ads.

Martin said it might be amusing to hear an ad network exec call for lighter ad loads. She joked that she often finds sites to add to Mediavine’s network based on what’s popular with her kids, prompting them to ask if she’s going to “ruin the site with ads.”

But even Mediavine has found that lowering ad loads can increase CPMs in some cases, she said, which allows a site to maintain its revenue threshold with fewer ads. Which is not to say a site can make more revenue with less advertising, she said, but at least it won’t be punished for doing the right thing.

Meanwhile, to bring the AI theme full circle: Private-equity-backed publisher conglomerate The Arena Group has seen positive returns from using its own AI-driven data platform, called Encore, to tailor its ad experience to specific audiences.

Arena Group’s head of programmatic, addressability and operations, Stephanie Mazzamaro, walked the Sell Side Summit crowd through her company’s turnaround from six consecutive quarters of negative revenue growth starting in Q1 2023 to profitability over its last four quarters.

Part of that turnaround came from using Encore to divide its audience into different “engagement buckets” and find the optimal monetization strategy for each bucket, she said.

For example, 80% of Arena Group’s traffic comes from users making their first site visit in a year, she said. Because of the lack of actionable data on this user cohort, Arena Group’s strategy is to increase this group’s page views per session – and the number of ad impressions served – through content recommendations.

Then, for users who might return only twice a year, the strategy is to increase revenue per session by ramping up ad density, she said.

But once a user shows up four or more times in a month, she said, the strategy shifts toward fostering loyalty by funneling them to subscriptions, email newsletters and other community-oriented channels.

In these cases, Encore’s AI tech is just helping Arena Group’s sales and ad ops teams surface insights and take action faster and more easily than they could before, Mazzamaro said.

“What we get scared about when we talk about LLMs and AI is that it’s replacing all this human insight,” she said. “It’s really just amplifying our first-party intelligence.”

Update 11/14/25: This story was updated to clarify a paraphrasing of how Arena Group uses its Encore solution.