“On TV And Video” is a column exploring opportunities and challenges in programmatic TV and video.

“On TV And Video” is a column exploring opportunities and challenges in programmatic TV and video.

Today’s column is written by Andreas Schroeter, co-founder and chief operating officer at wywy.

TV’s ad budgets are under pressure to shift toward digital buys. Yet even Facebook can’t provide TV’s unmatched reach and recently admitted video ad measurement issues.

TV advertisers want more accountability, which has been the strongest argument for digital campaigns. Programmatic TV allows advertisers to use more data and thereby buy beyond the traditional demographics based on age and gender.

Programmatic TV is slowly gaining traction. Both the automation of the TV buy and the availability of data have made huge advancements in breaking down technical and psychological barriers, as evidenced by this year’s upfronts, where advertisers, agencies and TV networks have (albeit slowly) started to take advantage of the benefits of programmatic TV.

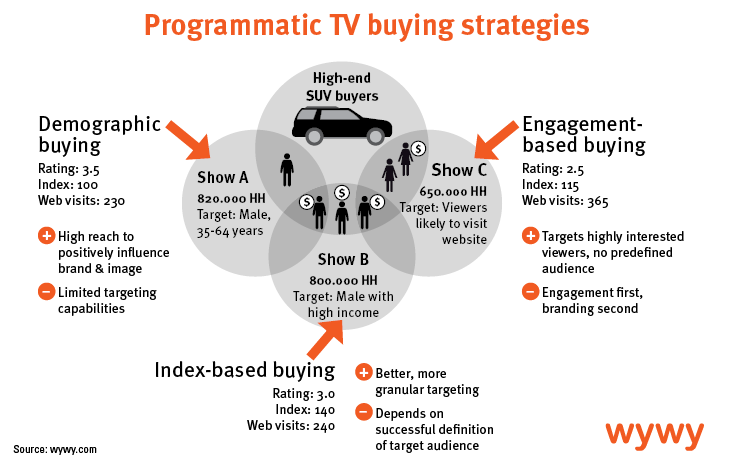

The demand for more accountability beyond age and gender creates the need for better targeting, which has led to the emergence of two buying strategies.

(Traditional) Demographic Buying

Most campaigns are planned and bought on gender and age demographics, based on the Nielsen TV panel. Once the target demographic is defined, the programs with the highest reach and the best price within that target demographic will be bought. TV’s reach helps to positively influence the advertiser’s brand.

The traditional approach has limitations as it relies heavily on Nielsen’s TV panel with about 26,000 households and partially outdated methods, such as keeping physical TV viewing diaries.

Index-Based Buying

New set-top boxes allow advertisers to capture the viewing habits of millions of households in granular detail. Combining this massive set of viewer data with other available data sources allows advertisers to build detailed viewer profiles at a very granular level. Household income, family status, hobbies, food preferences and more can be used for targeting. Instead of ranking the TV program based on the gross rating point, the new index-based buying approach ranks the TV program based on the chosen targeting metrics for each individual campaign. So while a show might have a low “traditional” rating, it might have a high index value and therefore be bought based on the new targeting metric.

However, as more targeting becomes available, the right definition of the desired target audience and the choice of the right targeting metrics become critical for this buying strategy.

Engagement-Based Buying

The rise of the “always-on” culture has led to almost all viewers watching TV and using their smartphone or tablet as a second screen in parallel. This change in viewing habits results in many viewers engaging with TV ads immediately following the airing, blurring the traditional boundaries between brand and direct-response TV advertising.

More TV advertisers are starting to measure the impact of their TV advertising on their online channels. These impact metrics can be used to rank the TV program based on people who are highly interested and most likely to engage. The advantage of this approach is that there is no need to predefine the audience as the viewers’ engagement is the relevant optimization metric. However, as engagement comes first, the challenge is to combine this with the advantage of TV’s broad reach for branding to less interested viewers.

Both new buying strategies help advertisers bridge the accountability gap. The campaign goal will define which strategy to use: whether to better target the desired audience through index-based buying or target highly interested viewers through engagement-based buying.

Follow wywy (@wywy) and AdExchanger (@adexchanger) on Twitter.