Whose Customer Is It Anyway?

If you believe advertising has become too complicated, without clear results, well, CEOs agree.

A growing number of chief execs believe their businesses have lost the point of marketing, according to a McKinsey report released Monday. A whopping 90% of CEOs say marketing’s role is not clearly defined or understood by C-suite executives. That’s up from 70% of CEOs who said so last year.

Part of the reason for that disconnect could be companies deprioritizing the CMO role. The share of Fortune 500s with CMOs declined from 71% in 2023 to 66% in 2024, according to executive consulting firm Spencer Stuart.

CMOs say they’re less involved in strategic planning, which makes it easier for fellow execs to discount marketing’s impact. As one CMO put it, “CFOs often view marketing as a cost center, rather than an investment.”

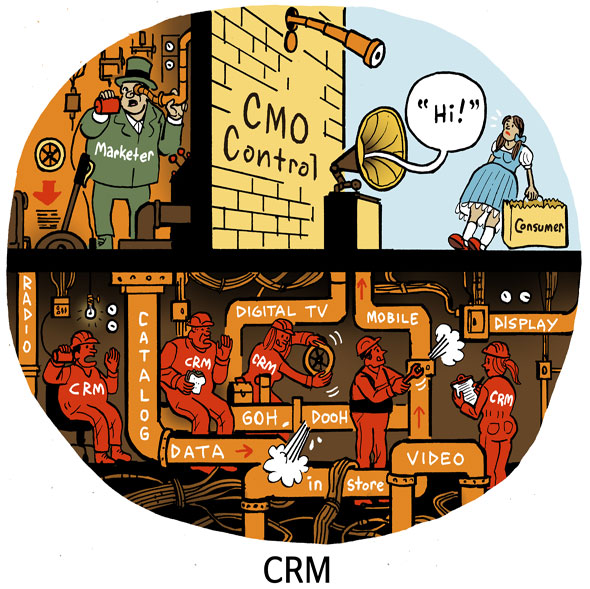

Meanwhile, increased digital media fragmentation has led to a profusion of specialized executive roles like chief data officer and chief digital officer. Which means no single executive owns the company’s relationship with the customer, CMOs say. That perpetuates the lack of clarity around how marketing leads to outcomes.

WhatsAd

When Meta announced early this year that ads will roll out to all Threads users, the reaction was pretty much, “Yawn.”

But if Threads is small potatoes, WhatsApp is a porterhouse steak.

WhatsApp, which boasts more than two billion global users and was acquired by Facebook in 2014, announced at Cannes that it will show ads in the app for the first time. Targeting could be based on location and default language, as well as other data collected by Meta if the user agrees to link their accounts, The New York Times reports.

WhatsApp also now lets live video broadcasters show ads on their streams. It’s a common feature for video creators on platforms like YouTube or Twitch. And it’s an additional revenue line for Meta.

But it’s a notable strategy reversal. Meta has for years monetized WhatsApp’s status as a more personal, ad-free messaging service. Per the Times, Facebook and Instagram built a multibillion-dollar ad product from businesses paying to send users to their WhatsApp or Messenger accounts (via those “click to message” business prompts). Now, businesses will be paying to expose their customers to more ads.

Safety In Numbers

Speaking of Meta: Back in January, when Meta announced it will dramatically reduce fact-checking and content moderation across its network, advertisers weren’t overly concerned about brand safety issues. Brands weren’t boycotting the platform, at least, as was the case in previous scandals.

But even if brands find the environment suitable, users often don’t, 404 Media reports.

A new survey conducted by UltraViolet, GLAAD and All Out found that 72% of respondents felt that harmful content targeting protected groups has increased in the last six months.

Of the 7,000 users polled, two-thirds say they’ve directly witnessed harmful content on a Meta app since January; another quarter felt attacked personally.

Not that any of that info matters much when it comes to Meta’s bottom line.

As of Meta’s Q1 earnings report this year, the number of people who use at least one of Meta’s apps on a daily basis has increased year over year, as has the number of ad impressions and overall ad revenue. (Welcome to the club, WhatsApp.)

It’s an interesting and unfortunate dichotomy: Meta’s core product experience – apps used by people – can degrade substantially without Meta’s ad platform product, which is campaign ROAS, taking a hit.

But Wait! There’s More

PayPal intros shoppable ads for digital media sites. [Adweek]

TikTok rolls out even more tools for AI-generated video ads. [Bloomberg]

Gallup’s new poll says your boss is more likely to use AI than you are. [Business Insider]

A record number of global CEOs attended Cannes Lion this year. [Beet.TV]

Omnicom strikes partnerships with Disney and Walmart. [Digiday]

Skyrocketing subscription costs and media fragmentation have ruined the once-communal experience of watching sports. [NYT]

You’re Hired!

Vice Media hires NBCUniversal alum Adam Stotsky as CEO. [WSJ]