Twitter reported $361 million in Q3 revenue, up 114% YoY, toward the higher end of the $332-$378 million range predicted by Wall Street. (Read the release.)

Twitter reported $361 million in Q3 revenue, up 114% YoY, toward the higher end of the $332-$378 million range predicted by Wall Street. (Read the release.)

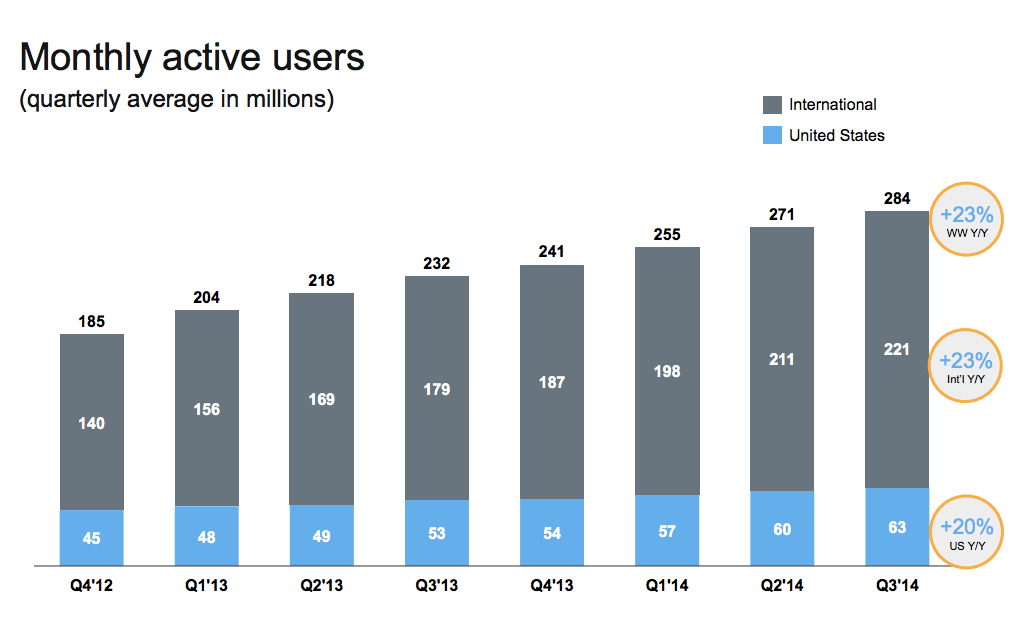

Analysts however are still concerned about the engagement levels and growth rates of Twitter’s monthly active users (MAUs).

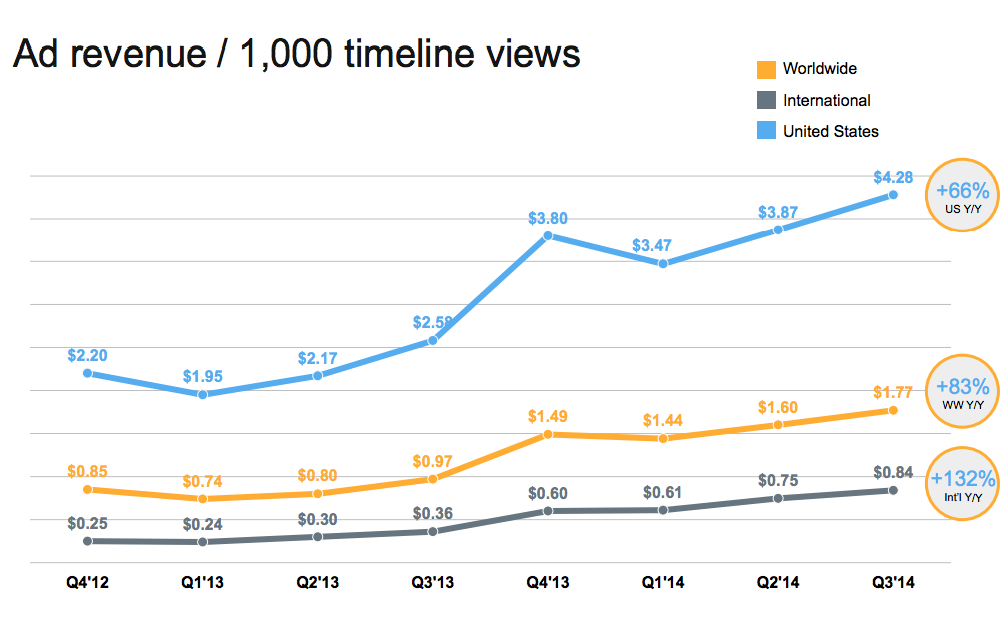

As always, the good news centered around Twitter’s revenue. Its advertising revenue (of which 85% was mobile) totaled $320 million, a 109% YoY increase.

“Today, we continue to drive nice growth and spend per advertiser as we improve the ROI we provide for them and offer new advertising products,” said CFO Anthony Noto. He added that product changes such as better dashboards – which improve clickthrough rates – encourage advertisers to spend more on the platform, even though Twitter’s ad load is lower than that of other social networks.

