Programmatic attribution always comes with a push and pull dynamic.

There are the methodologies and theories embraced by advertisers and ad tech vendors. And then there’s how those theories are put to practice in the form of actual programmatic metrics and conversion events is another matter.

One important example is the growth of incrementality measurement. Because the big ad platforms and attribution services have all begun reporting metrics like incremental sales or new-to-brand conversions, although those metrics don’t mean anything of the sort.

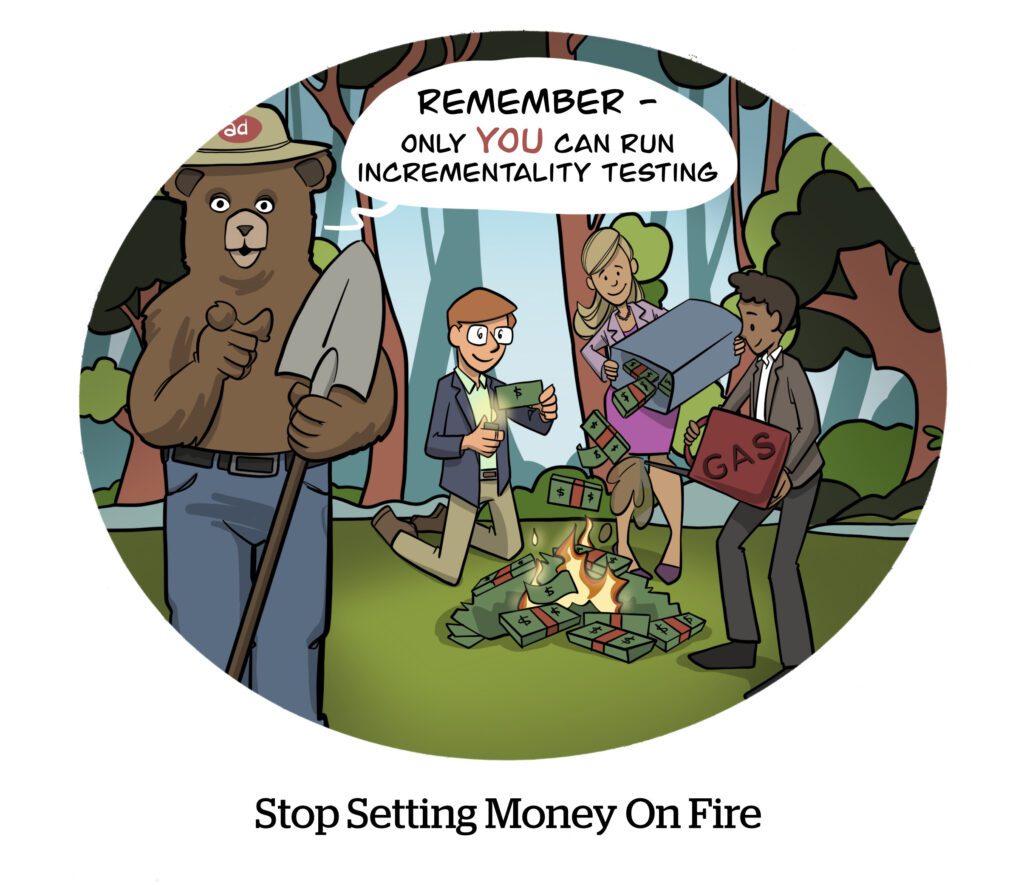

Oh, you want incrementality?

Advertisers have been asking for incrementality measurements and metrics from the big ad platforms for years. So it’s no surprise that the platforms have responded.

The Amazon ad platform only recently began enabling incrementality tests. Previously, advertisers couldn’t create large holdout or control groups city by city or market to market, three ad measurement and agency sources told AdExchanger privately so as not to jeopardize relationships with Amazon and other platforms. Now it is feasible to create incrementality test groups through Amazon Marketing Cloud (AMC), the ad business’s AWS-based data clean room, although it’s a beta program.

Last year, Meta opened a beta program for a new “incremental attribution” product. Also last year, Google’s Performance Max began offering “New Customers” as a conversion metric to set those AI-driven campaigns, according to two agency buyers.

