Commerce data platform Klover raised $25 million in Series B funding and changed its parent company name to Attain.

The company’s Klover app – which offers discounts and financial services in exchange for user data – will retain the Klover branding. The name change will only apply to the parent company and its data platform.

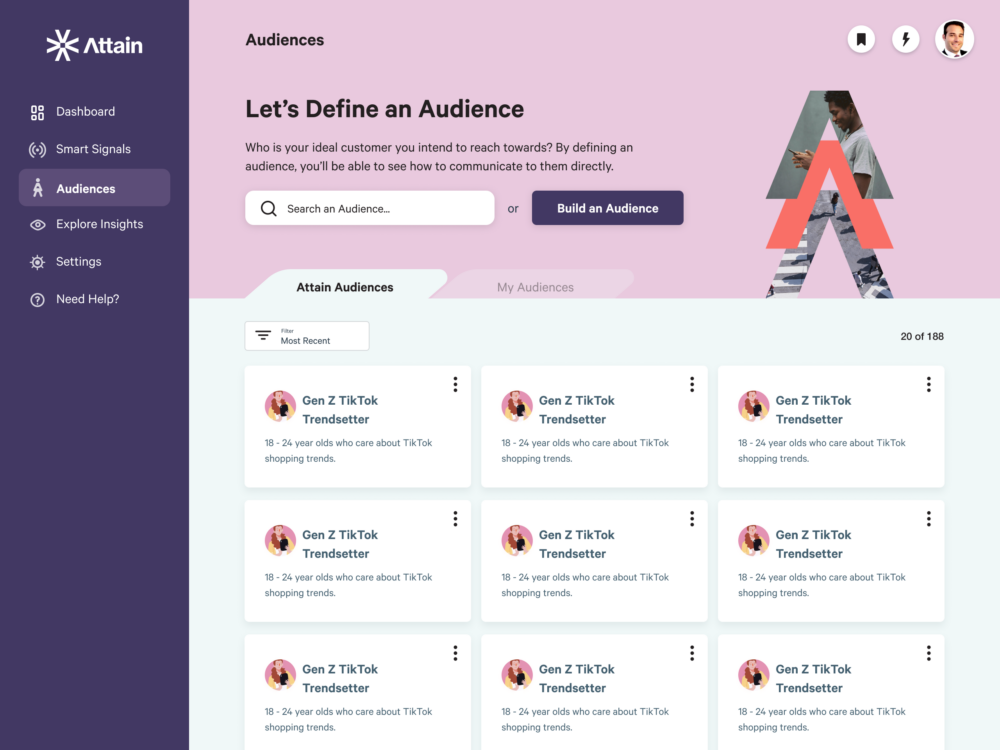

The newly branded Attain will use the funding to launch what it’s calling a software-as-a-service (SaaS) commerce data platform for marketers.

Insights will be the first entry in Attain’s commerce data offering. Marketers will be able to use a self-service platform to understand consumer purchasing behavior and financial services needs using data derived from the Klover app. This product will have its beta launch in January, with a wide release set for mid-2023.

Attain sees an opportunity for its first-party data to fill the gap created by the loss of signals like third-party cookies and device IDs, said the company’s founder and CEO, Brian Mandelbaum.

And with the economy facing a likely recession, marketers will require more robust targeting and measurement to ensure they don’t waste their ad spend, he said. The fact that Attain was able to raise $25 million despite the tough climate for tech investments speaks to this need, Mandelbaum said.

“If there is a recession, you’re going to see consumer spending slowing down, and when consumer spending is slowing down, [advertising] is about making every dollar more effective,” he said.

Attain plans to build its own tech instead of relying on ad tech partners, as it does now, Mandelbaum said. That approach will improve its operating leverage and ensure it’s not on the hook for big licensing fees in an economic downturn.

The Series B round was led by equity firm Mercato Partners, which was also the lead investor in the company’s Series A funding round. Additional Series B investors included Core Innovation Capital, Starting Line, Motivate Venture Capital and Silicon Valley Bank.

Attain will use the funds to double its current headcount of about 70 within the next 12 months, according to Mandelbaum. New hires will be spread across the company’s sales, product engineering and marketing departments.

The funding will also support R&D for Attain’s expanded software offering to enable deeper data collection from more users, Mandelbaum said.

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Daily Roundup

In addition, Attain will roll out more consumer-facing apps with the intention of growing its first-party data set, including branching out into areas beyond commerce data, Mandelbaum said. More information about these new apps could be announced early next year.

And Attain is also looking to grow via mergers and acquisitions. “We are looking at acquiring certain assets, whether it’s on the marketing tech side or on the consumer side – whatever can be accretive for our long-term goals and help us grow faster,” Mandelbaum said.