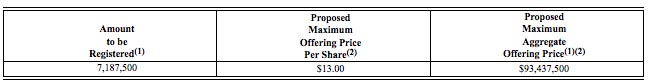

Video demand-side platform (DSP) TubeMogul has updated the S-1 it filed in March, saying it will sell 7,187,500 shares at a suggested offering price of $13 per share. Read the S-1. TubeMogul hopes to raise $93 million and will now take this offer to potential IPO investors – “the roadshow” – prior to the company going public.

Video demand-side platform (DSP) TubeMogul has updated the S-1 it filed in March, saying it will sell 7,187,500 shares at a suggested offering price of $13 per share. Read the S-1. TubeMogul hopes to raise $93 million and will now take this offer to potential IPO investors – “the roadshow” – prior to the company going public.

Given the $13 per share offering price and the 28,685,816 shares of common stock outstanding once the company goes public, its valuation is expected to be $372 million. Though not a perfect apples-to-apples comparison, this is a slightly lower valuation to the rumored $500 million acquisition price of LiveRail by Facebook.

Recapping some of the previously released figures for TubeMogul, the company revenues were $22 million in Q1 2014 versus $9.6 million during the same period last year. Total spend through the platform was $48 million in Q1 2014, versus $16.3 million in Q1 2013.

Also, the company said gross margins had expanded to 72% for Q1 2014 versus 65% in Q1 2013.

Finally, net loss was $800,000 in Q1 2014 versus $1.9 million in Q1 2013.

Among several caveats typical of S-1 registration statements, TubeMogul tips its hat to the challenges around video ad fraud saying: “Our business depends in part on providing our advertisers with services that are trusted and safe for their brands and that provide the anticipated value. We frequently have contractual commitments to take reasonable measures to prevent advertisements from appearing on websites with inappropriate content or on certain websites that our advertisers may identify. Our advertisers also expect that ad placements will not be misrepresented, such as auto-play in banner placements marketed as pre-roll inventory, and that ad impressions represent the legitimate activity of human internet users…”

Ryan Joe contributed