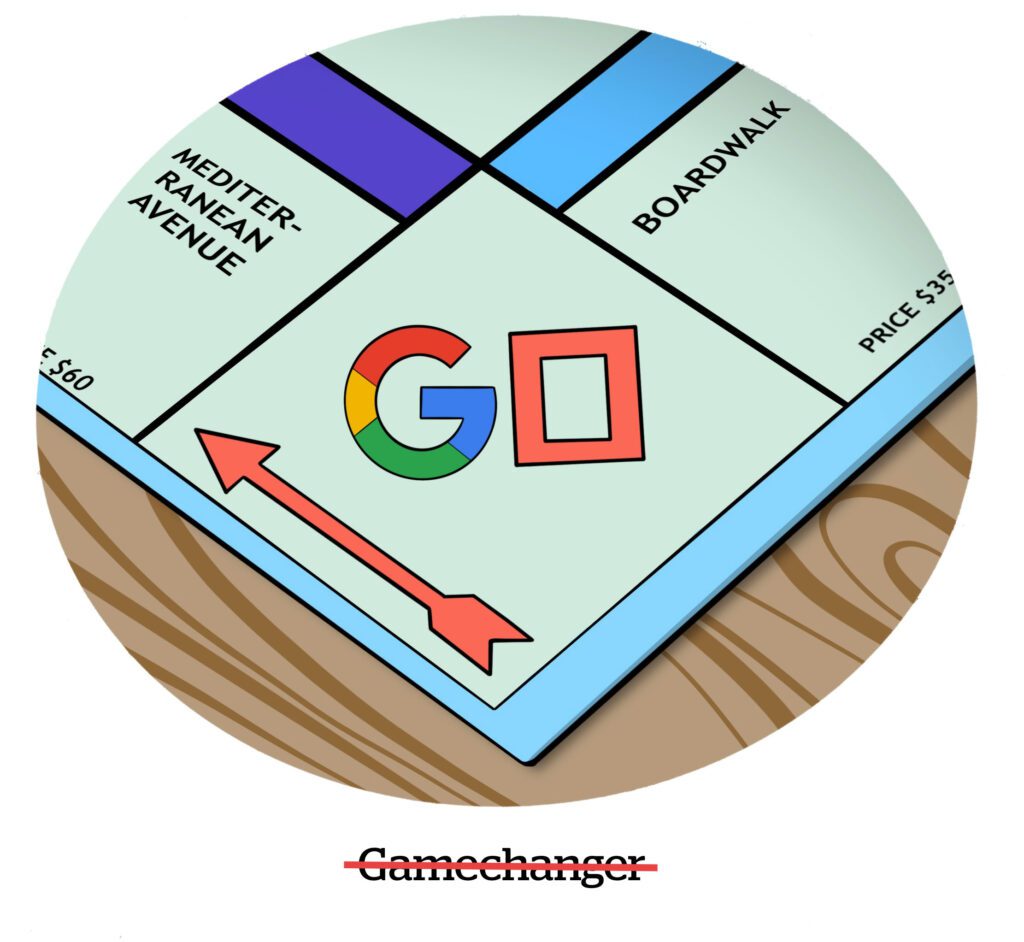

Remedies in the federal search antitrust case against Google landed with a thud earlier this week. Most publishers and ad industry pundits were sorely disappointed.

“United States v. Google LLC turned out to be pretty mid,” said Justin Wohl, VP of strategy at publisher tech platform Aditude.

To be fair, some were skeptical from the start that regulators could ever curb the anticompetitive practices that Judge Amit Mehta ruled last August had given Google monopoly power in online search.

An ad agency source told AdExchanger they doubted the US government’s ability and willingness to make any real changes to Google’s business. The source, who requested anonymity because they work with Google, pointed out that a federal judge once ruled that Microsoft was operating a monopoly in personal computing, but the outcome ultimately amounted to a slap on the wrist.

After the remedies were published, “I got a few ‘You were right’-type emails and texts,” they said, “[but] in this case, it feels worse to be right.”

AI has already reshaped search

Meanwhile, the wheels of justice turn slowly, and the search market already looks different than it did when the Department of Justice brought its case against Google in 2020.

From the publisher perspective, said Wohl, who previously served as CRO of Salon, Snopes and TV Tropes, the fact that the DOJ’s case focused on the traditional online search environment seems almost quaint in today’s marketplace, which is being reshaped by zero-click generative AI search chatbots.

“When this trial began, it looked like Google’s monopolistic ownership of search across browsers and devices would be balanced out by the courts,” he said. “The rapid arrival of AI has wildly changed that landscape and effectively dissolved that concern.”

Indeed, Judge Mehta explicitly notes in his ruling that the remedies he chose were influenced by the stiff competition Google is now facing from AI search startups.

