Nikesh Arora, Google’s SVP and chief business officer, will be leaving the company after a decade, according to the company’s earnings press release.

Nikesh Arora, Google’s SVP and chief business officer, will be leaving the company after a decade, according to the company’s earnings press release.

He’ll join Japanese telecommunications and internet company SoftBank, where he’ll be vice chairman of SoftBank Corp. and CEO of SoftBank Internet and Media.

Omid Kordestani, a senior adviser to the CEO and one of Google’s founders, will be the interim leader of Google’s business organization.

Arora tweeted shortly after the announcement, “Thank you googlers for your support and love in the last 10 years. Will miss all of you. Looking forward to the next adventure.” He was married in recent days to Ayesha Thapar, CEO of Indian City Properties, at an extravagant multiday ceremony in Italy, as reported by India West.

Arora ran Google’s Europe operations from 2004 to 2007, when he added the Middle East and Africa regions. Starting in 2009 he assumed global responsibility for sales, and took charge of all commercial operations as of 2011.

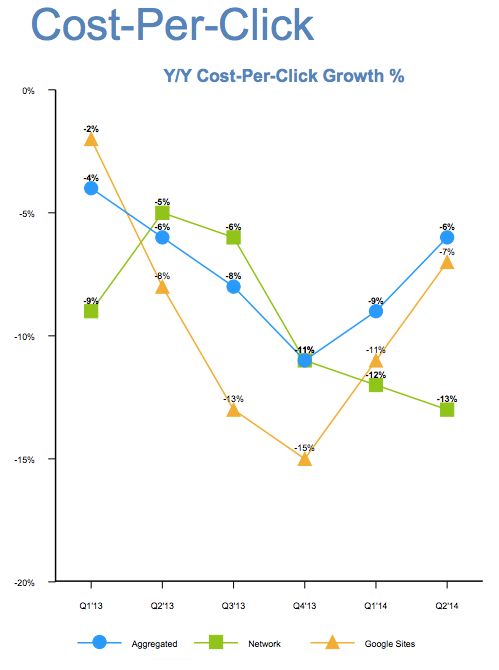

Touching now on Google’s earnings, the company’s narrative in recent years has been one of growing business but declining margins. Here’s the predictable story structure: Google’s strong revenue growth and increasing paid clicks are undermined by lowering cost per clicks (CPCs). Last quarter, for instance, CPCs decreased 9% year over year and 11% the quarter before. One can track the declines back to the end of 2011.

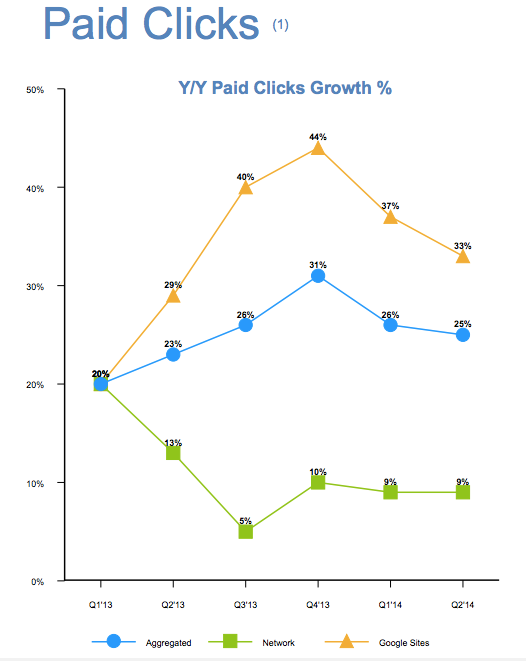

So how did the search and advertising behemoth fare in the second quarter of 2014? More of the same. Google reported $15.96 billion in revenue for Q2 2014, an increase of 22% compared to the same period last year. (Google reports all revenues excluding traffic acquisition costs or ex-TAC.) Clicks on Google-owned sites and sites of its network partners increased about 25% year over year.

But average CPCs decreased 6% from the same period last year. Google also, for the first time, split out CPC revenues between Google-owned sites and network partners (these include ad serves on non-Google properties, placed via AdSense for search, AdSense for content and AdMob). CPCs on Google-owned sites declined 7% year over year, while CPC revenues from network partners declined 13%. See the earnings slides.

Google SVP and CFO Patrick Pichette emphasized that the overall story extends beyond simply measuring CPCs – it includes click volumes as well, which are increasing. “You can’t look at them in isolation,” he warned, adding that, over the past 18 months, Google has been working to improve quality, which impacts the growth rates particularly on its network business.

“All in all, the team is doing a good job on network and on sites,” Pichette said, “and you can see that on our detailed information, where we continue to see, over the last few quarters, the gradual creeping up of CPCs.”

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Daily Roundup

Pichette emphasized numerous factors affecting CPCs. One is geographic dispersion.

“Geography makes a big difference in that CPCs are sometimes lower in international or emerging markets,” he said. Pichette emphasized that Google has a number of localization efforts: “We focus on each country to get the maximum CPCs on a country-by-country basis.”

Google’s CPC rates have also been affected by mobile, where traffic has exploded, but where rates are still way cheaper than desktop, driving down the average. Google’s been aware of this problem for a while.

“Right now, mobile has not monetized as well as other forms,” said the exiting Arora. It was the same point he acknowledged last quarter, saying the price of mobile inventory, which has location and context, should ideally exceed desktop inventory. But there are a lot of factors keeping the dream from reality, such as inconvenient mobile payment methods, inadequate search capabilities and poor mobile browsing experiences provided by merchants.

Still, dwindling CPC rates don’t compare favorably to Google rival Facebook’s growing Q2 CPCs. The social network’s ad partner, Nanigans, said they grew 29% year over year. (We’ll know for certain when the social network releases its quarterly earnings next week.)