That’s all well and good. But it’s important to always bear in mind the distinction between “incrementality measurement” as a methodology or philosophy, and what platform attributes to itself in terms of incremental sales or new-to-brand customers.

“Whether it’s a ‘new to brand’ metric or an incrementality report that’s coming directly from the retailer, the retailers or platforms only have access to a sliver of information,” Jason Colon said in a recent interview. Colon was the managing director of Publicis’ retail media business and now serves as EVP, commerce media, at Horizon’s Night Market.

What is wrong with platform incrementality measurement?

When a platform like Meta, Google or Amazon reports a conversion or a new customer to your brand, usually what that metric really means is that each particular platform had never converted that customer on behalf of your brand. But that customer could already exist in the company’s CRM, or have purchased the product more than a year before.

One advertiser told me, for example, that they’d used TikTok’s new Conversion Lift Study, an incrementality measurement solution introduced last year. It reported great results for the brand for a spell, but couldn’t maintain any pace of incremental results. The platform had picked off the easy conversions, which were new for TikTok but not necessarily for the brand, he said. The company saw that TikTok was also driving sales from previous customers on Amazon.

The same advertiser also tested AppLovin’s beta ecommerce ad product. The results there have been less dramatic, he said – not the big initial jump and then tailing off. But he said he suspects that’s because AppLovin’s program leans on third-party incrementality measurement vendors, which are impartial and compare AppLovin to other platforms. If AppLovin had its own incrementality product and a more walled garden approach, they said, those incrementality results would probably resemble the reported results from TikTok.

And even when a consumer genuinely buys a product for the first time, that conversion could be reported as a new-to-brand or incremental new customer across numerous platforms. Plus, that doesn’t even get into the difficulty – sometimes even the impossibility – of understanding whether a customer is new or not. Someone could change their home address, email address or credit card; their IP address might rotate; they could have a new laptop or smartphone or perhaps turned on a product like Apple’s private relay so their identity is disguised.

When platform ad campaigns convert an audience target they don’t recognize, it counts as an incremental or new sale. But that individual could in reality be a loyal repeat customer.

Incrementality reporting by a platform may be useful and directionally correct, but it is not true.

Meta’s incrementality testing isn’t available for iOS 14 mobile app campaigns. The modeling simply won’t work. Meta’s attribution setting options are “click-through,” “view-through,” “engaged view,” “standard attribution” (which is a seven-day window on an ad click or a one-day window on an ad view) and “incremental attribution.”

Click-throughs may be a terrible way to attribute a campaign and no sure indicator that an ad is actually driving interested customers. But it is confirmable that each individual click and new site page load happened. Only incremental attribution uses modeled data, so the advertiser must simply accept the platform’s conclusion.

Platform rules also generally have a one-year cap on incremental or new-to-brand metrics, noted Kate Greubel, VP of self-serve media at Omnicom’s retail media agency Flywheel. She added that Flywheel actually has an exclusive arrangement announced in January with AMC, so that, on Amazon at least, Flywheel can use a five-year lookback window to attribute incremental sales.

There are many good reasons not to necessarily trust incremental sales by an ad platform. But there is also painful data inequity.

A retailer might know perfectly well that a shopper has purchased a certain brand of mayonnaise every other month for years. But that retailer’s shiny new retail media network hasn’t self-attributed the sale before. So that’s an incremental customer.

Especially as AI products like Google PMax or Amazon’s Performance Plus take hold, those campaigns will be built for metrics and not for real marketer interests.

Some products have a life cycle of more than one year. For those brands, most purchases will count as incremental or new customers. Amazon’s AI could very effectively target shoppers of, say, a cleaning product someone infrequently replenishes or walking shoes someone buys on a roughly 18-month cycle. If that’s what a platform like Amazon or Google defines as a “new customer,” and the advertiser wants “new customers,” then that’s what the AI products will deliver.

If it was a human account exec at the wheel, it would be inexcusably cynical. But AI doesn’t know it’s cynical. It just thinks those are the results you want.

So, while it may be healthy for brand marketers to embrace incrementality measurement as a methodology, or in the form of a third-party vendor, do not allow a platform the license to decide whether customers are actually new or whether sales are incremental.