Google itself pointed to pressure from AI competitors in its statement on the ruling: “Competition is intense and people can easily choose the services they want,” the company wrote. “That’s why we disagree so strongly with the Court’s initial decision in August 2024 on liability.”

Still, critics had been hoping for serious structural changes to resolve Google’s search monopoly, and they feel let down by the outcome of this trial.

“There’s a dissonance here,” said Erez Levin, principal at marketing consultancy Emet Advisory and a former Google employee. “Google was found to be a monopolist, but the remedy does not seem like it will do anything to materially curb their search monopoly power, at least not anytime soon.”

Expectation vs. reality

Two of the DOJ’s proposed remedies – a forced divestiture of Chrome and of Google’s Android mobile operating system – would have upended Google’s core business if Judge Mehta hadn’t rejected both for being too extreme.

Divesting these assets would have limited Google’s access to the user data that benefits its search business and weakened the advantage Google has as the default search engine for Chrome and Android.

Instead, Judge Mehta ruled that Google must share some of its search data with so-called “qualified competitors.” An oversight committee will ensure Google is adhering to the data-sharing provision in a way that promotes competition.

But it will be a tricky balance to make sure Google is sharing data that’s useful and not easily obtained elsewhere while also respecting Google’s right to protect its business and its users, said Andrew Frank, VP and distinguished analyst at Gartner.

Judge Mehta also placed some restrictions on Google’s search distribution deals with other platforms. Google is barred from pursuing exclusive search agreements with other platforms, meaning it can still pay platforms to be their default search engine, but not if the deal precludes users from choosing other search engines.

This restriction on “exclusive” search deals will likely have little impact, though, Frank said, because Google’s most scrutinized search partnerships weren’t actually exclusive. For example, Google’s deal with Apple to make Google the default search engine for the Safari browser already lets users pick other search engines.

According to Judge Mehta’s ruling, prohibiting search deals with Apple’s Safari and Mozilla’s Firefox could potentially harm Google’s partners. Google paid Apple an estimated $20 billion in 2022 to be Safari’s default search option. And Google has paid Mozilla more than half a billion dollars since 2005 to be the default search engine for Firefox, with those payments representing the majority of Mozilla’s annual revenue.

But although the restrictions on search deals may have little real-world impact, the data-sharing provisions imposed by Judge Mehta do address some key aspects of Google’s monopolistic advantage in search, Levin said.

Forcing Google to share data with rivals could also prevent it from getting a leg up in the growing AI search market, he said, but “only time will tell if [the provisions] will meaningfully restore competition.”

What about publishers?

Yet restoring competition in search through data sharing isn’t necessarily great for publishers.

Doing so could give Google’s competitors more power over digital publishers, said Gisele Navarro, editor at HouseFresh, a small product review site that has catalogued its drop-offs in traffic caused by Google’s search algorithm changes and the growing use of AI search chatbots.

Rather than publishers only having to deal with one Big Tech giant that has a monopoly over search, she said, “the ruling is effectively giving birth to an oligopoly that could replicate all the unlawful practices Google has carried out without any fear of repercussions from the DOJ.”

Google has also effectively been given a green light from Judge Mehta to continue most of its anticompetitive strategy, Navarro said. And publishers have no choice but to “continue to depend on the whims of a monopoly that can reduce our site earnings to nothing with the flip of a switch,” she said, “or the introduction of new AI features that regurgitate our content without providing traffic in return.”

Google’s dominance over online content discovery and the rise of AI search – which is being aggressively pushed by Google and others – are real concerns for publishers.

Over the past 12 months, Wohl said, Salon’s search traffic has dropped by over 75% – and it won’t be coming back now that zero-click AI chatbots have taken over, he said.

“Google can share its data with other search providers, and those search providers can maybe improve their models,” Wohl said, “but none of that changes the current reality that folks just don’t click on search results like they used to.”

However, said Gartner’s Frank, the main focus of the trial wasn’t on the harm caused to publishers by Google’s search dominance, but rather on the harms caused to Google’s search competitors.

In other words, publishers were unlikely to see any resolution to their traffic woes as a result of this search antitrust trial. But pubs are still holding out hope that pending remedies to Google’s monopoly in the sell-side ad tech and ad server markets will give them some relief. (The remedy phase of the ad tech antitrust trial against Google begins on September 22 in Alexandria, Virginia.)

However, it’s hard not to be cynical.

While some sources who spoke to AdExchanger said there’s reason to believe Google won’t get off so lightly in the ad tech antitrust case, the same agency source who requested anonymity because of their work with Google isn’t so sure. The result of the search trial could be an example of the past as prologue.

“Since the news came out on part one,” they said, “it’s a little clearer that Google doesn’t have an awful lot to worry about.”