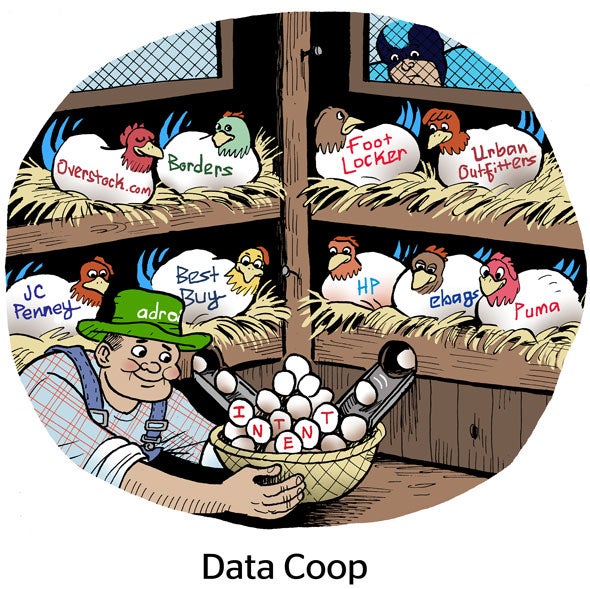

Seems as if every retailer has its own data and ad targeting business these days.

But what they don’t have is scale.

So a growing number of retail media networks (RMNs) are partnering with ad tech intermediaries and each other to manufacture national scale and audiences.

As of Tuesday, you can add regional grocery chains Wegmans and Giant Eagle to that list. Both have joined Rippl, a retail data co-op operated by Bridg, a customer data platform acquired by Cardlytics in 2021.

Going national

Joell Robinson joined the performance marketing team at Giant Eagle two years ago to help in-house ad buying that previously was done by an agency.

Last year, when the chain formalized its ad tech and data business as Leap Media, Robinson was made senior director of retail media, and now oversees ad buying for the Giant Eagle brand itself and CPGs working with Leap Media.

Giant Eagle has partnered with other vendors in the past to extend its reach across specific media channels. One vendor, for example, specializes in RMN campaigns on digital out-of-home screens, while another serves audio ads to in-store radio feeds.

“But we wanted to find a way to be considered for a more scalable audience,” Robinson told AdExchanger.

Giant Eagle has 470 stores, mainly in Pennsylvania, Ohio and a few surrounding states. Wegmans, meanwhile, has around 110 locations based primarily in New York.

Smaller chains like these can find it hard to compete on advertising with national chains like Kroger, which has more than 2,700 locations under various banners.

Rippl effect

Enter Rippl, which is a co-op of mostly regional or smaller retail chains that packages data for targeting and attribution across the network. By joining up many retailers, Rippl creates a national footprint to attract new agencies and brand buyers.

Typically, brand marketers are assigned to one or a few specific retailers.

But Rippl works with different kinds of agency buyers than the shopper marketing teams advertising directly with a retailer, said Amit Gupta, COO of Cardlytics and GM of the Bridg business.

A co-op setup allows these buyers to work directly with a regional RMN, like Giant Eagle’s Leap Media, which is a managed service-only business, while still being able to attribute based on the retailer’s sales.

Some ad buyers need a national footprint for their campaigns and want to attribute sales that happen in stores – but they don’t necessarily care which chain was responsible for a purchase. In that case, it makes sense to work with Rippl, Robinson said.

Giant Eagle’s brand advertisers see operational efficiencies with Rippl, she said, “because they’ll be able to use one audience that will come from multiple retailers.”

Competitive friction

Still, a data co-op is a delicate thing.

Unlike vendors that extend Leap Media campaigns to new channels, like audio, CTV or in-store screens, Rippl is out there working with the same brands and agencies as Leap – and buying the same media. It could be seen as a competitor.

And there are other tough pills to swallow for regional chains.

“We provide the ability for [advertisers] to cherry pick and curate” from across Rippl’s network, Gupta said.

That’s great for advertisers. But for retailers, being cherry-picked is not such an appealing pitch. So why do they join?

For one thing, Bridg pays them to license their data. But retailers are also reckoning with the reality that they can’t create a massive ad business on their own.

“There is a moment now for retailers to say, ‘We don’t have national scale like Walmart,’” Robinson said. “I think you just have to face those realities, and for those of us who are thinking about it that way, it’ll be beneficial in the end.”