Twitter also saw strong growth in data licensing and other revenue (171% increase YoY to $41 million) and international revenue (176% increase YoY to $121 million).

International revenue was 34% of Twitter’s total revenue.

While Twitter’s short-term prospects seem pretty good, its average MAUs were only 284 million in Q3, a mere 23% YoY increase (80% of which were mobile). Last quarter, that number increased by 24% YoY. The Asia-Pacific region in particular was a problem area this quarter, due to a user authentication bug Noto claimed cost Twitter 1-2 million MAUs.

Twitter’s timeline views increased 14% YoY to 181 billion.

And advertising revenue per thousand timeline views increased 83% YoY to $1.77.

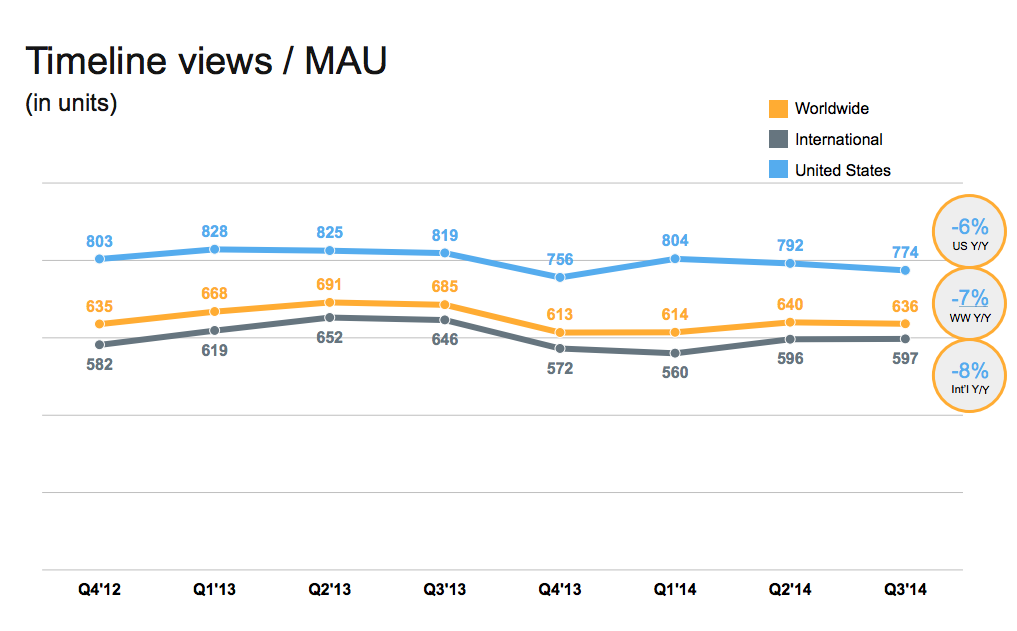

However, timeline views per MAU decreased 7% worldwide to 636 (an 8% decrease internationally and a 6% decrease in the United States).

This is the fourth quarter in a row where that metric declined. Last quarter, Twitter blamed the decrease on a lack of events such as the Oscars and the Super Bowl.

Twitter also claimed last quarter that “product improvements” affected timeline views per MAU – a narrative Noto reiterated in Q3, when he said changes to Twitter products “may pressure timeline views per MAUs over time.”

Company CEO Dick Costolo tried to divert analysts’ attention away from these disappointing growth and engagement rates, emphasizing that Twitter’s audience is greater than its number of MAUs.

He encouraged investors to think of Twitter’s total audience “as a series of concentric circles.” These include the core users – the MAUs. Beyond that, Twitter’s audience includes individuals that visit Twitter without logging in. Costolo said logged-out users number in the “hundreds of millions” and counting them makes Twitter’s user base two to three times bigger.

These individuals tend to come to Twitter, according to Noto, by doing searches for a person (in which case they will find that individual’s Twitter timeline), searches for a general topic (which links to a page with just a single Tweet related to the search query) or by attempting a search on Twitter’s platform and leaving the page when they find it requires a log-in.

As Twitter mentioned last quarter, it hopes to build products to attract these logged-out users, with the intention of monetizing them down the line. Twitter, however, has not revealed how exactly it plans to do this.

The final category that constitutes Twitter’s audience includes consumers Twitter reaches via embedded tweets and timelines on third-party websites. To this end, Twitter’s SDK Fabric is designed to push this benefit into the mobile environment.

Additionally, while 11% of Twitter users access the social network via third-party clients, Twitter advertising units aren’t always available there.

When analysts wondered if that would eventually change, Noto said: “We will think about and look for opportunities to provide our native advertising units in syndication to other Twitter-based properties like TweetDeck and across the entire mobile application ecosystem.”

Noto and Costolo offered little information about new ad-related products, such as the buy button and its video advertising capabilities. With video, Noto gave lip service to Twitter’s TV audience extension product Amplify, which launched last year, and a promoted video product, currently in beta.

Twitter’s stock price was down 10% in after hours trading