Forecasts for real-time bidding are rising for the next several years, after a strong showing in 2012, including participation from major national brands and premium publishers.

Forecasts for real-time bidding are rising for the next several years, after a strong showing in 2012, including participation from major national brands and premium publishers.

Market intelligence firm IDC said in October that worldwide RTB-based spending was $1.4 billion in 2011 and forecasted it will rise to $13.9 billion by 2016, for a compound annual growth rate of 59.2%. In the U.S., RTB was $1.1 billion in 2011, and will rise to $8.9 billion by 2016, for a compound annual growth rate of 53%. In the US, IDC forecasts that RTB will make up 27% of all display ad spending in 2016.

Another research firm, Parks Associates, forecast that RTB will be slightly more aggressive in its takeover of display advertising, rising to 50% of all display ads by 2017. However, the company predicts that RTB will make $7 billion in North America that year as well.

“There are so many different variables that go into their rate of adoption,” said Heather Way, research analyst with Parks Associates, in an August 2012 interview with Ad Exchanger. However, she added, “RTB will become the new de facto display online buying method.”

What about pricing? In 2012, CPMs for RTB ads averaged about $3.17, according to Forrester. But with an increasing number of premium publishers and buyers getting into the space, prices and CPMs will rise. That is one way that a forecast like IDC’s could happen, where RTB makes up a smaller percentage than Parks’ forecast but earns more money.

In its Digital Media Buying Forecast, 2012-2017, Forrester reported that CPMs will rise from $3.17 in 2012 to $6.64 by 2017 for RTB. It also predicts that 30% of total ad spend will be programmatic exchanged-based trading.

“We anticipate that CPMs will continue to rise, which is a great thing for publishers,” said Joanna O’Connell, principal analyst for interactive marketing professionals at Forrester. “You see more publishers getting comfortable, at least with dipping a toe in the water. You can’t have a healthy system without both premium buyers and premium sellers, long-term.”

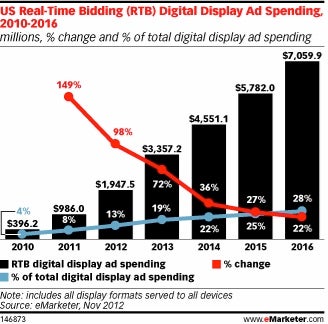

According to digital marketing research firm eMarketer, RTB will make up 25% of the display advertising space by 2015. eMarketer forecasts that in 2012, RTB digital display ad spending will reach $1.95 billion, rising to $5.78 billion by 2015. This includes all display formats served to all devices.

“Though real-time buying originated during a depressed economy, when stretching media budgets was a mandate, it has proven its usefulness and efficiency beyond dollar allocations and has matured to a point that even advertisers with ample display budgets use and will continue to use RTB to make a portion of their display ad buys,” analyst Lauren Fisher wrote in the eMarketer report “Real-Time Bidding: As Spending Forecast and Future Growth Factors.”

“Globally, we expect RTB to account for a quarter of total advertising revenues by 2015, compared with more optimistic forecasts of 50%,” said Monica Savut, senior research analyst for Econsultancy, in an August 2012 interview with AdExchanger. The company published a Real-Time Bidding Buyer’s Guide in August. “Both media buyers and sellers are still at an experimental stage, so we’re at least a couple of years away from widespread acceptance.”

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Daily Roundup

However, more premium buyers are becoming interested in RTB. According to Casale Media’s sell-side Index Platform, in the second quarter of 2012, 57% of all RTB advertisers were major national brands. Overall, the number of RTB impressions increased by 28% between the first and second quarters of 2012.

“Big brand marketers like Kellogg are talking about the use of programmatic buying very publicly now and that creates and environment where other marketers are comfortable,” Forrester’s O’Connell told AdExchanger.

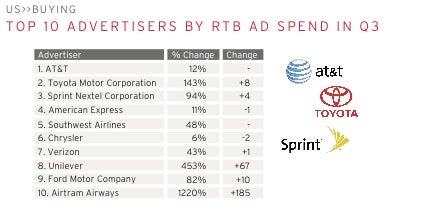

In fact, data from Rubicon found that the top 10 advertisers by RTB spend in the third quarter were all well-known national brands. The top five brands were AT&T, Toyota, Sprint Nextel, American Express, and Southwest Airlines.

Additionally, more premium publishers are getting into the space. According to media buying platform Accordant Media, the volume of RTB ad inventory grew 88% in the third quarter of 2012, compared to Q3 2011. It was also up 29% compared to Q2 2012.

“Long term, ten years out, RTB will be the basis for about half of all display advertising,” Karsten Weide, program vice president of digital media and entertainment for IDC, told AdExchanger. “But eventually, almost all spending will go through RTB, excluding custom executions and sales to top key accounts.”