Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Investing In Yourself

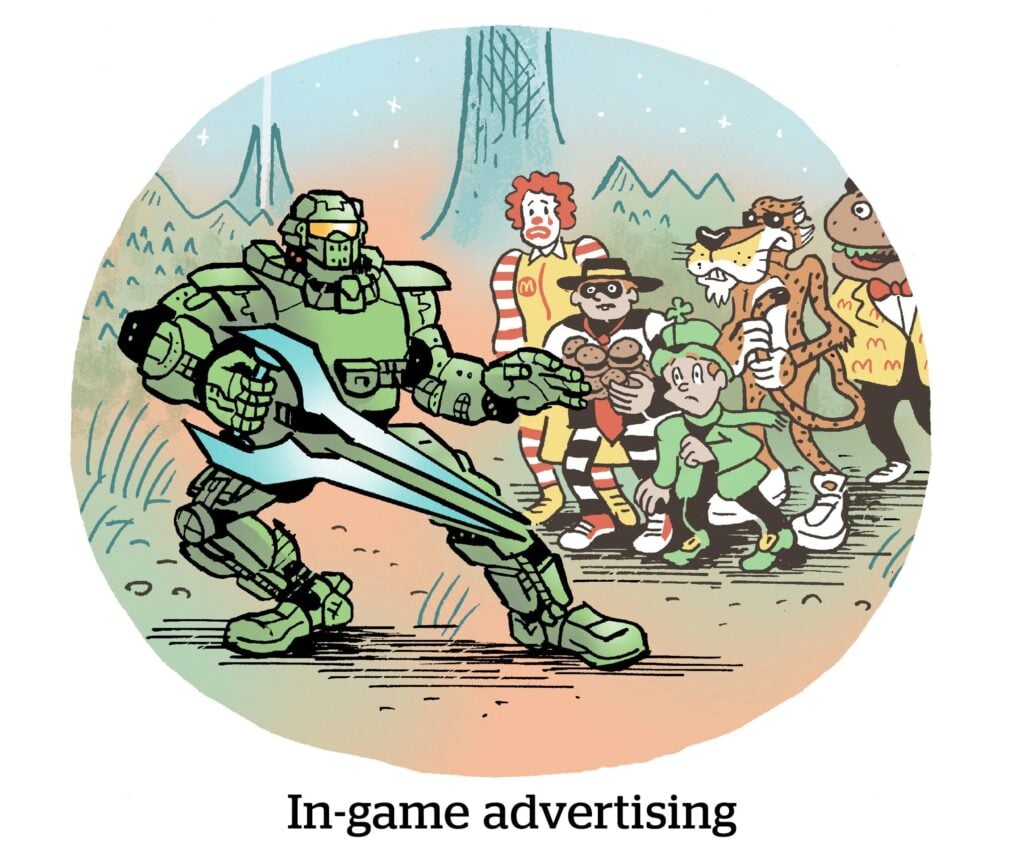

It’s been an eventful March for Bidstack, an in-game ad platform.

Bidstack suspended trading on the London Stock Exchange following a failed attempt to secure a buyer. On Friday, the company was acquired by … Bidstack.

A team of Bidstack execs, led by Founder and CEO James Draper, bought the business back from investors and shareholders. Client contracts will continue under the new (old?) ownership, and the existing workforce will be retained, according to a press release.

Bidstack reportedly shopped its assets to 200 potential buyers before the executive team made its offer.

Bidstack’s downward trajectory (its stock was down 98% since 2019) raises uncomfortable questions for mobile gaming ad tech overall. Bidstack is one of a few notable specialists in the category, alongside the likes of Anzu and Frameplay.

Mobile game developers have struggled, and there’s an inevitable knock-on for in-game ad tech.

With a smaller market, mobile game developers have added apps in other verticals.

Bidstack is remaining committed to in-game ads, Draper says, but it will also double down on licensing professional sports IP for virtual activations in games and elsewhere.

Don’t Call It A Comeback

When Martin Sorrell took over WPP in 1985, it was “WPP” for Wire and Plastic Products. The company mainly manufactured shopping baskets.

Over decades, Sorrell became the most prolific acquirer of marketing services, and WPP became the largest agency holding company.

Now, Sorrell is pursuing a similar route with S4 Capital – formerly a public shell company named Derriston Capital. (This arrangement allows S4 to be listed publicly on the London Stock Exchange, while Sorrell retains voting control.) But this time, if S4 is to grow into a juggernaut, it must avoid a market swarming with would-be acquirers, of the type Sorrell originally pioneered, reports The Wall Street Journal.

“Some of his most notable acquisitions [from the WPP era] were hostile takeovers,” writes the Journal.

He is now vulnerable to a hostile takeover.

S4’s share price has dropped 75% in the past year, putting its market cap at about $300 million. Sorrel has rejected offers valuing the business at more than double that.

And though S4 said in its 2022 annual report that it is “working on a succession plan for Sir Martin Sorrell,” there have been no confirmed plans.

Bugs!

Did you have a pleasant weekend?

It was another hellacious one for Meta ecommerce advertisers after a spending overage glitch (another overage glitch) consumed budgets while returning next to no ROI.

And now begins a massive effort by the most deeply involved Meta advertisers to marshall attention and fellow buyers to call for redress, because the feeling is otherwise Meta just dgaf tbh.

A parallel, inter-related issue is that Meta has absolutely wiped out its human customer service teams. It’s hired people back in some cases after perhaps cutting too deeply. But because of the cuts, the reps now know less than the ad buyers about how the platform works. If savvy consultants or social agencies can’t figure out the bug, Meta probably doesn’t know what’s up either.

Without service reps, buyers plead for help via Meta’s chatbot AI software, which makes clumsy errors. It happily reports all systems are functioning well, even as distressed advertisers buy triple-digit CPMs but see no sales.

However, harrumphing to a rep can earn a refund credit of up to 6X what the account would have received through Meta’s auto-refund process. Perhaps it’s a sign that Meta’s platform refunds severely undercount advertiser losses.

But Wait, There’s More!

ESPN’s model is eroding. Past and present execs are split on how it can protect its dominance. [CNBC]

Why media companies are still hybrid, four years since the pandemic started. [Digiday]

Media agencies go after smaller and mid-budget accounts. [Ad Age]

Here’s how Google’s generative AI service for newsrooms will work. [Big Technology]

Trustbuster Jonathan Kanter puts Apple and Google in his sights. [NYT]